Artificial intelligence (AI) has the chance to become one of the biggest and most impactful technological innovations of our time. The applications of the technology are still in the very early innings, as is the buildout of the infrastructure needed to test large language models (LLMs) and run AI inference.

Let’s look at three stocks set to be AI winners that you can buy and hold onto for the next decade.

1. Nvidia

Nvidia (NASDAQ: NVDA) has been one of the biggest AI winners thus far, but that doesn’t mean it won’t continue to be a long-term winner. The company’s graphic processing units (GPUs) have become the backbone of the infrastructure buildout to help power AI applications. As companies rush to create their own AI applications, demand for Nvidia’s chips has been through the roof.

To maintain its lead in the space, Nvidia has sped up its innovation cycle, and it is looking to introduce new chip architecture on an accelerated schedule. At the same time, the company’s Compute Unified Device Architecture (CUDA) software platform is a differentiator for the company and has helped it create a wide moat. The software platform is generally what developers are taught on to program GPUs, helping make Nvidia’s chips and software platform the industry standard.

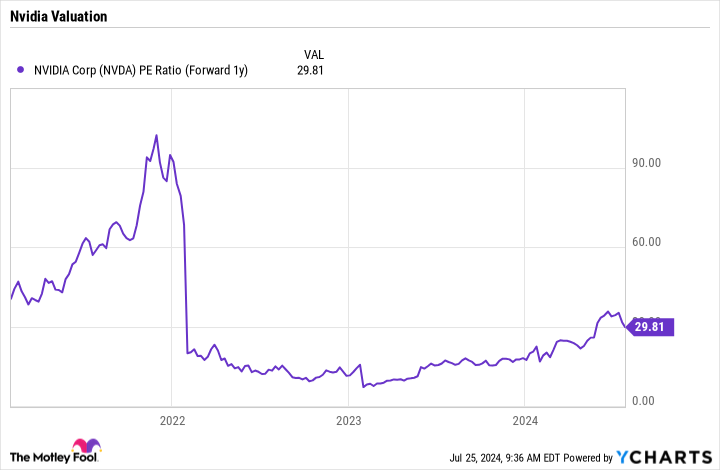

Despite the stock’s strong performance, Nvidia still trades at an attractive valuation, with a forward price-to-earnings (P/E) ratio of under 30 based on 2025 analyst estimates. Given its growth potential, that is a bargain.

2. Alphabet

Don’t let the slide in Alphabet’s (NASDAQ: GOOGL) (NASDAQ: GOOG) stock following its second-quarter results fool you. The company posted strong results that show it is set to become an AI winner.

The company’s cloud computing segment, Google Cloud, is making great strides, seeing Q2 revenue growth of 29% to $10.4 billion, as the segment benefits from developers using its AI infrastructure and generative AI solutions. Importantly, though, this is a very fixed-cost business where the company has just gained the necessary scale. As such, profitability is starting to soar, with Q2 operating income going from $395 million a year ago to $1.2 billion.

Meanwhile, the fears that AI could negatively impact Google Search have thus far been unfounded, with the company seeing search revenue jump 14% last quarter. Alphabet is just beginning to tap into the power of AI with its search, developing AI overlays to answer some queries. After some initial hiccups, users are beginning to engage with the new feature, and the company is in the early days of monetizing (profiting from) these AI overviews. The company plans to introduce new search and shopping ads with the format soon.

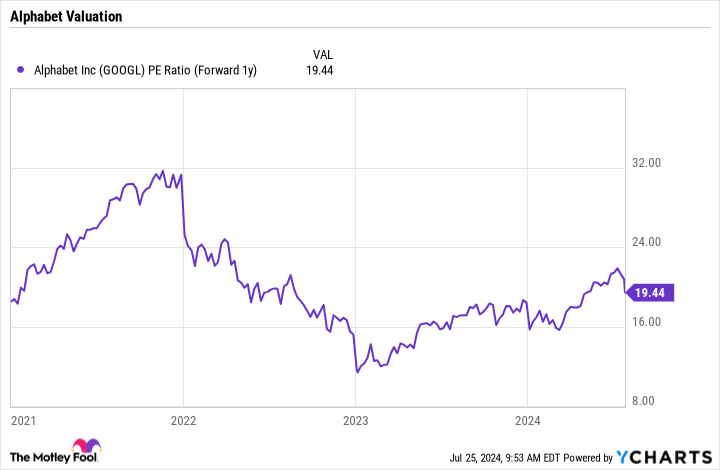

Trading at a forward P/E of under 20 based on 2025 analyst estimates, the stock is one of the cheapest mega-cap tech stocks out there and a great stock to buy and hold for the long term.

3. Adobe

While chip stocks related to building out AI infrastructure have been the big early AI winners, software companies have the potential to be strong AI winners as well. One such company embracing AI and leading the charge is Abobe (NASDAQ: ADBE), which holds a dominant position in the creative software space with programs such as Photoshop and InDesign. It is also the leading PDF solution company through its Acrobat programs.

The company has been pushing the use of AI into its products, with such AI features as generative fill, text to image, generative shape fill, and generative remove, using the Firefly AI models that it has developed. Adobe is still in the early days of monetizing AI, as right now, it lets users trial its AI capabilities for free before they have to buy generative credits. The company should find a better to way to profit from its AI capabilities in the future, but right now, it is helping drive solid growth.

Meanwhile, the company’s AI-powered Adobe Express app, which helps create graphics and videos for social media, looks like it could be a long-term AI winner. Social media is obviously a big business, and such a tool has a lot of potential. Adobe launched an all-new version of the Express app early last quarter and saw monthly active users double quarter over quarter as a result.

Adobe’s Document Cloud segment, home to Acrobat, meanwhile, drove some of its best growth last quarter, with revenue for the segment up 19% to $782 million in fiscal Q2. The results were powered by the introduction of its Acrobat AI assistant add-on subscription.

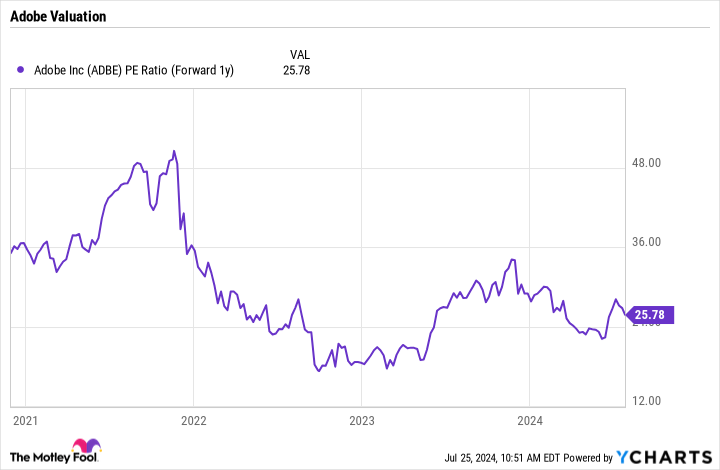

Adobe trades at a reasonable forward P/E of under 26 based on fiscal 2025 estimates, and the stock looks poised to be a longer-term winner investors can buy and hold.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $692,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Adobe, Alphabet, and Nvidia. The Motley Fool has a disclosure policy.

3 Artificial Intelligence Stocks You Can Buy and Hold for the Next Decade was originally published by The Motley Fool