The Phoenix Real Estate is Blazing—Especially When it Comes to Multifamily Properties

The Phoenix real estate market has arguably been one of the most attractive in the country for several years. From the smallest single-family rental investors to flippers and institutional funds, investors of all stripes have focused their sights on this market and have been rewarded handsomely in return. As we are heading into 2022, though, the question on everyone’s mind is will Phoenix continue to outperform the rest of the nation?

As we know, the health, or lack thereof, of any real estate market is generally not a leading indicator, but rather a reflection of the economic fundamentals, such as employment dynamics, population trends, and supply pipeline. To gain a meaningful perspective on the real estate market, we must first understand those fundamentals.

In this article, we won’t be able to detail all of the data. Our hope is to simply provide the highlights on what is driving the Phoenix economy to help you understand why Phoenix has been, and will likely continue to be, a darling of the institutional investor class.

Employment trends in the Phoenix metro area

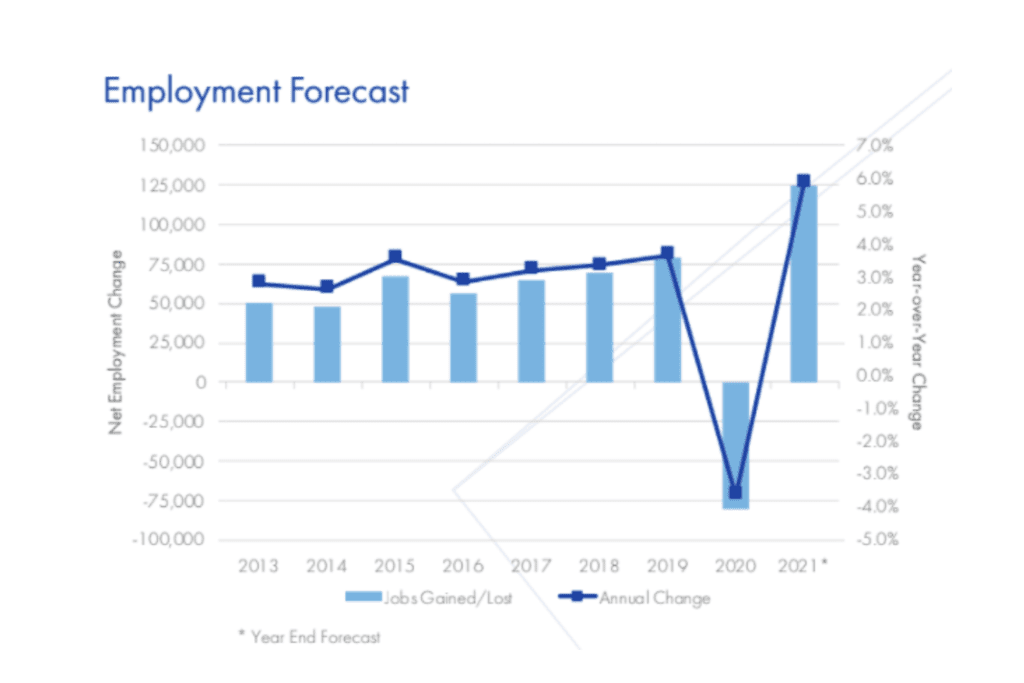

Employment dynamics is always the place to start, and as we survey the available statistical publications, Phoenix MSA is typically near the top of all primary markets as it relates to job growth. In 2020 and 2021, Phoenix was the fastest market to recover jobs and reduce unemployment. Companies large and small have been and continue to set up shop in Phoenix at a record pace.

A bit of background on this: Phoenix MSA was one of the hardest-hit markets in the Great Recession, due mostly to residential over-building, and took much longer to stabilize and start the recovery process. The foreclosures took a long time to work through.

To make things worse, the MSA started to lose population heading into the Great Recession. This happened in large part because those who came here to work in the residential construction space bought houses with mortgages that many of them should not have been approved for. When the recession hit, they were out of work, being foreclosed upon, and leaving town.

This, in turn, perpetuated the very crisis that cost them their jobs in the first place. It was a vicious economic cycle and a truly messy situation for Phoenix. While many of the primary markets began recovering in earnest by 2012 or 2013, Phoenix did not emerge from hibernation until 2016 or 2017.

However, there was a strong desire and political will to diversify the economy in this city in the wake of the Great Recession, and that led to an effort to attract more sustainable jobs in the fields of technology, medical, manufacturing, and education. Difficult decisions were made, which led to a regulatory stance that is now very business friendly, and companies small and large took notice.

Find a Local Phoenix Agent Today

The BiggerPockets Agent Finder makes it easy to connect with real estate agents who know the local market and can evaluate properties from an investor’s perspective. Here’s how it works:

- Pick your market

- Share your investment criteria

- Match with a real estate agent

There was also an added draw of Arizona’s predictable weather to lure in new residents. With no major catastrophes, reasonable cost of living for employees, and a lot of major universities producing talent, the explosion of corporate in-migration has continued over the last seven years.

As a result, Phoenix’s employment base is now highly diversified. The latest, and likely one of the most publicized, announcements is TSMC’s $35B semiconductor manufacturing campus, which will be built on Phoenix’s north side. This represents the single largest investment in the history of Arizona, and they’ve already broken ground on the first of three factories at the site.

Intel has also created two large campuses in Phoenix’s East Valley—and continues to expand. And these are all well-paying jobs, averaging $150,000 per year. You could say that the recent semiconductor shortage is playing well in Arizona.

According to a new report by the Arizona Office of Economic Opportunity, which studies the state’s economy and labor market, Arizona is projected to add more than 700,000 jobs by 2030. With Maricopa County being by far the most populous in the state, most of them will be in Phoenix MSA.

These projected employment numbers translate into more than 2.2% annual employment base growth. And realizing that most of the people relocating to Arizona for these jobs have families, can you imagine what this means regarding the population?

Population growth and trends in Phoenix

With a population now of more than 5 million, Phoenix MSA is the fifth-largest in the US. According to WorldPopulationReview.com, approximately 85,000 to 100,000 people move to Phoenix each year. According to deptofnumber.com, about 35% of those new residents are renters and the rest are buyers. According to statistics from realpage.com, there are approximately 1.4 occupants per apartment and 2.5 per house.

These statistics reveal that to accommodate the influx of new residents, Phoenix needs to add about 25,000 rental units and 26,000 single-family dwellings every year. The economic reality is that unless Phoenix can keep up with this demand, it should see price inflation in both home values and rents. So, let’s consider the supply side.

Let’s look at single-family residential supply by tracking monthly inventory levels for October 2018, 2019, 2020, and 2021. This should provide us with a good sense of the dynamics over the last four years.

According to historical data from Arizona Multiple Listing Service (ARMLS), the inventory in October 2018 was 21,724. But, by October 2019, things had gotten tighter, as the inventory dipped to 18,443.

At the outset of the pandemic in October 2020, there was a huge drop in inventory to 13,708 available units. And, that decline is still continuing, as there were only 11,609 dwellings available for purchase in October 2021.

It’s clear that there is nowhere near enough new construction, single-family homes to fulfill normal cyclical demand—let alone additional new demand due to the accelerating in-migration.

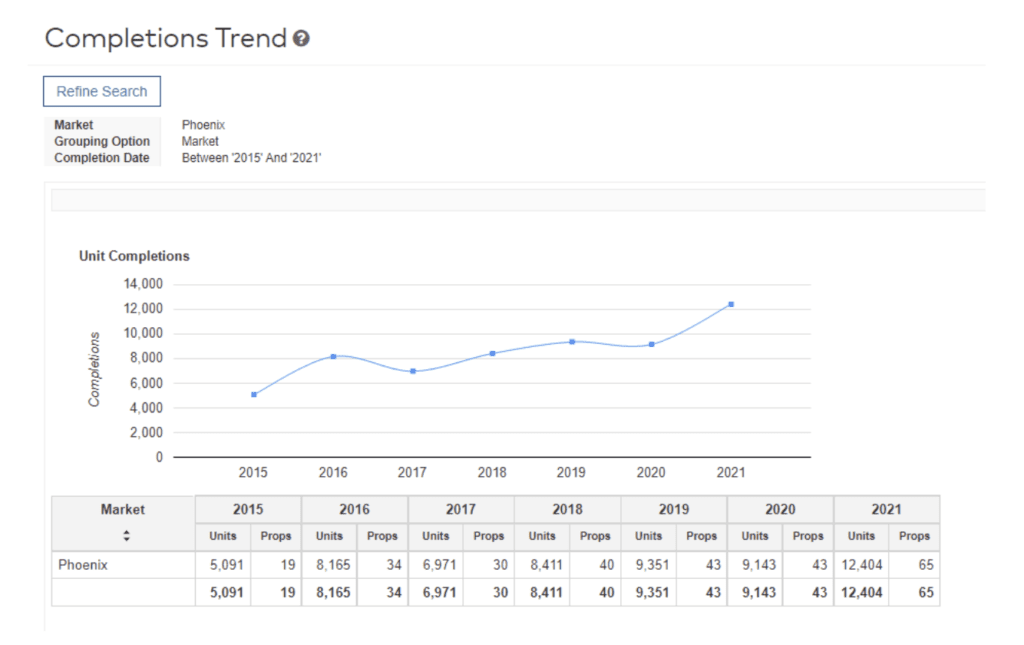

Moving on to multifamily, we already discussed that Phoenix has needed to add an additional 25,000 units each year since 2015 to accommodate the population growth, which adds up to a total of 175,000 units to date. According to Yardi Matrix, less than 60,000 new units have been delivered in total over this period. This means that Phoenix MSA needed to add at least 115,000 apartment units as of December 2021, and this does not account for the extra housing for future population growth.

Looking at the graph below, we can see the allocation of 60,000 new units that were delivered between 2015 and 2021. The highest unit count was in 2021, with 12,404 new rental units.

This data paints a clear picture of an acute supply and demand imbalance, both in single-family homes and apartments, and there are no indications that the situation will substantially change in the near future. While most observers expect staggering continued population growth in Phoenix, the data suggests that Phoenix in the post-Great Recession years has not added enough housing to have a meaningful impact.

WhiteHaven Capital is a very active operator in the Phoenix market, so we are quite attuned to the market sentiment. It seems to us that the trauma of the Great Recession, caused by the over-building and the ensuing bankruptcies of so many builders and developers, is still very fresh in people’s minds. As such, it appears that people are hesitant to repeat the mistakes of the past. To us, this indicates a continued shortage of inventory for the foreseeable future.

Home values and trends in Phoenix

The supply and demand fundamentals we discussed above have had a predictable impact on pricing. The median home value has increased from about $270,000 in September 2020 to $370,000 in September 2021. This is a staggering 36% increase in sales prices in one year.

The staggering population growth throughout the pandemic, combined with extraordinarily compressed supply, resulted in 37% price inflation. The numbers don’t lie.

Rent growth in Phoenix

Take a look at the year-over-year rent growth chart and note the complete absence of negative numbers. Internalize that any way you choose, but we think that speaks to the market.

Looking at the rent prices month-over-month and you’ll see that there have been a few individual months of negative rent growth, with the largest drop of -3.5% in October 2020 at the outset of the pandemic. Look closer, though, and you’ll see that on an annualized basis, Phoenix rents have not stopped growing since at least 2016.

This is five years of continued growth. In fact, since 2017, the lowest year-over-year rent growth was 4.9% in August 2019, and it took the onset of the pandemic to slow things down for a brief period of time.

Bottom line, as we consider the data on this chart, let’s remind ourselves that investors generally consider 3% annual rent growth to be a good indicator for most municipalities. These Phoenix numbers certainly do point to a very special kind of market DNA, and investors are noticing. As of October of 2021, the year-over-year rent growth registered at 27.7%

Will the Phoenix housing market continue to perform?

As noted, the Phoenix market took quite a bit longer to begin to recover from the Great Recession. For this reason, most economists still view Phoenix as a fairly early-stage emerging market—one that is very much in the expansion phase.

For example, Phoenix is in the top three emerging markets in the country, according to the Urban Land Institute’s Emerging Trends in Real Estate analysis. This ranking is calibrated using the factors we’ve discussed, including job prospects, growth, and the outlook for home-building.

In short, if we were to trust the professionals whose job it is to collect and analyze the data, we’d have no other choice but to be bullish on Phoenix’s continued strength. Certainly, all of the vital pieces are in place for a sustained run.

Should you invest in the housing market in Phoenix in this cycle?

The short answer is yes, and we are practicing what we preach, as we are very active in the Phoenix market as both a seller and a buyer.

To qualify this “knee-jerk” yes, allow us to take you back to 2020, when during our appearance on the BiggerPockets Podcast (Show 383) we identified the following six items that investors should consider when choosing a market to invest in:

- Competitive advantage

- Diversified economy

- Minimum population of 1 million

- Population growth

- Job growth

- Rent growth

Items 2-6 on this list deal with market fundamentals that we’ve been discussing in this article. And, these are more attractive today than they were in 2020. Thus, a resounding yes is appropriate – come and invest in Phoenix!

There is one caveat, which is the first item on our list: competitive advantage. The Phoenix market has become highly competitive because of its outstanding performance. For this reason, anyone choosing to operate in the Phoenix metro area must determine an element of competitive advantage.

For some, this may be an opportunity to tighten your own skill set. For most, the logical approach may be partnering with a successful local operator instead. Regardless of which approach you take, if you can crack the competitive advantage code, the Phoenix housing market can be extremely rewarding.

Buying for the future in Phoenix

So, what makes the best market for a landlord? Rent growth. That’s it. Article over. Thanks for reading.

OK, so maybe we have a little more to discuss.

Sure, there are other factors to consider, like property, landlord-tenant laws, cap rates, and other metrics. But the number one factor is rent growth. Everything else is a distant second or third.

Historical rent growth is great, but you’re buying for the future. And how do you know that rent growth is going to continue? You need to look at the drivers behind the rent growth. These are commonly called the fundamentals. The two big drivers are population growth and job growth.

So when you see Phoenix has the top rent growth for X consecutive years, it would make sense to surmise that they’re also in the top three each year for both population growth and job growth.

Let’s talk about population growth for a minute. Approximately 100,000 people move to Phoenix each year. Around 35% of those will be renters, so 35,000 renters each year. It’s estimated that there are 1.37 people per apartment, leaving Phoenix needing an additional 25,000 units each year.

| Per Year | |

| People Moving | 98,990 |

| Percent of Renters | 35.5% |

| Renters Moving | 35,092 |

| People per Apartment | 1.37 |

| Apartments Needed for Movers | 25,615 |

| 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | |

| People Moving | 98,990 | 99,000 | 98,990 | 90,460 | 85,410 | 94,820 | 89,550 |

| Percent of Renters | 35.5% | 35.5% | 35.5% | 35.5% | 35.5% | 35.5% | 35.5% |

| Renters Moving | 35,092 | 35,096 | 35,092 | 32,068 | 30,278 | 33,614 | 31,745 |

| People per Apartment | 1.37 | 1.37 | 1.37 | 1.37 | 1.37 | 1.37 | 1.37 |

| Apartments Needed for Movers | 25,615 | 25,617 | 25,615 | 23,407 | 22,101 | 24,536 | 23,172 |

As you can see from the table above, Phoenix has consistently needed an additional 23,000 – 25,000 units per year. However, we’re not building anything close to that. We’re following well short of that each and every year.

Over the last seven years, the Phoenix population growth has required 170,000 additional units. We’ve built less than 60,000. Talk about a supply and demand imbalance. This has caused some staggering rent growth.

| Needed | Completions | |

| 2021 | 25,615 | 12,404 |

| 2020 | 25,617 | 9,143 |

| 2019 | 25,615 | 9,351 |

| 2018 | 23,407 | 8,411 |

| 2017 | 22,101 | 6,971 |

| 2016 | 24,536 | 8,165 |

| 2015 | 23,172 | 5,091 |

Before the pandemic, Phoenix was seeing 9% rent growth per year. That is easily the top growth in the country. In 2020, when most of the country had negative rent growth, Phoenix was still at over 5%. That’s more than most of the country has in their best year.

So what happened in 2021 when things opened back up? It ended in an unprecedented rent growth of nearly 30%! That’s clearly not sustainable—but the drivers behind it are.

The population growth is consistently between 90,000 and 100,000 new residents each year, and it seems to only be increasing. I think it’s safe to say Phoenix will continue to see rent growth outpace the rest of the country.

Now that we know that population growth in Phoenix is a big driver, let’s take a look at job growth.

As mentioned earlier, Phoenix is typically near the top of all metropolitan areas regarding job growth. In 2020 and 2021, Phoenix was the fastest market to recover jobs and reduce unemployment.

Why? Because companies are relocating to Phoenix at a record pace. Phoenix has a very business-friendly environment. It has predictable weather with no major catastrophes. It’s why so many massive companies are investing heavily in this metro area—and offering staggering salaries to recruit new employees.

Speaking of salaries, Phoenix is also well below the national average when it comes to rent-to-income ratio. Nationally, residents spend an average of 33% of their income on rent. Phoenix, on the other hand, is in the low 20%. This leaves Phoenix with plenty of runway to increase rents even further, on top of the increases we’re seeing from the higher paid jobs being created in this metro.

Final thoughts on the Phoenix housing market

So, population growth is expected to continue in Phoenix. Job growth is expected to continue as well, with many of those new jobs being high income opportunities. And we have plenty of runway with our rent to income levels.

All of this points in one direction: rent growth in Phoenix doesn’t seem to be slowing down anytime soon, which makes it our favorite market to be a landlord.