4 Simple Steps for Less Money Stress in Real Estate Investing

There is a rosy glow about real estate investing—a land of opportunity, eye-popping numbers, and the lure of a tangible asset that can be painted a calming shade of blue. And a lot of these upsides are brilliantly true! But there is one soft underbelly that gets lost in the optimism—and that’s the added stress of being a landlord.

Leaky pipes that need fixing, the mortgage that needs to be paid between renters. It’s a lot of numbers and cash flow logistics to be jumbling around in your head—and it can be stressful!

Well, that’s kind of our thing: keeping finances neatly organized. Stay for the geekery. We know a thing or two about how to gain total control of your money, and how to be totally in control of your cash flow for real estate investing.

There are four simple rules, and they’re called the YNAB method. That’s You Need a Budget if you’ve got time to stop and smell the roses. Our secret sauce is this proven four-step method that puts you firmly in the driver’s seat for managing your cash flow no matter what tool you use.

At their heart, this method isn’t really about money management. It’s about creating a system to organize your finances, so you can spend less time stressed about money and more time living the life you want.

What you’ll learn:

- How to use the four-rule method for less money stress

- How to know when you’re financially ready to buy your first property

- Things to budget for as a landlord

- How to remove surprises from your expenses

- How to organize, track, and gain total control of your cash flow

Without further ado, let’s meet the YNAB Method:

- Rule #1: Give every dollar a job

- Rule #2: Embrace your true expenses

- Rule #3: Roll with the punches

- Rule #4: Age your money

Rule #1: Give every dollar a job

Think of each dollar in your possession like a devoted employee. Each dollar you have right now needs a specific job. Maybe some dollars are meant to pay for mortgages, while others are set aside for utilities. Maybe some dollars are saving up for your next (or first!) rental. You want the unemployment rate for your dollars to be 0%, so each one is given a job. You get to choose. You’re the boss.

Rule #2: Embrace your true expenses

No more getting walloped by a roof repair, surprised by a water bill, or left out in the cold for the inevitable renter turnover. With rule #2, you plan for non-monthly expenses within your budget. You save for things like maintenance and repair each month, turning your monthly expenses into neat-and-tidy monthly costs.

Rule #3: Roll with the punches

Rigid budgets break. They break on paper, they break your heart, they break your budgeting willpower. So with Rule three, we future-proof the ol’ budget.

You might spend more than planned on a repair—and that’s totally ok. Just move money from another category that’s less important (like the emergency fund you set aside for such a time as this!).

Rule #4: Age your money

Think of it like this: with Rule Four, money comes in and stays in your account for a little while. You use last month’s rental income to pay this month’s mortgages. You’re using “old” money instead of “new” money. As time goes on and you follow rules one through three, rule four is really just a byproduct—your pile of money and assets will grow larger.

Side effects of following rule #4: balances growing plump, and extra cash left over to continue growing your real estate collection.

Let’s see the four rules put into practice with two scenarios: the new investor, and the seasoned investor. We’ll show you examples within YNAB, but you can implement the method in a spreadsheet or any other zero-based budgeting system.

Budgeting for the new real estate investor

You’re itching to buy your first rental property but it’s hard to know when to pull the trigger. Instead of trying to time the rollercoaster market, you call the shots by knowing when YOU are financially ready. After you’ve used the four rules in your own life, you can map out the specific costs it will take to enter the market and start saving. Plus, you’ll know exactly when you’ve hit the target to start shopping for property that fits neatly within your budget.

Set aside money for your own personal expenses, and then set a target for the down payment needed on your first rental property. Don’t forget to set it high enough to cover closing costs and repairs needed.

Budgeting for the seasoned investor

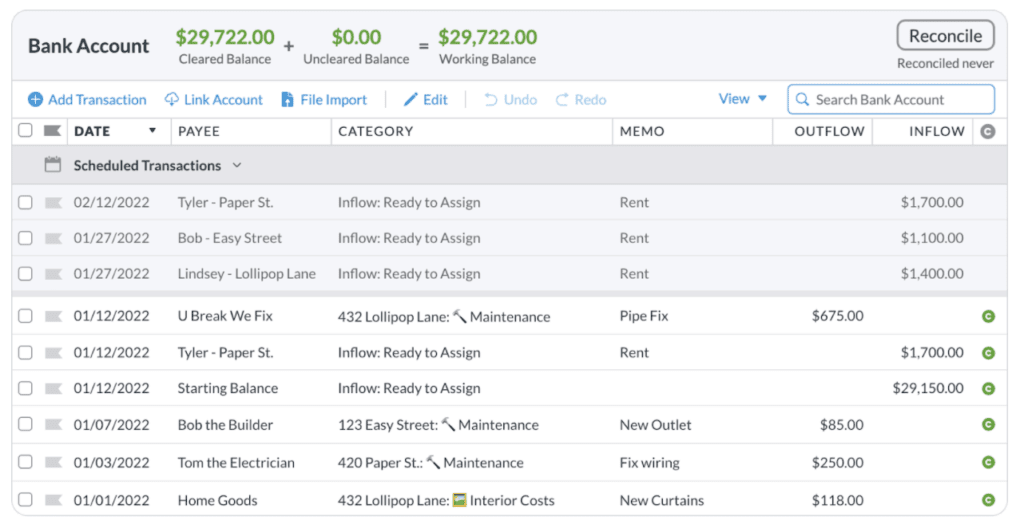

You’ve got your portfolio amassed, now you just want to optimize your organization system. Your budget could include all the expenses of each property, split out by address.

Don’t forget to save for those larger, less frequent expenses in your budget as well. Consider including a Master Funds category group to cover expenses between leases, an emergency fund, and a fund for capital improvements.

You can easily save for your next property as well in this Master Funds category group.

Keep an account register of your rent payments and outgoing expenses for easy reference.

As you follow the four rules, watch your net worth climb every higher as your asset-to-debt ratio increases.

As you track your spending and categorize your dollars, you’ll also be able to easily see an at-a-glance income statement by month and over time.

No matter what app or spreadsheet you use, follow the method to lower your stress, grow your wealth, and enjoy your ever-larger pockets.

Grow your real estate business and raise your game with other people’s money!

Are you ready to help other investors build their wealth while you build your real estate empire? The road map outlined in this book helps investors looking to inject more private capital into their business—the most effective strategy for growth!