Fast casual dining has become one of the most popular options for diners over the last several years.

Two leading fast casual restaurant chains are Mediterranean-inspired CAVA Group (NYSE: CAVA) and burrito specialist Chipotle Mexican Grill (NYSE: CMG).

So far in 2024, Cava stock is up 98% while shares of Chipotle have gained 25% — each handily topping the S&P 500.

Let’s dive into the business results of Cava and Chipotle and assess which stock might be the better buy for long-term investors.

Analyzing Cava

When analyzing restaurant businesses, metrics such as new store openings and same-store sales can be useful.

During Cava’s first fiscal quarter of 2024 (ended April 21), the company opened 14 net new restaurants. This represented 23% growth year over year, and brought Cava’s total restaurant count to 323.

The company’s revenue soared 30% year over year during Q1 to $256.3 million, while same-store sales rose by 2.3%.

Despite a macroeconomic environment battling stubborn inflation, Cava has also showcased a commitment to strong unit economics. For the period ended April 21, Cava reported net income of $14 million, compared to a loss of $2.1 million last year.

Moreover, the company’s adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) essentially doubled year over year during Q1, while free cash flow swung to $4.7 million compared to cash burn of $13.4 million last year.

All things considered, Cava’s financial profile is quite impressive. However, with the stock surging 98% so far in 2024, investors need to assess the company’s valuation.

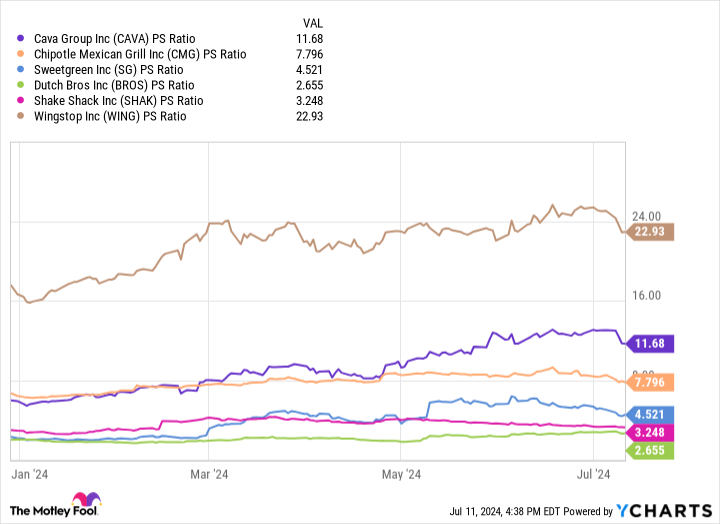

As seen in the chart above, Cava’s price-to-sales (P/S) multiple of 11.7 is considerably above Chipotle’s. In a way, this could make some sense. Chipotle is a much more mature business compared to Cava. However, the valuation disparity between the two restaurant stocks is hard to overlook.

Let’s dig into Chipotle’s business and see whether Cava’s premium valuation is deserved.

Analyzing Chipotle

For the quarter ended March 31, Chipotle reported revenue of $2.7 billion — an increase of 14.1% year over year. While this level of revenue growth is only about half as much as Cava’s during the first quarter, Chipotle is clearly a much larger business, considering that its revenue is more than 10-fold that of Cava’s.

Where Chipotle really sets itself apart from the competition is same-store sales and profit margins.

During Q1, Chipotle’s comparable restaurant sales rose 7% — more than triple Cava’s sales. The company’s restaurant level operating margin was 27.5%. In comparison, Cava’s restaurant level profit margin was 25.2%.

At the end of Q1, Chipotle boasted nearly 3,500 locations — roughly 10 times Cava’s number. The company’s average restaurant sales of $3.1 million were notably higher than Cava’s $2.6 million.

The bottom line

The trends explored above suggest that Chipotle has superior unit economics to Cava. It’s a much bigger company and outperforms Cava in just about every important financial and operating metric.

My suspicion is that a lot of capital has poured into Cava stock with the underlying thesis that the company might be the next Chipotle. While this has some merit, it is going to take many years to determine if Cava will eventually reach the size and scale of Chipotle.

All the while, Chipotle isn’t exactly giving investors reasons to think its own growth could begin decelerating or plateauing. While money can be made owning both Cava and Chipotle stock, I see one clear winner here: Chipotle.

I think Chipotle represents a best-in-class brand among restaurant stocks, and the company’s impressive financial profile and key performance indications suggest that the growth narrative should stay intact for years to come.

Should you invest $1,000 in Cava Group right now?

Before you buy stock in Cava Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Cava Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill and Wingstop. The Motley Fool recommends Cava Group and Sweetgreen. The Motley Fool has a disclosure policy.

Cava vs. Chipotle: Which Is the Better Restaurant Stock? was originally published by The Motley Fool