There’s one stock that everyone wants to talk about: Nvidia (NASDAQ: NVDA). And for good reason. The stock has gained nearly 1,000% in less than two years, meaning a $10,000 investment in late 2022 would be worth almost $100,000 today.

While nobody can predict what will happen, there are two paths forward for Nvidia. One path is promising; the other is downright terrifying. Let’s dive in and see which is more likely.

The bull case: Nvidia is Apple circa 2004

The bull case for Nvidia goes something like this: Artificial intelligence (AI) is the story of the next 20 years. It will bring changes to the way people interact on a level equal to or exceeding those brought on by the smartphone in the mid-2000s. Therefore, the best historical comparison for Nvidia is Apple in 2004.

Back then, Apple’s hot new product was — wait for it — the iPod. Remember that? The company wouldn’t debut its first iPhone for another three years.

Nevertheless, Apple was already well on its way to becoming the world’s largest company. In 2004, its stock grew by more than 200%, making it the top performer in the S&P 500.

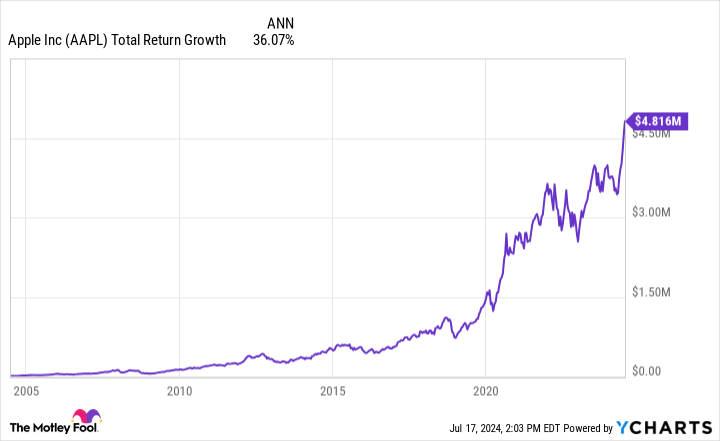

From 2004 until today, its market cap has surged at a compound annual growth rate (CAGR) of 36%. A $10,000 investment made 20 years ago would be worth $4.8 million today.

It would be incredibly difficult for Nvidia to repeat that performance, but it is possible. AI is a fascinating new technology, and 20 years is a very long time, giving the company plenty of runway to live up to the lofty expectations surrounding its stock.

But what about the bear case?

The bear case: Nvidia is Oracle circa 2000

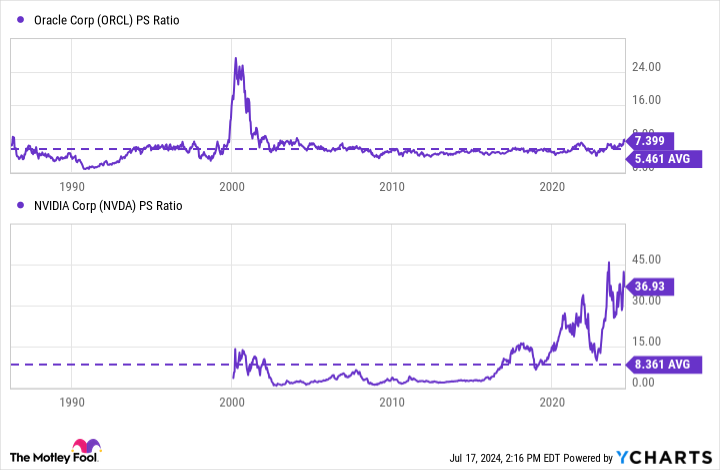

This is the bear case for Nvidia: AI is a promising technology but overhyped. Due to elevated valuations in AI stocks, a stock market bubble has formed, and when it pops, Nvidia’s stock will feel the pain. In short, Nvidia today is like Oracle in 2000.

To recap, the 1990s were full of hope for the internet. In particular, the stock market went gaga for internet stocks. Valuations soared, not just for brand-new companies but also for legacy tech companies that were cashing in on the internet craze.

In particular, Oracle, whose business revolved around facilitating the transition from mid-century mainframe computers to modern servers for enterprise clients, saw its stock skyrocket in the late 1990s.

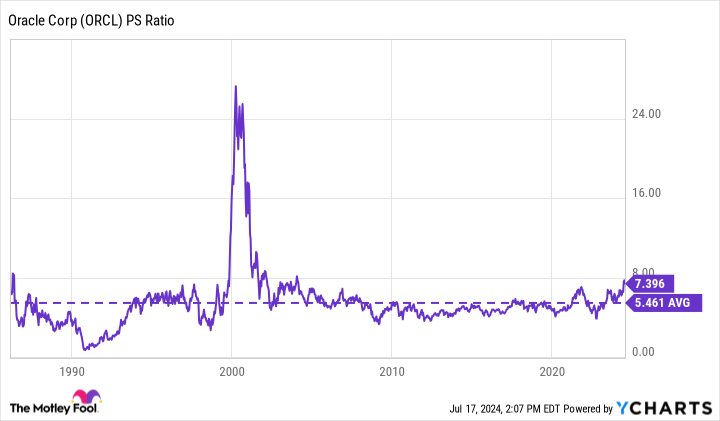

Unfortunately for Oracle, expectations ran far ahead of actual sales. At its peak in 2000, its stock traded with a price-to-sales (P/S) multiple of 24, far above its lifetime average of 5.

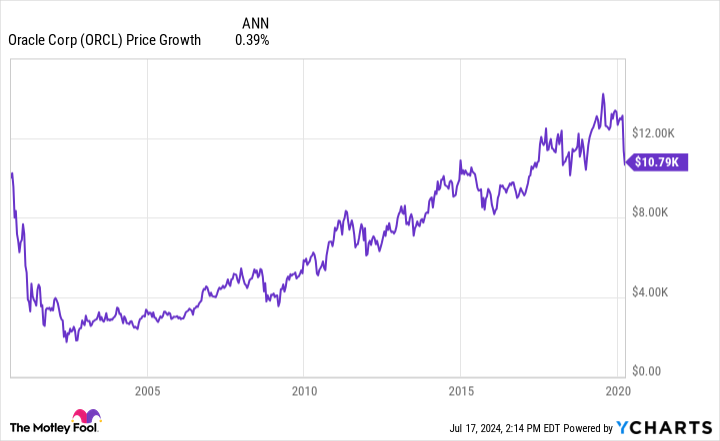

When the dot-com bubble burst in 2001, Oracle experienced an 85% drawdown. The stock has taken over 20 years to recover its pre-bubble high. Those who bought in the summer of 2000 and held through 2020 would have made almost no money on their investment.

It’s a lesson that even companies with the most promising technological innovations and solid business models don’t necessarily make great investments.

So which is it?

On the one hand, Nvidia’s P/S ratio has a scary resemblance to Oracle’s in the run-up to its crash in 2001.

That should give pause to any Nvidia bull. Simply put, the stock is so expensive now that some moderation must occur.

Either the company’s sales will continue to grow like a weed to bring down the ratio, or the stock price will have to come down. Factors such as increased competition, market saturation, or a slowdown in AI and semiconductor spending could decrease Nvidia’s P/S ratio.

My gut tells me it’s the latter, although the party could continue for some time. Either way, I recommend caution with Nvidia stock.

Unlike many of its mega-cap peers, the company lacks a well-diversified business model. Its stock is performing well because AI and semiconductor spending has gone through the roof, but that trend may taper off — particularly if the economy deteriorates or enters a recession.

Moreover, if the demand for AI and semiconductor technology were to decline, Nvidia’s stock could be in for a rough ride — perhaps as bad as Oracle’s 23 years ago.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $741,989!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Jake Lerch has positions in Nvidia. The Motley Fool has positions in and recommends Apple, Nvidia, and Oracle. The Motley Fool has a disclosure policy.

Where Will Nvidia Stock Be in 20 Years? was originally published by The Motley Fool