Ad hoc time series analysis.

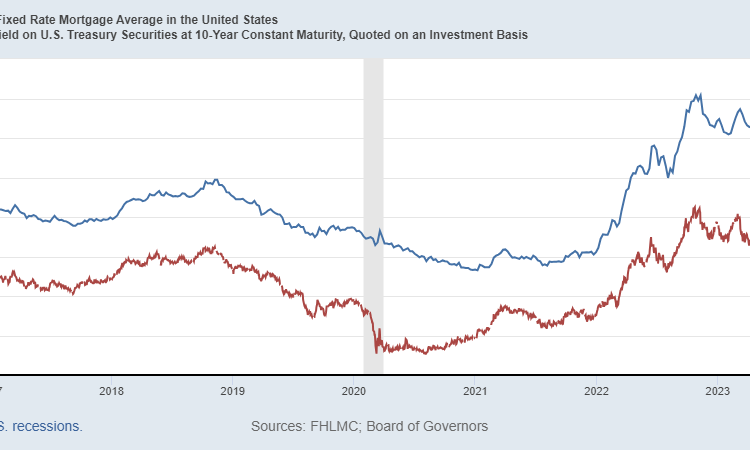

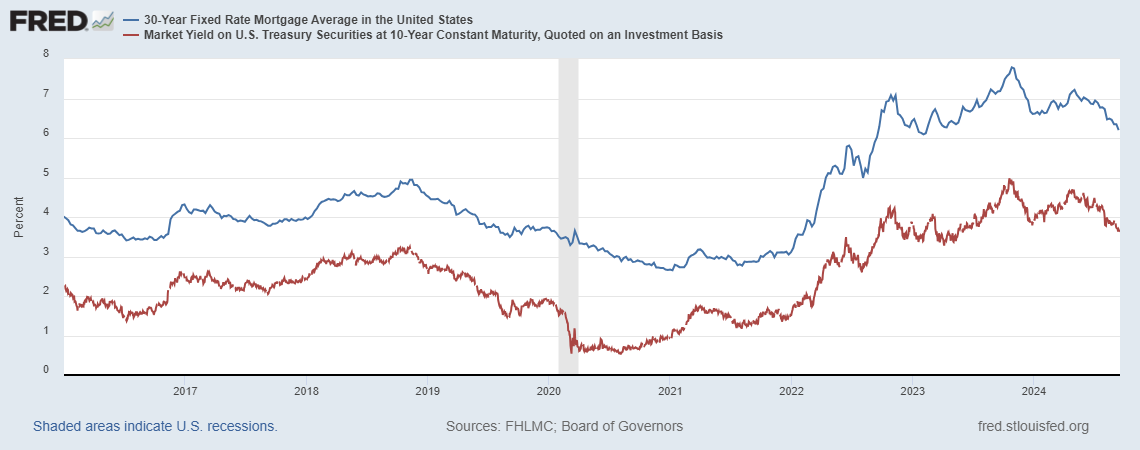

The 30 year mortgage rate and 10 year Treasury constant maturity yield comove over the past 8 years. A Johansen maximum likelihood test (constant in cointegrating equation, in VAR, 4 lags of differences) rejects the no cointegration null using the Trace statistic (also only 1 cointegrating vector, so both series might be stationary) over the 1986-2024M08 period.

The null hypothesis of (1 -1) cointegrating vector is not rejected (point estimates (1 -1.02).

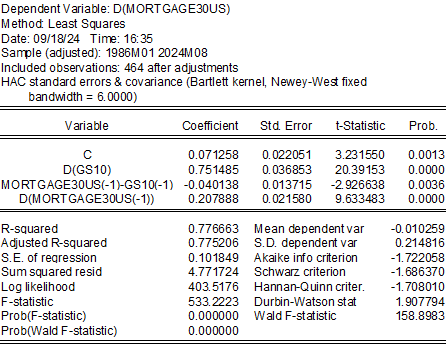

Using a single equation error correction model (imposing homogeneity) yields:

These estimates indicate mortgage rates are about 7 ppts above 10 year Treasurys. A one percentage point reduction in the 10 year yield results in a 0.75 percentage point reduction in mortgage rates upon impact (here, in month). Deviations from equilibrium have a half live of about 4.5 years.

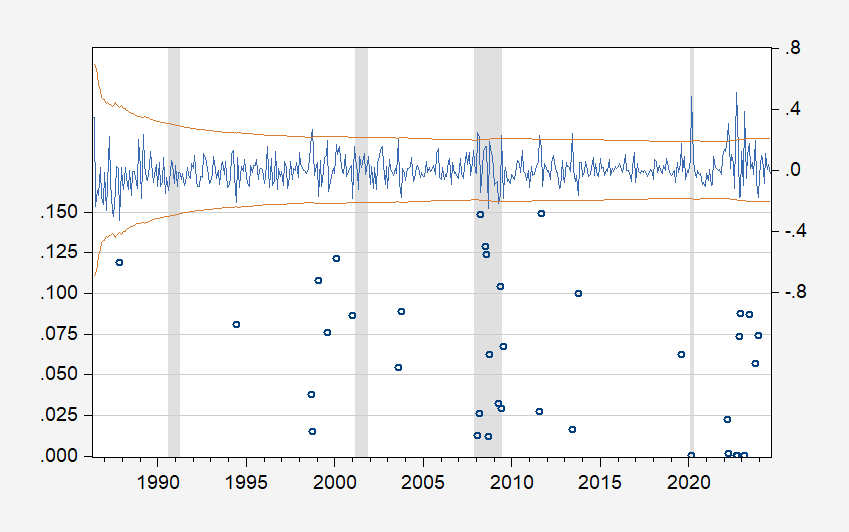

The relationship is subject to structural breaks, as indicated by recursive one-step ahead Chow tests, particularly around September 2022.

Figure 1: Probability for recursive Chow one-step ahead test for no break (left scale), recursive residuals (right scale). NBER defined peak-to-trough recession dates shaded gray.

If 100 bps reduction in the Fed funds rate (currently the talk for end-of-year) results in about 30 bps reduction in the ten year, this implies about 23 bps reduction in mortgage rates by year’s end (ballpark!).