At the end of April, natural gas prices at Henry Hub reversed a three-month dip and started heading up again. As a result, natural gas futures prices are now back at the same levels seen at the beginning of this year. The shift in price has triggered a shift in stance, as well. The prospect of stronger pricing and profits, amid a surge in demand, has attracted a round of investor interest in energy stocks.

Covering the energy sector for Wells Fargo, 5-star analyst Michael Blum looks at multiple reasons for taking a bullish view of the energy industry – and he comes down to a simple conclusion: “We see continued multiple expansion for natural gas midstream stocks driven by growing gas demand supported by AI, re-shoring, LNG, etc.“

Blum elaborates further, emphasizing, “Investors typically view midstream capex negatively after having lived through a period of disappointing returns. However, investor psychology on capex could change (at least for natural gas names). As ROIC increases and investors become more comfortable with the visibility of future returns (e.g. tied to data center demand), we believe growth (and capex) could be viewed favorably again. Higher growth rates typically tend to support higher EV/EBITDA multiples.”

Against this backdrop, the Wells Fargo analysts, Blum and his colleagues, are telling investors to pull the trigger on two natural gas midstream stocks in particular. We ran these tickers through the TipRanks database to see what other Street experts make of their prospects.

The Williams Companies (WMB)

We’ll start with Williams Companies, a $50 billion name in the natural gas midstream business. The company got started back in 1908, building pipelines for the expanding petroleum industry. Today, Williams owns and operates a continent-ranging network of natural gas assets, including gathering and storage facilities, pipelines, and processing plants.

This network is centered on the Gulf Coast of Texas-Louisiana-Mississippi, and extends into the Gulf and east to Florida. To the northeast, the company’s network reaches out to the natural gas fields of Appalachia, while to the northwest, it extends through the Plains to the central Rocky Mountains and out to the Pacific Northwest. The Williams Companies has a part in moving approximately one-third of all the natural gas used in the US for cooking, home heating, and electrical generation.

All of this adds up to more than just big business – it adds up to multi-billion dollar business. Williams reported $2.77 billion at the top line in 1Q24, a figure that was down 10% from the prior year but did beat the forecast by $80 million. In other key metrics, the company reported $1.234 billion in cash flow from operations, and reported that it had $1.507 billion in available funds from operations. This latter figure was up 4%, or $62 million, year-over-year.

At the bottom line, Williams had a non-GAAP net income of $719 million, supporting an EPS of 59 cents per share. The per-share result beat the forecast by 10 cents and was up 5% from the prior-year period.

The company’s solid results supported the dividend declaration, which was made on April 30 for a June 24 payout. The dividend was set at 47.5 cents per common share, up 6% year-over-year. The annualized rate of $1.90 gives a forward yield of 4.5%. Williams has a reputation for reliable dividend payouts.

Covering WMB for Wells Fargo, analyst Praneeth Satish sees plenty of reasons why the stock should keep on shining.

“WMB with essentially 100% natural gas exposure is uniquely positioned to benefit from rising domestic power/gas demand over the coming decade via higher pipeline & storage volumes (longer runway for gas demand), higher G&P volumes (longer runway for gas demand), higher E&P profits (potentially higher gas prices LT), and higher marketing profits (more gas price volatility),” Satish opined.

Putting this into concrete terms, Satish upgraded WMB shares from Equal Weight (i.e. neutral) to Overweight (i.e. Buy). Furthermore, the analyst bumps up his price target to $46, suggesting a 13% upside potential in the next 12 months. With the dividend yield added in, the potential return here approaches 17.5%. (To watch Satish’s track record, click here)

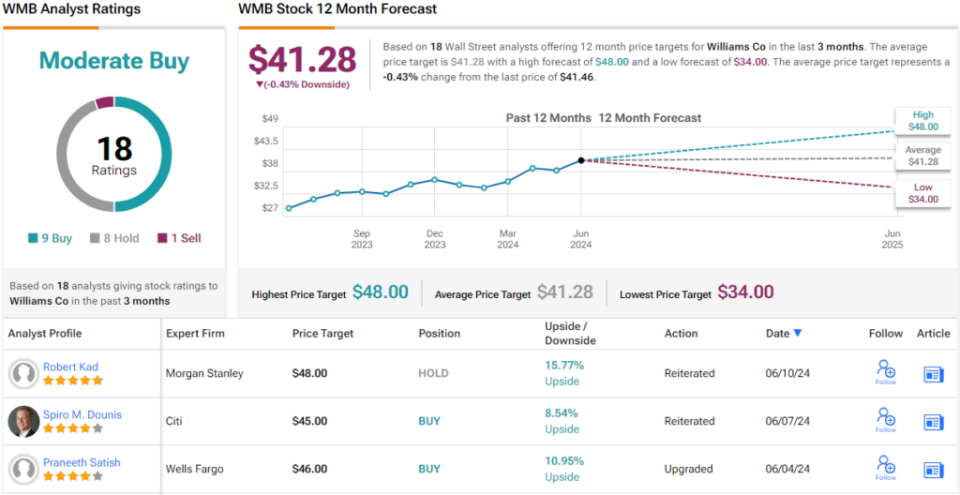

So, that’s Wells Fargo’s view, what does the rest of the Street have in mind? The current outlook offers a conundrum. On the one hand, based on 9 Buys, 8 Holds and a single Sell, the stock has a Moderate Buy consensus rating. However, the analysts expect shares to remain range-bound for the foreseeable future as indicated by the $41.28 average price target. (See WMB stock forecast)

Kinder Morgan (KMI)

The second stock we’ll look at here is one of the largest energy infrastructure companies on the S&P 500 index, with an asset network that spans the continental US and a $43.7 billion market cap. The company’s goal is to provide the widest possible access to reliable and affordable energy, and to that end, it provides safe, efficient services for the transport and storage of hydrocarbon resources. Kinder Morgan’s operations include wholly and partly owned interests in 79,000 miles of pipelines, 139 terminals, and 702 billion cubic feet of natural gas storage capacity. The company also has more than 6 billion cubic feet of renewable natural gas generation capacity.

Kinder Morgan’s pipeline network moves large volumes of natural gas, but the company’s business is not limited to that one resource. It also transports crude oil, refined petroleum products, renewable fuels, condensate, and even CO2. The company’s terminal facilities have the capacity to handle and store a wide range of commodities, such as diesel fuel, gasoline, jet fuel, chemicals, petroleum coke, and metals, as well as ethanol and other renewable fuels.

In recent years, Kinder Morgan’s business faced headwinds, in the form of reduced fuel demand, and the lingering effects can be seen in the company report for 1Q24. Kinder Morgan reported total revenues of $3.84 billion, down 1.3% year-over-year – and $540 million below the forecast. The company’s non-GAAP EPS figure came to 34 cents per share. While that was in-line with expectations, it was also up 13% from the prior year.

In an important metric for dividend-minded investors, the company’s distributable cash flow (DCF) was listed as $1.422 billion, up 3.5% year-over-year. Per share, the DCF came to 64 cents, for a 5% y/y gain. The DCF-per-share fully covered the company’s 28.75 cents common share dividend payment, declared on April 17 and paid out on May 15. The dividend annualizes to $1.15 per common share and yields 5.8%.

For the Wells Fargo view here, we can check in again with analyst Michael Blum, who notes that Kinder Morgan is on the verge of realizing strong gains as headwinds recede.

“Over the last 5 years, KMI’s base EBITDA has been negatively impacted by gas recontracting headwinds (expiration of legacy higher priced contracts into a lower market rate environment). We expect the opposite to now occur in the gas storage and pipeline segments. Given this dynamic will play out over years & terminal value risk is lower with power demand rising in the US, we believe KMI will benefit from continued multiple expansion,” Blum opined.

Like Williams above, this company gets an upgrade from the Wells Fargo analyst, from Equal Weight to Overweight. Blum’s $22 price target implies a one-year gain of 11%. (To watch Blum’s track record, click here.)

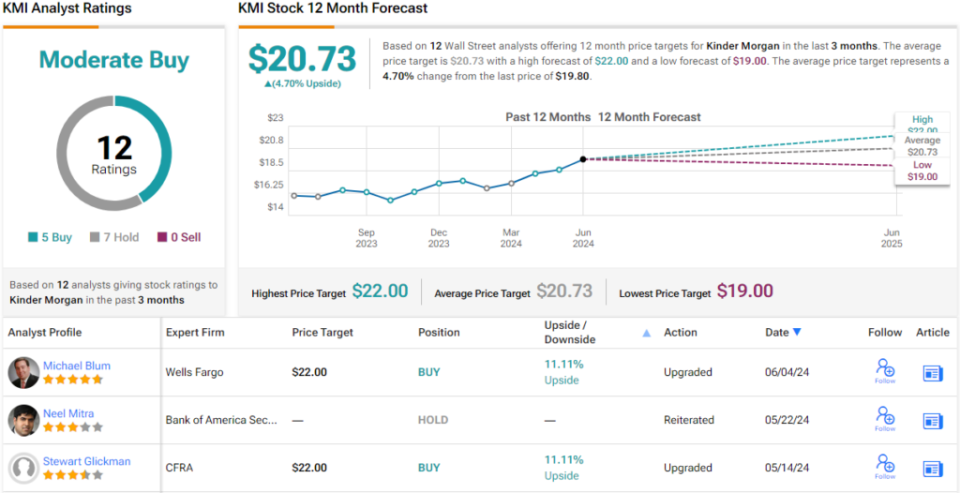

All in all, there are 12 recent analyst reviews of KMI stock, and the 5 Buys and 7 Holds breakdown gives a Moderate Buy consensus rating. The shares are priced at $19.80, and the $20.73 average price target suggests ~5% share appreciation on the one-year horizon. (See KMI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.