America is running headlong into a big problem: Boomers are getting older. In the coming years, the retirement-age population will balloon to its largest size yet, drawing down Social Security funds, overwhelming retirement homes, and leaving a labor shortage in its wake.

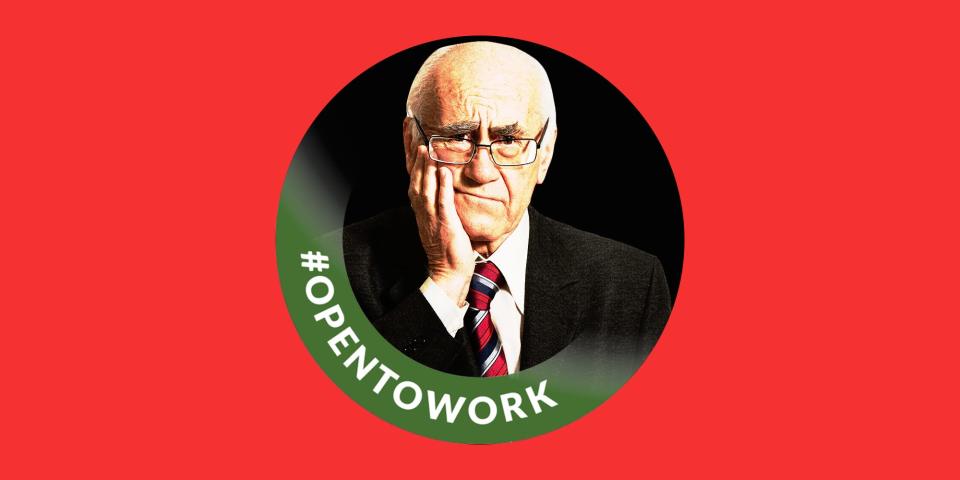

Larry Fink, the 71-year-old CEO of the asset-management behemoth BlackRock, offered a two-part solution to the looming retirement crisis in his annual March letter to shareholders. In order to avoid economic catastrophe, he argued, people should save more money and work longer. “What if the government and the private sector treated 60-plus year-olds as late-career workers with much to offer rather than people who should retire?” Fink wrote. The current Social Security retirement age is 67, but most Americans depart the workforce earlier than that. If more people kept working into their late 60s and 70s, the impending crisis would soften.

In some ways, Fink’s solution sounds nice and even sensible — many able-bodied, energetic 70-year-olds are happy to stay employed and contribute to the economy, so why not encourage more people to do the same?

The problem is that his plan overlooks a few key realities. For one, many older people cannot work because of a disability or because they need to care for someone else with a disability. The second is that those who are willing and able to work are often unwanted. Despite a legal ban on discriminating against people 40 and older in the workplace, it’s still common.

Instead of making it easier for Americans to save for retirement and work as long (or as short) as they want, Fink is setting up a catch-22: The economy needs aging Americans to work longer, but many companies simply don’t want them.

Down in Texas, Daniel Ross has been busy. As a founding partner of Ross Scalise Employment Lawyers, an Austin firm that represents people who have experienced age discrimination, this isn’t necessarily a good thing. Over the past five years, he said he’s noticed an increase in age-discrimination cases, especially those alleging wrongful discharge. “Here in Austin, we have a lot of tech jobs and tech companies,” he said. “They want to look younger.”

In 2023, a Society for Human Resources Management survey found that 30% of workers felt discriminated against because of their age at some point in their careers.

“This absolutely isn’t good when we are in a moment in time where we still have so many more jobs to fill and people who are trained to fill them,” Emily Dickens, SHRM’s head of government affairs, said about the survey results.

Stacie Haller, a chief career advisor at ResumeBuilder.com

According to the US Chamber of Commerce, there are 8.5 million open jobs in the US and only 6.5 million unemployed people looking for work. The shortages span several industries, with healthcare, hospitality, and business services such as accounting topping the list for the most unfilled positions. In the Texas tech scene, job openings are on the rise. But despite the shortages, many companies are reluctant to fill their open roles with older people.

Patrick Button, a professor of economics at Tulane University, has done extensive work on employment discrimination, mostly through what’s known as résumé correspondence field experiments. These studies involve creating fictional résumés that vary in a few ways and using them to apply for job openings. The number of callbacks that each résumé receives indicates the employer response to that type of worker.

One of Button’s studies looked at “bridge jobs,” part-time jobs in administration or retail that many people use to ease into retirement and cushion their finances. “The ability to get these sorts of jobs is one mechanism that older people use to work longer and then provide better security for themselves in retirement,” Button said. He and his coauthors sent out 40,000 résumés they wrote to represent different age groups: younger workers between 29 and 31, middle-aged workers between 49 and 51, and older workers between 64 and 66. They applied to listings for administrative, retail sales, security, and janitorial positions — all typical bridge jobs that attract applicants from every demographic.

Among women, they discovered a 3 percentage-point drop in résumé responses around age 50 with a significant decline around 65. For men, the decline appeared at age 65. The results were clear: “There is a significant amount of age discrimination in the ability to take these jobs, particularly against older women,” Button told me.

Other studies have found a similar pattern: A 2024 survey of 1,000 hiring managers conducted by ResumeBuilder.com, a website that helps people write résumés, found that more than one-third of respondents admitted to a bias against candidates older than 60 and Gen Z candidates.

“We’re in a situation where we’ve got one group of people who are apparently only hiring their own age group, because they seem to be biased against those younger than them and older than them,” Stacie Haller, a chief career advisor at ResumeBuilder.com, told me.

Several companies have recently come under fire for explicit age bias. A 2018 ProPublica and Mother Jones investigation found that IBM had an express, top-down program in place from 2013 until 2018 to fire workers over 40 and replace them with workers under 40. The Equal Employment Opportunity Commission found that there was “reasonable cause” to believe that IBM discriminated against certain employees based on their ages. The case is ongoing.

In 2023, the pharmaceutical company Lilly was ordered by the EEOC to pay a $2.4 million fine for a program it operated between 2017 and 2021 to attract “early career” salespeople, which included incentives for managers to hire people under 40. The same year, Scripps Medical Clinic in San Diego was ordered to pay $6.9 million for setting a mandatory retirement age for physicians of 70, regardless of the doctors’ interest or abilities.

More often, though, the discrimination is less explicit. Ross, the age-discrimination lawyer, said that most of his cases involve circumstantial evidence. He told me that people who would never dream of making remarks about race, gender, or religion will casually joke about old people, ask people when they are retiring, or otherwise contribute to making an older colleague feel unwelcome. Often, he said, this kind of circumstantial evidence helps him build cases.

Age discrimination happens for a host of reasons. We live in a youth-obsessed culture, and gray hair doesn’t reflect corporate branding. Employers may assume that older workers have health problems and so might require more time off or that they’re out of touch with rapidly changing technology. Some managers don’t know how to talk to their older reports. And some older workers have heard all the corporate buzzwords and blather before, so they don’t buy into management’s sloganeering, rendering them “difficult.”

“Companies want to create a younger workforce. And I think one of the reasons they want to do that is so they look like a younger workforce to customers and to potential employees who are statistically going to be younger than 40 or so,” Ross said.

In an ideal world, older workers could retire peacefully, leaving the work of running the country’s economic engine to younger generations while they enjoy a well-deserved break. But increasingly, retirement-aged Americans are stuck between a rock and a hard place. They can’t retire when they want to because they don’t have enough money saved up. But they can’t continue working, either, because companies don’t want them.

Larry Fink is correct that most industrial countries have not prepared for the economic impact of an aging population. In the US, the Silent Generation and older baby boomers have enjoyed relatively rich pension and healthcare benefits. But for most retirees, it simply isn’t enough. Fewer than half of boomers have enough retirement savings, with one-fifth saying they have none at all. Already, retirement-age Americans are struggling to get by, reckoning with working into their 70s in order to stretch their meager savings.

The problem with Fink’s assessment is that it just isn’t realistic. He’s asking people who have not yet retired to work longer than their elders did and to save even more money, without changing the systematic barriers to either. Sure, we’ve all been told that life isn’t fair — usually by the people who hold all the cards — but the system isn’t set up to help people work longer or save more money. Already, younger generations are panicking about how much money they need to save in order to retire.

For Fink and others in the executive class, the dilemma is this: They can either pay workers more and let them work longer so that they can be better prepared for retirement, or they can pay more in taxes so that the government can provide better retirement benefits that allow people to stop working when they need to.

They can’t have it both ways. If they ignore the problem and do nothing, they will leave the average person to live out their golden years in bad financial shape — sparking an economic disaster for everyone.

Ann C. Logue is a writer specializing in business and finance. Her most recent book is “Options Trading.” She lives in Chicago.

Read the original article on Business Insider