(Bloomberg) — Taiwan’s benchmark stock index plunged by a record, as tech-heavy gauges in Asia took the brunt of a selloff triggered by fear of a deeper US economic slowdown.

Most Read from Bloomberg

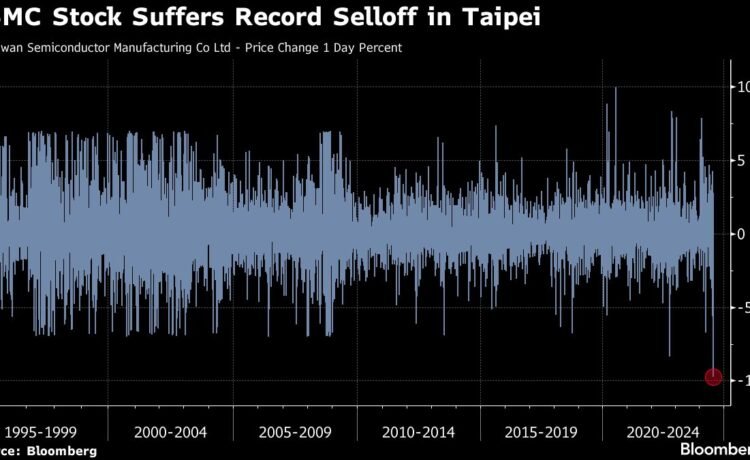

The Taiex gauge ended 8.4% lower in Taipei, marking its worst selloff since 1967. The decline was led by AI-chipmaker Taiwan Semiconductor Manufacturing Co., which plunged by 9.8%, also a record daily decline. Its rivals in South Korea tumbled.

The price action underscores how quickly sentiment has pivoted from the potential of artificial intelligence to focusing on the risks of a US recession and disappointing earnings outlooks from companies including Intel Corp. Taiwan, South Korea and Japan are the worst stock performers in Asia on Monday, a reflection of their export-oriented companies and reliance on the world’s biggest economy.

“Taiex has been one of the best-performing markets this year together with Japanese equities, driven by a combining of cheap funding through the JPY and strong sentiment around AI,” said Peter Garnry, head of equity strategy at Saxo Bank. “With both factors reversing now a lot of traders are exiting their gains. I think it is a classic momentum crash which is a well studied phenomenon.”

Traders are selling just about every risk asset, while piling into Treasuries and the yen. The Japanese currency has soared almost 13% this quarter as the Bank of Japan raised interest rates. The surge has led to an unwinding of the yen carry trade, leading to a broader selloff of assets funded by the cheap currency.

Japan’s benchmark gauges plunged by more than 12% on Monday, with both the Topix and the Nikkei 225 sinking into bear markets. In South Korea, the Kospi Index has also tumbled by more than 9%, set for its worst day since 2001.

The Taiwanese Finance Ministry, which is responsible for the operation of financial stabilization funds, said it will closely monitor development in both domestic and overseas markets. TSMC accounts for more than than 30% of the Taiex gauge.

–With assistance from Miaojung Lin.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.