Be prepared. It doesn’t look good for Wisconsin (just like Trump 1.0 didn’t but this time there isn’t $18 billion on tap to bail out the soybean farmers).

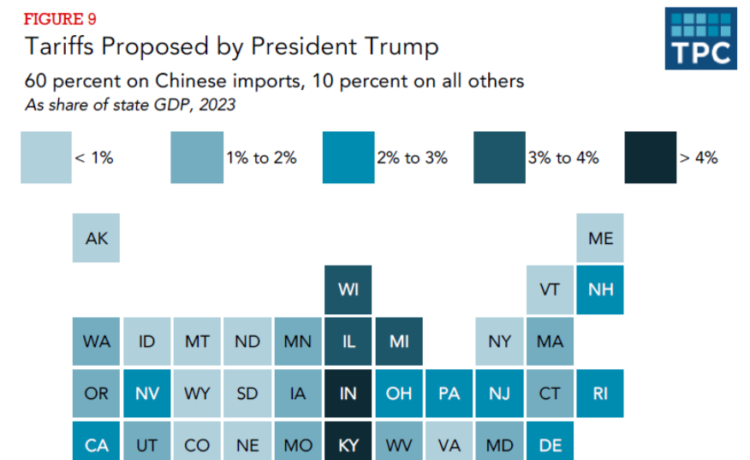

Source: McClelland et al. (2024).

These estimated impacts are for imports and might result in industry-specific employment increases, but almost certainly will cause manufacturing-wide employment decreases as input costs rise (recall, estimates are that the 2018 tariffs cost on net 175,000 manufacturing jobs). For nationwide macro impacts see this post. What happened last time Trump raised tariffs is that China (and other countries) retaliated. China retaliated by imposing tariffs on soybeans, and a whole range of other manufactured and commodity goods.

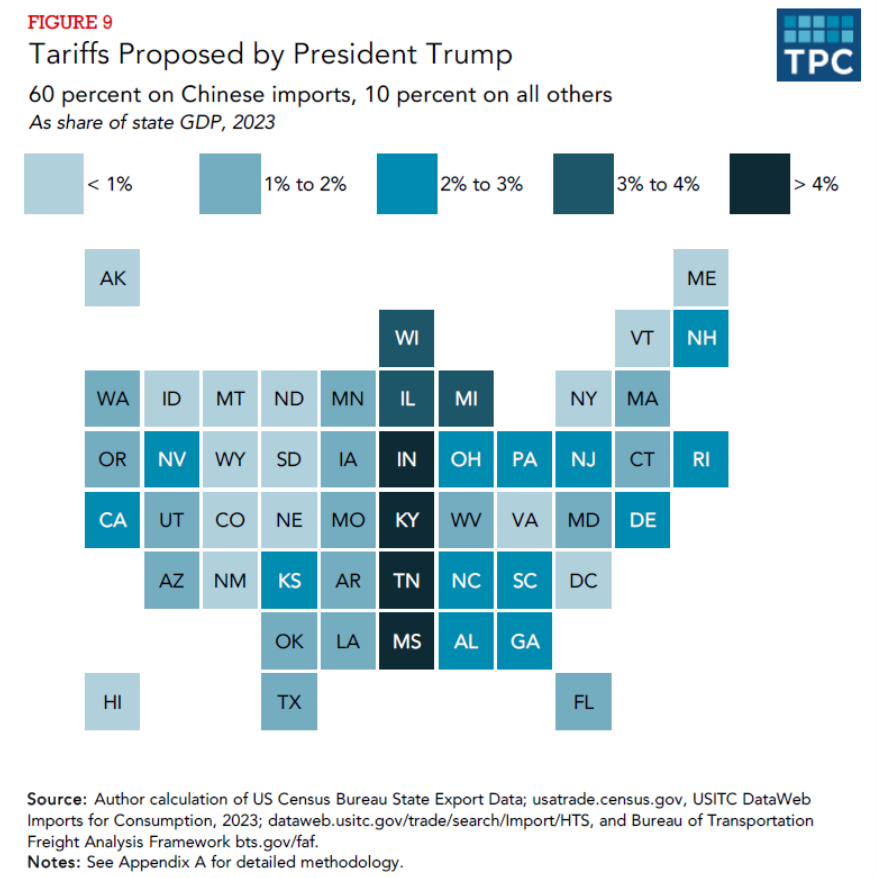

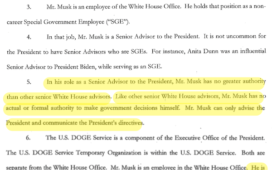

Figure 1: Wisconsin exports of goods in millions $ (blue), in millions of 2000$ (tan), n.s.a. Wisconsin exports deflated by US export price index, 2000=100. NBER defined peak-to-trough recession dates shaded gray. Trump administration shaded orange. Red dashed line at announcement of Section 232, 301 actions. Source: Census, BLS via FRED, NBER, and author’s calculations.

Real exports from Wisconsin declined (manufactured and commodities) as retaliation took hold.

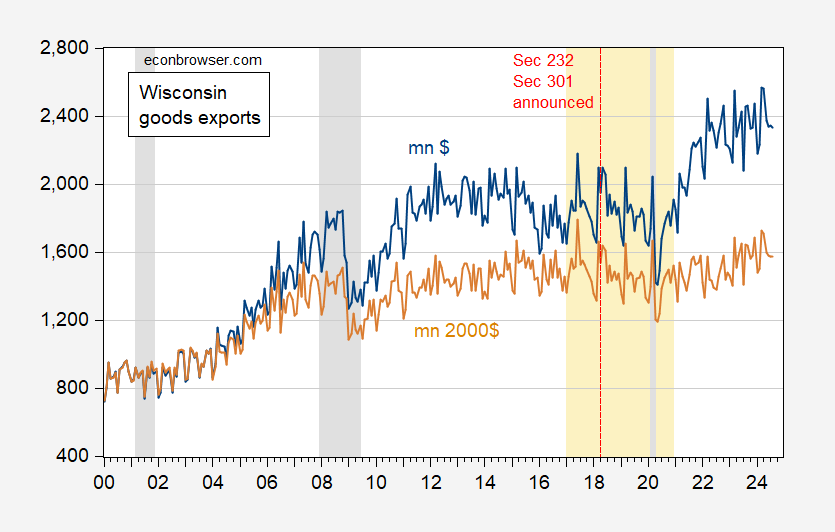

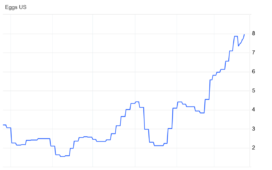

As for soybeans, here’s a picture of the volume of US soybean exports — essentially Brazil stepped in.

Source: Colusi, et al. (2024). Marking for trade war in 2018 by author.

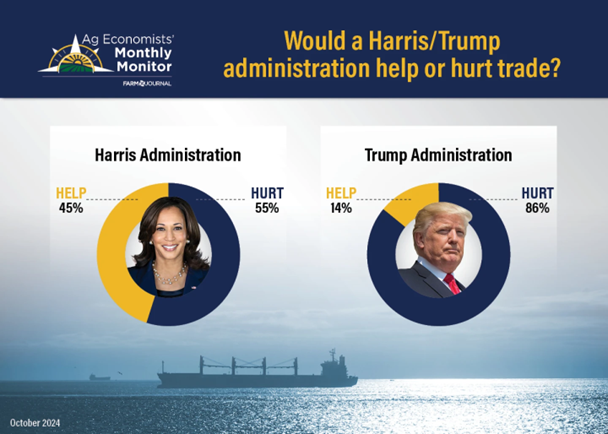

Interestingly, agricultural economists believe that Trump policies will hurt the agricultural sector more than Harris policies (AgWeb farm journal), at a time when more than half of agricultural economists believe the ag economy is in recession.

Source: Agweb (Oct. 10, 2024).