The world takes notice whenever tech giant and iPhone maker Apple does anything. CEO Tim Cook famously said that Apple doesn’t emphasize being the first to do something because being the best is far more important.

Knowing this, the company’s announced partnership with Buy Now, Pay Later company Affirm (NASDAQ: AFRM) to offer loans through Apple Pay caught my attention. Ironically, investors have met Affirm’s stock with: Meh. Shares are lower now than they were before the announcement!

So, has the market fallen asleep here, or is something amiss?

What might Apple’s decision to partner with Affirm mean?

The stock market hates uncertainty, which is why many new, less-proven companies can spend years fighting market skepticism. Affirm is fighting this fight now; shares are down 80% from their former high despite the company making a ton of business progress (more on this later). Why? Its core business, Buy Now, Pay Later loans, could be seen as a commodity. Apple thought so when it launched its in-house Buy Now, Pay Later product Apple Pay Later in March 2023.

Apple’s decision to shutter the business just over a year later and outsource it to Affirm speaks volumes. One could argue two primary statements. First, it says that Apple was not happy with the consumer experience its service had provided. Delivering the best user experience is Apple’s bread and butter, the source of its competitive edge, which is why Apple’s ecosystem is so darn appealing.

In that same breath, one might argue that Apple’s decision to partner with Affirm is, in the same light, a compliment to Affirm’s product, which features myriad loan types with varying terms and durations. After all, Apple chose Affirm over everyone else.

Second, it challenges the notion that Buy-Now, Pay-Later lending is a commodity anyone can copy. If it were so easy, why did Apple quickly jump ship? Sure, anyone can lend money, but not everyone can do it well. It’s another nod to Affirm’s edge on the field.

Apple brings a ton of long-term growth potential to the table

The more obvious aspect of the partnership is the immense growth potential Apple’s user base adds to Affirm’s growth story. Affirm is integrating its lending right into the Apple Pay interface, enabling users to seamlessly become Affirm customers without leaving their digital wallets.

And Apple’s user base is massive. According to Capital One, there are approximately 60 million Apple Pay users in the United States, which could grow to over 75 million by 2030. Affirm is no slouch; the company has 17.8 million total active users. Even assuming some overlap, that’s instant exposure to a customer base almost four times Affirm’s current size, a remarkable opportunity that should see Affirm pick up users once things roll out.

Of course, not everyone will use Buy Now, Pay Later loans, but it’s arguably the best customer funnel a company like Affirm could dream of. Make no mistake — this is a big win for Affirm in the long run.

Why Affirm was a buy even before this

This is not to diminish the Apple partnership, but it’s worth pointing out that Affirm has already woven itself deep into the retail space. It works with over 292,000 active merchants and has partnerships with other heavyweights, including Amazon, Shopify, Walmart, and Target.

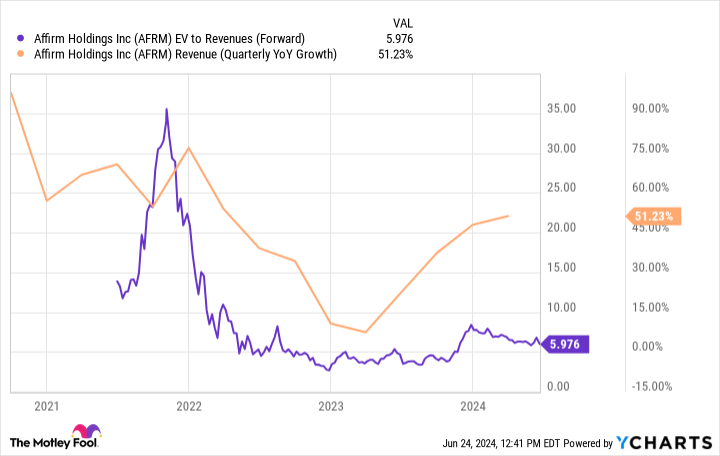

Affirm went public during a frenzied market a few years back, so it’s fair to say that the stock’s valuation needed to cool down. Affirm also grappled with surging interest rates that slowed growth for several quarters. However, note the company’s turnaround with 51% year-over-year revenue growth in its most recent quarter. Meanwhile, the valuation (enterprise value to sales) remains relatively suppressed.

Affirm is growing rapidly again, and the Apple partnership hasn’t even begun yet. Management doesn’t think it will have a material effect in its next fiscal year (the rollout will take time), so investors are seeing a path to strong growth that could begin in the next 18 months and last for some time.

Investors may start feeling good about the stock again as time goes on. For now, it’s hard to find a fintech stock with more upside over the next few years than Affirm.

Should you invest $1,000 in Affirm right now?

Before you buy stock in Affirm, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Affirm wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $774,526!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has positions in Affirm. The Motley Fool has positions in and recommends Amazon, Apple, Shopify, Target, and Walmart. The Motley Fool has a disclosure policy.

This Hyper-Growth Fintech Stock Is a Table-Pounding Buy After Announcing Its New Blockbuster Partnership was originally published by The Motley Fool