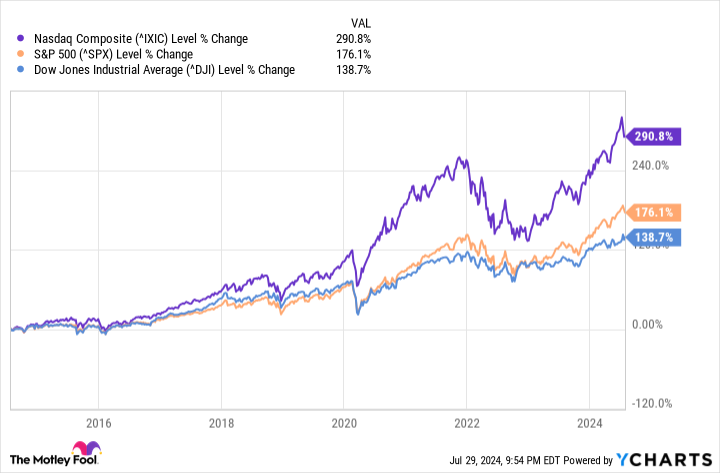

The Dow Jones Industrial Average (DJINDICES: ^DJI) is one of the three major performance-tracking indexes in the U.S. stock market, alongside the S&P 500 and Nasdaq Composite. Unlike its two peers, however, the Dow Jones is a much smaller index, tracking just 30 of America’s largest companies. These companies come from most major sectors, except separately tracked areas such as utilities and real estate.

Unfortunately, the Dow Jones has lagged behind the S&P 500 and Nasdaq Composite in the past decade. The good news, though, is that many of the companies within the index still are great investments on their own.

Investors looking to add high-quality companies to their portfolio should consider the following two Dow Jones stocks, which have the ability to soar this year and beyond.

1. Amazon

Amazon (NASDAQ: AMZN) may be almost synonymous with e-commerce at this point, but its business has expanded impressively over the years. The modest online bookstore has become a true big tech giant with its hands in many pots.

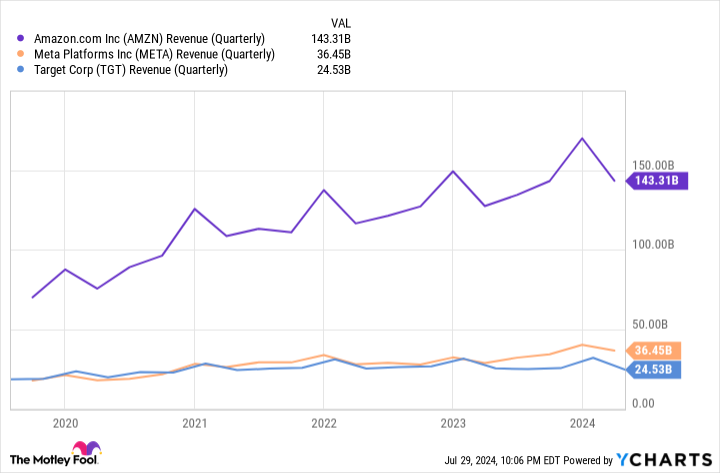

Amazon has been able to fund its research and development and enter into new industries because of the cash flow its e-commerce business generates. In the first quarter, net sales from its North American and international segments were a combined $118.2 billion. That’s more than Target generated in its last four quarters combined.

Add in the revenue from its successful cloud business, Amazon Web Services (AWS), and Amazon brought in more revenue in the first quarter than Meta Platforms‘ last four quarters combined. The only company that tops Amazon’s revenue is Walmart.

Revenue is great, but you could argue that profit is even better, and that’s where AWS comes into the picture.

Cloud services are a much more profitable business than e-commerce because many of the costs are fixed, and once a platform reaches a certain size, it benefits from the economics of scale. This seems to be the case for AWS, the world’s most-used cloud platform and undisputed market leader with a 31% market share (Microsoft Azure is second with 25%).

As Amazon adds artificial intelligence (AI) capabilities to AWS and continues to be a platform where companies can create their own generative AI and machine learning models, it should hold its top spot for quite some time, though Azure has been gaining ground.

Amazon’s price-to-sales (P/S) ratio is around 3.28, which sits below its five-year average. That isn’t necessarily “cheap,” but long-term investors can justify it, considering Amazon’s potential growth areas.

2. Apple

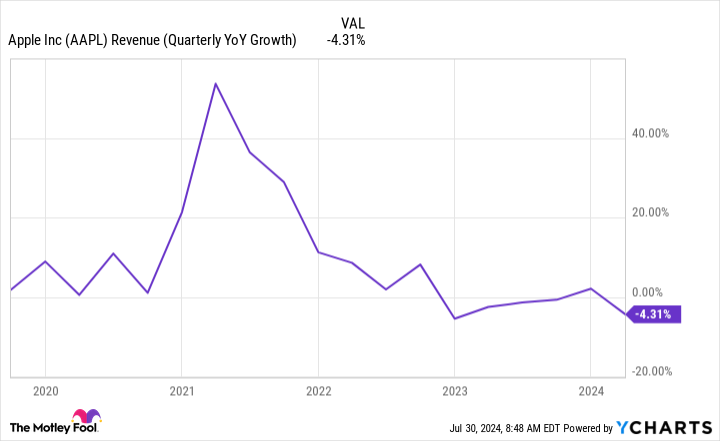

After spending much of the past year away from the top spot, Apple (NASDAQ: AAPL) has regained its title as the world’s most valuable public company. While many top tech companies have seen huge stock price surges fueled by AI hype, Apple was noticeably exempt. In the past 12 months, it has underperformed the S&P 500.

It’s no secret that Apple’s finances are tied to the success of its iPhone sales, and that’s been a thorn in its side recently, as global smartphone sales have slumped over the past few years.

Despite the seemingly stagnant past couple of years, there’s light at the end of the tunnel. To begin, global smartphone sales are projected to rebound this year, which comes at a great time as Apple introduces its Apple Intelligence features in its next generation of hardware.

The second encouraging sign is the growth of Apple’s services segment, which set a revenue record in the first quarter, generating close to $23.9 billion. Services offer higher margins than hardware products as well as provide more reliable revenue because a lot of it is subscription-based.

Services may never overtake hardware as Apple’s cash cow, but they’re becoming a great complement to the ecosystem that many Apple loyalists (myself included) find themselves in. As Apple enters industries like financials and health, it can create deeper integration for its users. That’s a recipe for longevity.

Apple has proven time and time again that it’s one of the best-run companies in the world (thanks to CEO Tim Cook). Like most businesses, it hit a rough patch, but there are few companies that I’d bet on long-term before Apple.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $657,306!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Amazon, Apple, Meta Platforms, Microsoft, Target, and Walmart. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

These 2 Dow Stocks Are Set to Soar in 2024 and Beyond was originally published by The Motley Fool