Yves here. In my usual role as house skeptic, I have to pour a some cold water on Wolf Richter’s enthusiastic endorsement for running your own business and the generally hyping of being an entrepreneur as virtuous….for what I think are not great reasons. Note that this occurs in Wolf’s articles below, with the opening question about running your own business as “being your own boss” which in America is seen as having more status as working for someone else (except in PMC circles, where social status is nearly always tied up with the name of the institution you are affiliated with). As someone who has done a lot of survey research, this framing is not neutral.

Here, it is for the opportunity to get rich. In Japan, entrepreneurs are revered because they create jobs. There is the additional romance in the US of greater autonomy, which given that employers seem to be becoming more oppressive and micro-managing over time, would make getting out from under their thumbs seem awfully appealing. That is confirmed by the continuation of work-from-home, despite the desire of many employers to end it. It amounts to a fairly successful white collar labor action against micro-managing bosses and long commutes.

At least as of 20 years ago (I have not seen this factoid updated) the most common characteristic of people who started their own business was that they had been fired twice. That makes sense given the high failure rate of startups; it ought to appeal more to those who found paid employment to be awfully risky. There is a lot to be said for being on a corporate meal ticket if you can put up with the politics and need to at least feign being agreeable: no need to worry about paying overheads, steady income, limited administrativa demands.

My sister-in-law, who made much of being an entrepreneur, failed at three different business ventures and is now back as an employee. This is despite being a very good salesperson. My consulting business lasted 15 years, so in terms of official statistics, it would be deemed a success for operating more than ten years. Mind you, I never set out to have my own business; I was looking for a job after a splashy gig with the Japanese did not work out (not that it would have long term but the guy who hired me was diagnosed with liver cancer 10 days after I arrived, which put a big spanner in the works). People I knew from McKinsey called me with potential assignments,. After two years of that, I concluded I was in the consulting business. Nevertheless, the market for consulting changed a lot after the dot-com era and it became harder for me to find opportunities for my sort of work.1

In addition, Wolf is what is called a lifestyle entrepreneur, which is typically a solo operator or someone with perhaps only a single support staffer. The dynamic changes if you have staff, even if only 1099s and/or part time, who depend on your for income.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

“Everything else being equal, would you rather – be your own boss or work as an employee for someone else?”

This question that Gallup asked is dear to my heart. I’ve been my own boss at the WOLF STREET media mogul empire since 2011. It has been the most enjoyable job I’ve ever had. Flexible hours? I’ve never worked as many hours as I have been in recent years, but it doesn’t seem like work because I have a blast. Long vacations? This is a 24/7 business, I’m the only underling, and I have the worst slave-driver boss in the universe who makes me go on vacation with a laptop and work. It has been financially rewarding, but not right away.

Another massive benefit is that ageism doesn’t exist for me. All that matters is how well I do my job. I don’t have to worry about getting sacked by a 35-year-old, to be replaced by someone who’ll be like a breath of fresh air or whatever.

So I’m hugely in favor of being your own boss. But I also see the financial risks. Many small businesses struggle; they’re a lot of work for the owner, and often not financially rewarding. And when they run out of the owner’s money, they get shut down. That’s the fate of many. But many others become very successful.

“You can’t always get what you want, you can’t always get what you want… but if you try sometimes, well, you might find, you get what you need…” comes to mind. The Rolling Stones nailed it.

The answers to the question whether you’d like to be your own boss were astounding:

- 62% would rather be their own boss

- 35% would rather work as an employee for someone else.

Turns out, wanting to be an entrepreneur isn’t the wish of some small risk-seeking group of crazies, but of nearly two-thirds of adult Americans.

The survey was based on 46,993 members (18 and over) of the Gallup Panel. Of them, 6,986 self-identified as business owners; 4,030 said they have seriously considered owning their own business; and 35,167 said they have not seriously considered owning their own business, according to the study.

Financial Risk

Those that want to be their own boss were asked: “How much financial risk would you be willing to accept in order to become your own boss?”

Starting your own business is risky, everyone knows that, and many such efforts don’t work out. But over half (52%) are willing to take a “fair amount of risk” or a “great deal of risk”:

- A great deal of risk: 14%

- A fair amount of risk: 38%

- Only a little risk: 37%

- None at all: 11%.

Why Start a Business?

Among people who either already own a business or want to start a business, the two top motivations were #1 being your own boss and #2 making more money. So, more control and more money (both in bold):

| Most Important Reasons for Starting/Wanting to Start a Business | Business owners | Want to start a business |

| You want to be your own boss | 57% | 60% |

| An opportunity to earn more money | 54% | 60% |

| Desire for a more flexible work schedule | 42% | 45% |

| To pursue a passion project | 30% | 45% |

| To fill a need in the market for a specific product or service | 23% | 20% |

| To make a positive impact or change in the world | 19% | 36% |

| Someone you know encouraged you to start a business | 15% | n/a |

| You wanted to leave the corporate world | 15% | 22% |

| Family or generational expectations | 14% | 16% |

| To support your community | 11% | 24% |

| Someone you know wanted to be a business partner with you | 10% | 10% |

| Laid off or lost previous job | 9% | n/a |

| Concern about job becoming obsolete because of technology | 3% | 9% |

| Unhappy in current job | n/a | 19% |

| Friend/Family member encouraging you to go into business with them | n/a | 10% |

| Other | 8% | 4% |

Most Helpful Resources for Starting a Business

Business owners were asked which of the following had been particularly helpful in being able to start your business. The #1 and #2 most helpful resources are in bold. Note #3, personal savings. We’ll get to the three in a moment:

| What was particularly helpful in being able to start your business? | |

| Prior work experience in the industry/field | 60% |

| Encouragement from people you know | 57% |

| Personal savings that could be used to fund the business | 45% |

| Personal or community networks (mentors, chamber of commerce, etc.) | 29% |

| Software and other technology to assist with routine business tasks | 20% |

| Funding through loans | 12% |

| Training programs on how to run a business | 10% |

| Other | 6% |

| Government programs or services to help business owners | 6% |

| Funding through investors | 4% |

Obviously, #1 (prior work experience) would be a great resource to have: If you already know what you’re doing, you’re way ahead. In my case, I’d never run a website, had no idea how to do that, had no idea how to make it get traction, and didn’t know anyone in the business. That was a tough place to start from, and is not recommended. It took more time and ate up more resources. But it eventually worked out.

Obviously, #2, encouragement, is great especially from your family who will have to deal with the fallout. My wife encouraged me because she got tired of listening to this stuff that I’m now publishing. But others looked at me askance, and some essentially ridiculed my efforts.

Money

Obviously, #3 – personal savings – is super helpful. Even if the business doesn’t require a lot of upfront investment, it’s possible that revenues aren’t materializing right away, or maybe for years, and personal savings have to be used to tide the owner over until the business starts generating enough cashflow.

I would have never started my business without enough savings. The risk I was willing to take was not making significant amounts of money for a few years. I would not have been willing to risk becoming homeless or whatever. So if the business makes enough money right away – such as consulting in your prior industry with your former clients – great. If it doesn’t, personal savings are key.

The alternative to personal savings is money from equity investors. And then you’re not really your own boss anymore because now you have a board of directors to answer to. But enough money from investors can perform all kinds of miracles – such as hiring lots of expensive staff and renting a fancy office long before the business generates the first cent of revenues, and some of the biggest companies today started out that way.

Not Enough Money

People who would want to start a business, but haven’t done so yet, cited financial reasons as the #1 and #2 biggest obstacles. And the #3 obstacle was seen as “inflation,” which is interesting in its own right.

| The biggest challenges or obstacles you think you would face in starting a business? | |

| Lack money needed to start a business | 60% |

| Concerns about the personal financial risks of going into business | 50% |

| Inflation | 33% |

| Needing to learn more about starting/managing a business | 33% |

| Lack of confidence that business would succeed | 26% |

| Government regulation, permitting, bureaucracy, red tape, etc. | 25% |

| Access to business loans | 24% |

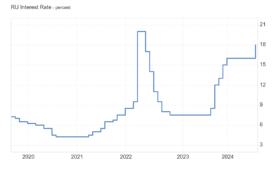

| Interest rates on business loans are too high | 22% |

| Lack of time/Time management | 18% |

| Marketing or customer acquisition challenges | 17% |

| Family situation (e.g., health, child or elder care) | 13% |

| Difficulty finding employees | 11% |

| Access to technology and equipment needed to start a business | 11% |

| Feeling alone or isolated as a business owner | 7% |

| Supply chain | 6% |

| Limited technical knowledge | 6% |

| Loss of unemployment benefits | 5% |

| Family expectations | 5% |

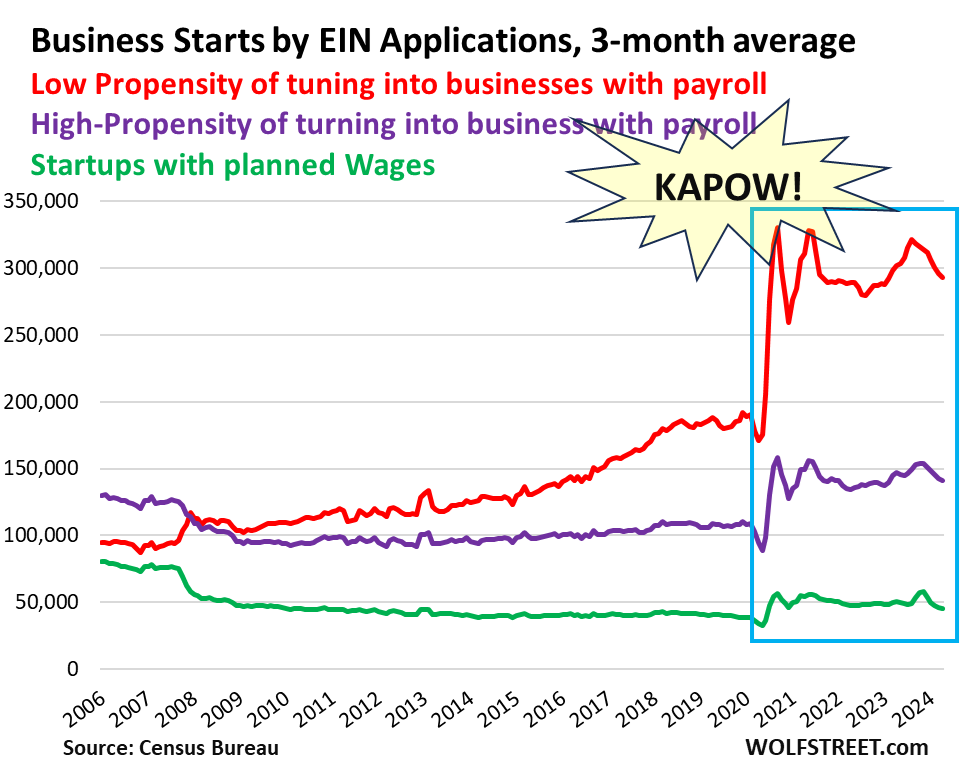

The KAPOW! Moment During the Pandemic Continues

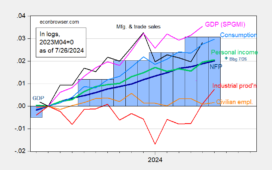

Whether it was the extra time, the free money, or pretending to work from home… for whatever reason there was a huge spike in new business formations, starting in the summer of 2020 and reaching a very high plateau. And then new business formations have continued to move along the high plateau, against all expectations.

New business formations in April were still up by 48% from April 2019, based on the three-month average of applications for federal Employer Identification Numbers (EIN) with the IRS, according to data by the Census Bureau.

A business only needs an EIN if it has payroll, if it is a corporation or partnership, and for some other purposes (trusts, estates, etc.). An EIN is not required to be self-employed or to start a business that doesn’t have employees; the owner’s Social Security number is enough. An EIN was not required to get PPP loans during the pandemic; a Social Security number was enough. This data here covers only EIN applications for typical businesses. EIN applications for trusts, estates, tax liens, etc. are removed from this data.

The Census Bureau categorizes EIN applications based on the data submitted in the application.

Businesses that have a high likelihood of creating a significant payroll are categorized as “High-Propensity Business Applications” (HBA).

About 32% of all EIN applications have been HBAs, and the number of these applications is up by 33% from 2019 (purple line)

Businesses indicating a date for the first payroll are categorized as “Business Applications with Planned Wages” (WBA), a subgroup of HBAs. They’re ready to hire and have funding to meet that payroll. These businesses are most likely to grow their payroll and become significant employers. Only about 11% of EIN applications fall into this category. And the number of applications is up only 13% from 2019 (green).

The biggest increase came from businesses with a low propensity to end up with a significant payroll, tiny shops, similar to the WOLF STREET media mogul empire, with entrepreneurs essentially striking out on their own. They accounted for about 68% of all EIN applications, and the number of applications was still up by 58% from 2019 (red line).

In April, there were 432,517 total EIN applications, including 139,496 High Propensity Applications (HBA), of which 44,875 had planned wages (WBA). The remainder, 293,021 applications were from businesses with a low propensity to end up with a significant payroll.

The chart shows the KAPOW! moment in the summer of 2020 that has barely let up since then though the pandemic-era free money is long gone. The red line is astonishing – businesses with a low propensity to become significant job creators. It represents Americans striking out on their own, often only on a wing and a prayer.

____

1 Citibank used to divide its sales types into beaters (ones who found opportunities) versus baggers (the ones who closed the sale). Yours truly was a terrible beater but a very very good bagger.