Since the internet first began to proliferate three decades ago, Wall Street and investors have been waiting for the next big innovation that can alter the growth trajectory of corporate America. The artificial intelligence (AI) revolution appears to be answering the call for game-changing growth.

With AI, software and systems are used in place of humans to oversee or undertake tasks. What gives this technology such broad-reaching utility is the potential for software and systems to learn and evolve without human oversight.

Although growth estimates are all over the map when it comes to AI, the analysts at PwC released a report last year that estimated the technology would add $15.7 trillion to the global economy come 2030. With an addressable market this large, there are bound to be multiple big-time winners, which is why we’ve witnessed investors pile into AI stocks.

However, optimism surrounding AI stocks isn’t universal among Wall Street’s brightest and richest investors.

Nvidia’s top billionaire seller dumped over 29 million (split-adjusted) shares in the first quarter

Based on Form 13F filings with the Securities and Exchange Commission — 13Fs provide a snapshot of what Wall Street’s most-successful money managers were buying and selling in the latest quarter — over a half-dozen billionaire money managers dumped shares of AI leader Nvidia (NASDAQ: NVDA) during the first quarter. But no billionaire seemingly mashed the sell button harder than Coatue Management’s Philippe Laffont.

Factoring in that Nvidia has since completed a 10-for-1 forward-stock split, Laffont’s fund sold the equivalent of 29,370,600 shares of Nvidia, or roughly 68% of Coatue’s prior stake in the company.

Despite Nvidia having a veritable monopoly on AI-powered graphics processing units (GPUs) in high-compute data centers, and enjoying otherworldly pricing power due to demand for AI-GPUs overwhelming supply, Laffont likely had a number of viable reasons to run for the exit.

To state the obvious, he and his team may have simply been locking in some of their gains. Nvidia’s stock has gained nearly $3 trillion in market value since the start of 2023, which is a level of scaling we’ve simply never witnessed before.

A more prevailing concern for Nvidia and Laffont might be history. There hasn’t been a new innovation or technology in 30 years (including the advent of the internet) that’s avoided an early stage bubble. Investor euphoria for new innovations consistently ignores that all new innovations need time to mature. Artificial intelligence is unlikely to break this trend, which would eventually expose Nvidia to some serious downside.

Nvidia is also contending with its first real semblance of competition in AI-accelerated data centers. In addition to external competitors rolling out their AI-GPUs, Nvidia’s top customers are also developing AI-GPUs for their data centers. This all translates to reduced AI-GPU scarcity and waning pricing power for AI leader Nvidia.

But while Philippe Laffont and his team were busy dumping shares of Nvidia in the March-ended quarter, they couldn’t stop buying shares of four other supercharged growth stocks.

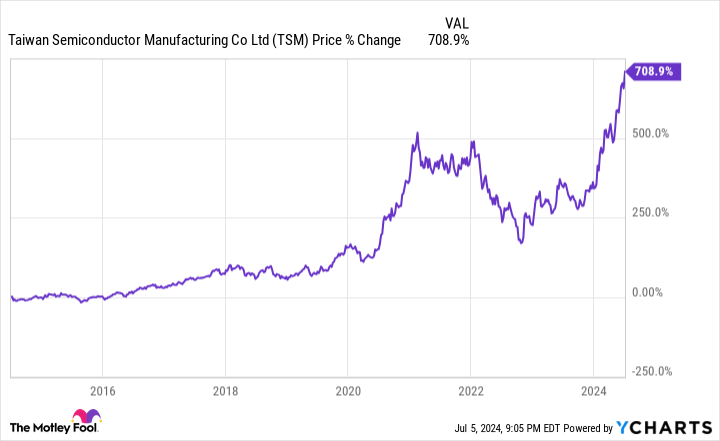

Taiwan Semiconductor Manufacturing

One of the most interesting moves made by billionaire Philippe Laffont and his investment team during the first quarter was buying more than 10 million shares (10,027,552, to be precise) of world-leading chip fabrication company Taiwan Semiconductor Manufacturing (NYSE: TSM).

Taiwan Semi, which is now Coatue’s fifth-largest position by market value (as of March 31), provides its services to most of the top tech companies and semiconductor titans, including Nvidia. With demand for AI-GPUs swamping supply, chip-fab companies like Taiwan Semiconductor, which are responsible for packaging the high-bandwidth memory that make high-compute data centers tick, should enjoy an extensive backlog of orders.

Furthermore, Taiwan Semi is steadily reducing the geopolitical risk that had previously weighed down its valuation. The foundry giant opened its first Japan-based plant earlier this year, and expects to begin production at a new facility in Arizona by sometime in 2025. This means geopolitical tensions between China and Taiwan won’t be as potentially damning to its future capacity.

Salesforce

A second supercharged growth stock that Laffont and his investment team were buying instead of Nvidia during the March-ended quarter is cloud-based customer relationship management (CRM) software solutions provider Salesforce (NYSE: CRM). Laffont more-than-doubled Coatue Management’s stake in Salesforce by picking up 2,556,774 shares in the first three months of the year.

The primary reason Salesforce has worked its way to Coatue’s fourth-largest holding probably has to do with the company’s seemingly impenetrable moat in cloud-based CRM software. A recent report from IDC notes that Salesforce has been the global No. 1 in CRM software sales for 12 consecutive years. Further, its 21.7% worldwide CRM market share is over three times greater than its next-closest competitor (Microsoft at 5.9%).

On top of a sustained double-digit growth runway for cloud-based CRM software, CEO and co-founder Marc Benioff has orchestrated a number of earnings-accretive acquisitions, including MuleSoft, Tableau Software, and Slack Technologies. Bolt-on acquisitions expand the company’s services ecosystem and provide abundant cross-selling opportunities.

Alphabet

The third high-octane growth stock Laffont was busy buying while sending shares of AI kingpin Nvidia to the chopping block is Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG), the parent company of internet search engine Google, streaming platform YouTube, autonomous driving company Waymo, and cloud infrastructure service platform Google Cloud. Coatue’s first-quarter 13F shows the fund’s position in Alphabet’s Class A shares (GOOGL) grew by 138%, or 2,597,338 shares.

Similar to Taiwan Semi and Salesforce, the lure of Alphabet might be as simple as its impenetrable moat in internet search. For more than nine years, Google has accounted for at least a 90% monthly share of worldwide internet search. More often than not, this affords the company exceptional ad-pricing power, which leads to an abundance of operating cash flow.

In the second half of this decade, Google Cloud is liable to be Alphabet’s fastest-growing segment. Enterprise cloud spending is still in its relatively early stages of ramping up, and Google Cloud made the shift to recurring profits last year. Since cloud-service margins are noticeably higher than advertising margins, this segment should provide a nice lift to Alphabet’s cash flow in the years to come.

PayPal

The fourth supercharged growth stock Nvidia’s top billionaire seller was a big-time buyer of during the March-ended quarter is financial technology (“fintech”) juggernaut PayPal Holdings (NASDAQ: PYPL). Laffont oversaw the addition of 8,014,159 shares of PayPal, making it Coatue’s 16th-largest holding by market value, as of March 31.

In spite of increasing competition in the digital payment space, many of PayPal’s key performance metrics are moving in the right direction. Specifically, payment transactions grew by 11% from the previous year to 6.5 billion, total payment volume increased by 14% on a constant-currency basis to almost $404 billion, and engagement among active accounts continues to climb. Over the trailing-12-month (TTM) period, ended March 31, the average active account completed 60 payments, which is up from an average of 40.9 payments over the TTM for active accounts, as of the end of 2020.

Furthermore, new CEO Alex Chriss has a good understanding of what small businesses need to succeed. He’s overseeing the introduction of a new advertising platform for PayPal and has been mindfully monitoring spending to boost margins.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $771,034!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Alphabet and PayPal. The Motley Fool has positions in and recommends Alphabet, Microsoft, Nvidia, PayPal, Salesforce, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short June 2024 $62.50 calls on PayPal. The Motley Fool has a disclosure policy.

Forget Nvidia: The Artificial Intelligence (AI) Leader’s Top Billionaire Seller Is Buying These 4 Supercharged Growth Stocks Instead was originally published by The Motley Fool