(Bloomberg) — European and US equity futures inched lower on Wednesday, taking a breather after American shares advanced to fresh highs, as traders adjust portfolios amid bets the Federal Reserve will soon start cutting interest rates.

Most Read from Bloomberg

MSCI’s Asia Pacific Index – a gauge for benchmarks in the region – erased some of its earlier gains, dragged down by Japanese stocks after US warned allies of stricter trade rules in the crackdown on China. Stocks in Hong Kong and mainland China fluctuated as traders awaited more details from the Third Plenum.

Optimism that the Fed will cut rates soon, alongside signs of US retail resilience, supported some risk-on sentiment, while increasing chances of a Donald Trump presidency raised concerns over geopolitical and trade risks over the past few sessions.

“We have a complex matrix of drivers,” said Vishnu Varathan, head of economics and strategy at Mizuho Bank Ltd. in Singapore. “Impending Fed easing ought to be good for rotation into smaller cap and tech, but equally, Trump 2.0 raises the uncertainty associated with geopolitics and trade.”

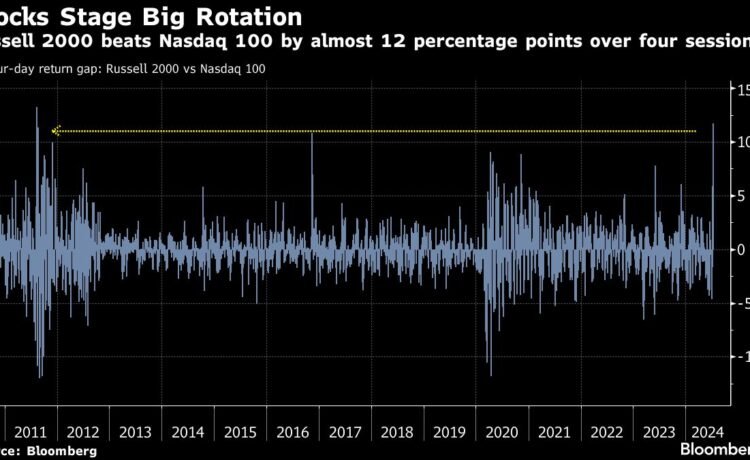

The risk-on sentiment drove a rotation into smaller US stocks — the Russell 2000 Index rose 12% in the five sessions through Tuesday, its best showing since April 2020. The sector rotation continued in Asia, where the regional stock gauge’s top-performing sector was health care, and its worst was technology.

“Bolstered by optimism from the record-making journey, the bullish momentum in Japan and the Australian markets appears well-protected by rising expectations for more cuts and supportive data,” said Hebe Chen, an analyst at IG Markets Ltd. “However, also notable is the peace-breaking noise sparked by Trump’s comments on Taiwan, poised to cast a long-tail shadow on the region’s stability, putting the markets with the most direct impact — Taiwan, China, and South Korea — at looming risk.”

Treasury yields were little changed Wednesday, after declines on Tuesday. The dollar was steady.

New Zealand yields edged higher with the kiwi after mixed inflation data muddied the outlook for an interest rate cut. Singapore’s exports declined more than expected in June as electronics shipments remained weak, suggesting challenges ahead for the trade-reliant economy.

Traders are awaiting a monetary-policy decision in Indonesia. Markets are closed in India and Pakistan.

In the corporate world, ASML Holding NV’s order intake beat estimates as the artificial intelligence boom drives demand for the Dutch firm’s advanced chipmaking machines. Japan’s Tokyo Electron Ltd. shares tumbled by the most in three months after Bloomberg reported US discussions about using its most severe trade restrictions to curb China’s access to advanced semiconductor technology.

In commodities, gold hit another record after rallying almost 2% Tuesday to touch an all-time high of $2,469.66 per ounce, while West Texas Intermediate declined for a fourth day.

Key events this week:

-

Eurozone CPI, Wednesday

-

US housing starts, industrial production, Wednesday

-

Fed Beige Book, Wednesday

-

Fed’s Thomas Barkin speaks, Wednesday

-

ECB rate decision, Thursday

-

US initial jobless claims, Philadelphia Fed manufacturing, Conference Board LEI, Thursday

-

Fed’s Mary Daly, Lorie Logan and Michelle Bowman speak, Thursday

-

Fed’s John Williams, Raphael Bostic speak, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.2% as of 6:28 a.m. London time

-

Japan’s Topix rose 0.3%

-

Australia’s S&P/ASX 200 rose 1%

-

Hong Kong’s Hang Seng fell 0.1%

-

The Shanghai Composite fell 0.6%

-

Euro Stoxx 50 futures fell 0.1%

-

Nasdaq 100 futures fell 0.4%

-

Australia’s S&P/ASX 200 rose 1%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0903

-

The Japanese yen rose 0.1% to 158.18 per dollar

-

The offshore yuan was little changed at 7.2860 per dollar

-

The Australian dollar was little changed at $0.6738

-

The British pound was little changed at $1.2969

Cryptocurrencies

-

Bitcoin rose 1.9% to $65,945.41

-

Ether rose 2.1% to $3,512.69

Bonds

-

The yield on 10-year Treasuries advanced one basis point to 4.17%

-

Japan’s 10-year yield was unchanged at 1.025%

-

Australia’s 10-year yield was little changed at 4.24%

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Richard Henderson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.