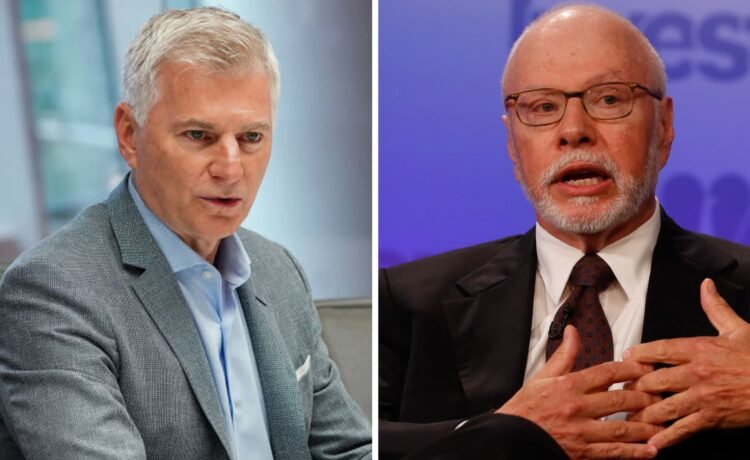

Southwest Airlines CEO Bob Jordan and Elliott Investment Management co-CEO Paul Singer.

Christopher Goodney | Bloomberg | Getty Images | CNBC

Activist investor Elliott Management said Monday it would mount a proxy fight to push for change at Southwest Airlines through a special shareholder vote unless management is willing to negotiate, citing a poison pill and board expansion that the investor views as “entrenchment maneuvers.”

Elliott in its letter to Southwest’s board said it remained open to collaboration, but that the board had taken steps to box Elliott out. The activist is seeking the ouster of CEO Bob Jordan and executive chairman Gary Kelly, citing underperformance and a failing corporate culture.

Barring a change in the board’s posture, Elliott partner John Pike and portfolio manager Bobby Xu said Elliott intended “to move expeditiously to give shareholders a direct say on the necessary leadership changes.” A proxy fight would be expensive and challenging for Elliott and Southwest Airlines.

Southwest’s bylaws have a special provision that allows big shareholders like Elliott to call for an extraordinary shareholder meeting to vote on directors or other proposals.

The high-stakes gambit comes on the same day that Southwest announced it’s adding billionaire airline entrepreneur Rakesh Gangwal to its board, just days after the company adopted a poison pill that limited shareholders from getting more than a 12.5% stake in the airline. Elliott said it has an 11% interest in Southwest, making it one of the largest beneficial owners.

Elliott cited numerous conversations with investors and stakeholders that supported leadership change at the airline.

“Elliott remains committed to providing them with a clear choice,” Pike and Xu wrote, between incumbent management and “new and proven airline industry executives capable of returning Southwest to its rightful place as an industry leader.”

The activist described the poison pill as “a shield for failure and a sword for nothing except the fees of advisers” which highlighted a core tenet of its case for change. Elliott considers insular management culture averse to outside thinking.

Southwest has described the poison pill as a fiduciary obligation, given Elliott has indicated that it plans to grow its stake, and called Gangwal’s addition to the board a step in a “deliberate” process of board refreshment.

Companies normally hold an annual shareholder meeting where shareholders approve board nominees and other changes to a company’s bylaws or compensation packages without much trouble. Activist investors can mount proxy fights if they are seeking to force change in a company’s leadership or operations.

Companies usually settle with Elliott, one of the most successful activist investors, rather than risk taking on the activist in a proxy battle. For example, when the activist nominated a slate of directors at Salesforce — usually the first step in a contest — the company managed to assuage Elliott’s concerns with cost-cutting, operational changes and a blowout earnings report. Elliott later withdrew the rival slate.

A Southwest spokesperson said the airline had acted in good faith when dealing with Elliott. “Elliott has focused on personal attacks,” the spokesperson said in a statement, adding that the activist was “conditioning any serious discussions on an immediate CEO change.”

“We remain open to constructive conversations with Elliott, including evaluating additional strong and independent director candidates, as we continue to solicit candid feedback from all shareholders,” the spokesperson said.