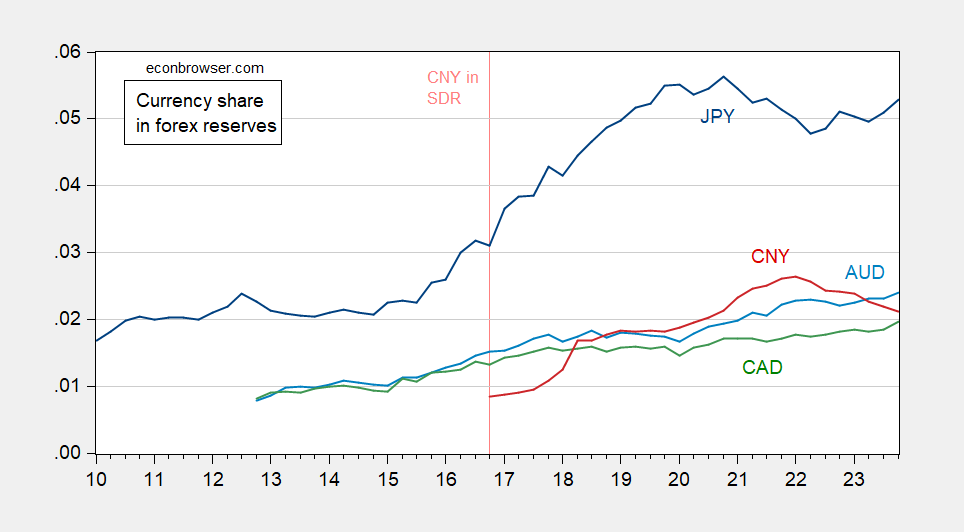

COFER data through December 2023:

Figure 1: Foreign exchange reserves in JPY as share of tota reserves (blue), AUD (light blue), CAD (green), CNY (red). Source: IMF COFER, access 6/18/2024, and author’s calculations.

Peak CNY was 2022Q1 at 2.6%, while latest is at 2.1%.

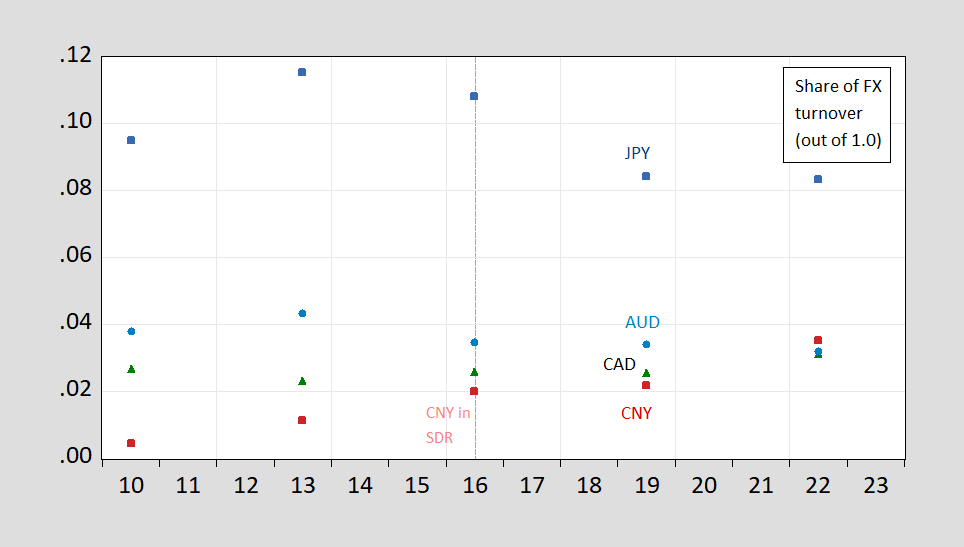

In terms of daily foreign exchange turnover, CNY was rising through April of 2022.

FIgure 2: Foreign exchange turnover share in April in CAN (blue square), in AUD (light blue circle), in CAD (green triangle), in CNY (red square), out of 1.00. Source: BIS Triennial Survey, 2022.

What’s happened to turnover since 2022 is an interesting question, particularly in light of the burgeoning trade between Russia and China, and hence invoicing/settlement in CNY. Here’s CSIS’s estimate of invoicing in RMB from 2011 to 2023Q1.

Source: DiPippo and Palazzi (2024).

This last graph indicates how the CNY can gain in use as international currency, driven by trade which China dominates in, while losing favor as a reserve currency, or a vehicle currency. However, the gap between what happens in the financial sphere, vs. the trade sphere, reinforces for me the proposition that as long as investors remain suspicious of Chinese government intents with respect to political risk (including tighter capital controls), one shouldn’t expect further large gains in use of the CNY as a reserve currency.