I see a bevy of economists (a lot on the right, see here) saying we’re in a recession, or soon to be in one. What do predictive models say?

Miller (2019) showed the maximum AUROC probit model for predicting recessions at the 3 month over the 1954-2018 period uses the 10yr-Fed funds spread. Updating his regressions, assuming no recession as of August:

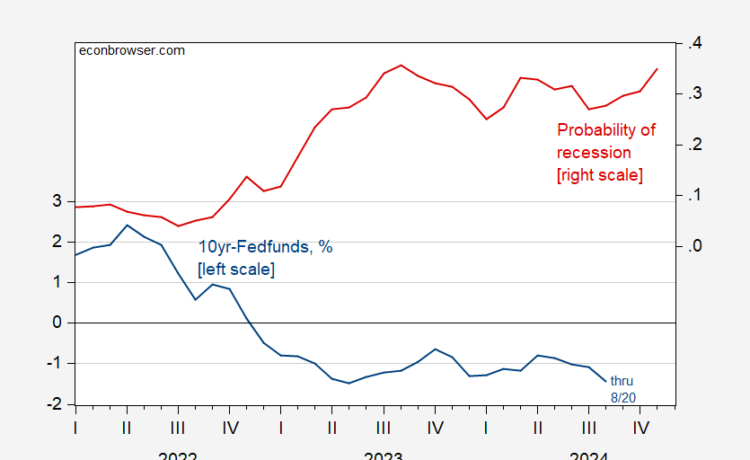

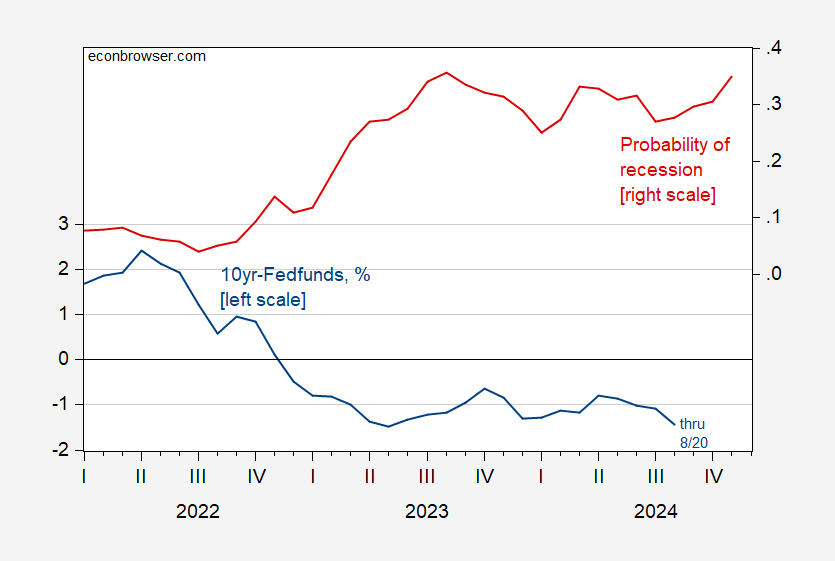

Figure 1: 10 year – Fed funds spread, % (blue, left scale), estimated probability of recession (red, right scale). Interest rate data for August through 8/20. Source: Treasury, Fed via FRED, and author’s calculations.

The McFadden R2 from this regression is 0.15, and puts the November recession probability at 35%. (Adding in the Chicago Financial Conditions Index raises the McFadden R2 to 0.31, but yields a recession probability of 0.07 for November).

Note that this is not conjunctural analysis (are we in a recession now?), but forward looking.