Part 3 in a series on U.S. historic preservation policy and current threats

By Dr. Brenna Spray, MHT/MHAA Outreach Coordinator

In Part 1 of this series, we looked at how the National Historic Preservation Act created a national framework for protecting America’s past. In Part 2, we explored how Maryland turned that federal mandate into on-the-ground success through the Maryland Historical Trust as the State Historic Preservation Office (SHPO). Now, in Part 3, we turn to the funding mechanism that makes all of this possible: the Historic Preservation Fund (HPF).

What Is the HPF?

If the National Historic Preservation Act was the blueprint and SHPOs are the builders, then the HPF is the toolbox – quietly opened day after day to do the painstaking work of preservation. Created in 1976, the HPF channels federal money to support the federal preservation mandates put into place by the National Historic Preservation Act. It funds preservation efforts in all 50 states, five U.S. territories, three freely associated states, and the District of Columbia. It’s how MHT and other SHPOs keep staff paid, projects reviewed, surveys updated, and communities supported. Until recently, that system ran quietly and efficiently in the background.

The HPF isn’t funded through income taxes or general revenue. Instead, Congress modelled the HPF on the Land and Water Conservation Fund by drawing funding from offshore oil and gas lease revenue from the outer-continental shelf. This structure creates a kind of tradeoff that reinvests in cultural resources as we extract natural ones, “using funds from one non-renewable resource to fund another non-renewable resource, our Nation’s heritage” [1]. The model was intentional: a policy-level recognition that natural resource extraction carries long-term societal costs. By dedicating a portion of that revenue to preservation, the HPF represents one of the few federal programs that attempts to balance development with stewardship.

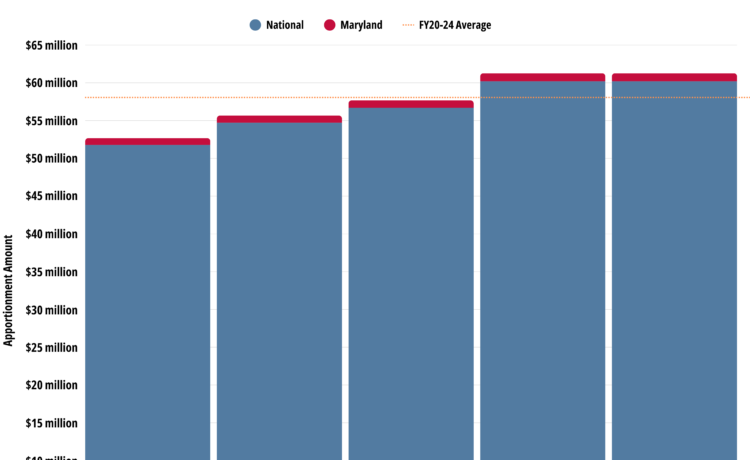

Funding for the HPF has been appropriated every year since 1976 because, across the board, members of Congress have recognized that historic preservation benefits the public. Congress usually appropriates funds for the HPF at around $60-100 million [2]. Since 2020, SHPOs have received an average of $57.7 million annually [3]. Remaining HPF funds support more than 200 Tribal Historic Preservation Officers (the equivalent of SHPOs for federally recognized tribes) and various grant programs administered by the National Park Service to document and enhance historic places, including Save America’s Treasures, Semiquincentennial Grants, and Underrepresented Communities Grants Program.

Total Amount SHPOs Received (2020 – 2024)

“Statistical Reports – Historic Preservation Fund,” https://www.nps.gov/subjects/historicpreservationfund/statistical-reports.htm

What Does the HPF Pay for in Maryland?

In Maryland, through the annual SHPO allocation and National Park Service grants, HPF dollars help:

- Conduct Section 106 reviews (more than 103,000 federal reviews since 1986) to ensure that historic properties and cultural sites are considered when a federal agency takes action;

- Maintain and expand the Maryland Inventory of Historic Properties (now with over 95,000 entries) and the National Register (over 1,500 individual and district listings since its establishment);

- Assist with the oversight of easements acquired with federal funds (like Riversdale House Museum), often required to protect past grant investments;

- Implement historic preservation projects across the state, like the restoration of the Hessian Barracks by the Maryland Department of Education in 2022, which was funded by the Semiquincentennial Grant Program;

- Develop and implement statewide preservation planning through Heritage2031, which helps ensure that state and local efforts for cultural heritage are aligned;

- Support municipalities via the Certified Local Government program, which has funded over $2.4 million in projects and educational opportunities since 2001;

- Offer technical assistance for planning and financial incentives, such as the Federal Historic Preservation Tax Incentives program; and

- Document underrepresented histories (including the women’s suffrage movement in Maryland).

This isn’t bonus money: it’s essential support to keep historic preservation, archaeology, and cultural heritage activities moving forward. These projects may not always make headlines, but their impact is visible in almost every corner of the state: preserved downtowns, revitalized schoolhouses, interpretive signage on walking trails, and growing archives that tell a fuller American story. In addition to funding work mandated by the National Historic Preservation Act – through SHPOs like MHT – HPF funding also gives communities the tools and resources to care for their own heritage.

A System Under Stress

HPF funding came through for SHPOs and grantees year after year, with some delays and uncertainty during federal government shutdowns, but in 2025, a months-long delay in releasing HPF funds left SHPOs and other grantees across the country in limbo. In May 2025, Ohio’s SHPO was forced to lay off a third of its staff [4], other SHPOs subsequently saw layoffs, and many more made operational adjustments to avoid or delay layoffs as long as possible. In a field that runs on continuity, even a short delay can ripple across years of work. For communities relying on SHPO support to access federal tax credits, meet compliance deadlines, or plan for historic sites, even a few months of uncertainty can derail timelines, stall investment, and discourage participation.

Thankfully, the FY25 HPF appropriation was eventually released, and most states have been able to access funds. As the FY26 budget process ramps up, the National Trust for Historic Preservation, the National Conference of State Historic Preservation Officers (NCSHPO), and partners across the country have urged Congress to fully fund the HPF in FY26 – especially as we approach the nation’s 250th anniversary. In May 2025, 60 House members and 20 Senators signed on to support a $225 million appropriation, including $70 million for SHPOs.

Preservation Needs People

While the president’s FY26 budget proposed virtually eliminating HPF funding, Congress (recently returned from recess) appears to support bills that include about $168 million for the HPF [5], with level funding for SHPOs at $62.15 million [6]. This is good news, but we can’t be complacent. Collective action was crucial to every step of support for federal preservation programs, from the establishment of the National Historic Preservation Act of 1966 to pushing the FY25 HPF funding across the finish line.

Now we need that energy again.

If you’ve ever admired a historic neighborhood, seen the impact of a tax credit project, or visited a place that helps tell your community’s story, you’ve witnessed the value of preservation firsthand. The HPF plays a key role in making this work possible. Preservation depends on a combination of passion and consistent, reliable support. The HPF is meant to ensure that America’s shared history is protected. Understanding how it works and why it matters is essential to appreciating the full story of preservation. As the conversation about federal funding continues, staying informed about the HPF helps us see the larger picture of how preservation endures – and, in Maryland as in every state, ensures that the history around us remains part of the story we share with future generations.

Resources

Learn how to contact your Congressman

Action Center (National Trust for Historic Preservation)

Advocacy Efforts from Colleague Organizations (Preservation Action)

Latest Advocacy (American Association for State and Local History)

SHPOs | Historic Preservation under Threat (NCSHPO)

Communicating with Elected Officials (NAPC)

Preservation at Every Level (NAPC)

References

[1] “Historic Preservation Fund,” 2020. https://preservationaction.org/in-1976-congress-established-the-historic-preservation-fund-hpf-to-support-the-initiatives-mandated-by-the-national-historic-preservation-act-of-1966-in-1980-congress-authorized-150m-in-ann/.

[2] Office of Natural Resources Revenue, “Historic Preservation Fund | How It Works,” https://archive.revenuedata.doi.gov/how-it-works/historic-preservation-fund.

[3] “Statistical Reports – Historic Preservation Fund,” 2022. https://www.nps.gov/subjects/historicpreservationfund/statistical-reports.htm.

[4] J. Pelzer, “Ohio’s State Historic Preservation Office slashes staff as federal funding remains in limbo,” Cleveland, May 13, 2025. www.cleveland.com/news/2025/05/ohios-state-historic-preservation-office-slashes-staff-as-federal-funding-remains-in-limbo.html.

[5] “Advocacy in Action: FY 2026 Funding for Historic Preservation on Capitol Hill | Historic Preservation Fund,” 2025. https://savingplaces.org/historic-preservation-fund/updates/fy26-funding-for-historic-preservation-on-capitol-hill.

[6] “Funding, Tax Incentives, Grants & Awards for Preservation Projects: Senate Appropriations Committee Approves Interior Bill – Includes Funding for HPF,” 2025. https://www.preservationdirectory.com/preservationblogs/ArticleDetail.aspx?catid=14&id=8783.

Discover more from Our History, Our Heritage

Subscribe to get the latest posts sent to your email.