Or, “who needs a stinkin’ independent central bank, non-Trump edition.”

Could this article explain why at 1:30 AM CST as I awaited data on the Russian Central Bank’s interest rate decision… nothing happened?

From Bloomberg yesterday (before the decision):

ong feted as the savior of Russia’s economy in the face of sanctions over the war in Ukraine, central bank Governor Elvira Nabiullina is increasingly under attack from officials who say she’s now destroying it with record high interest rates.

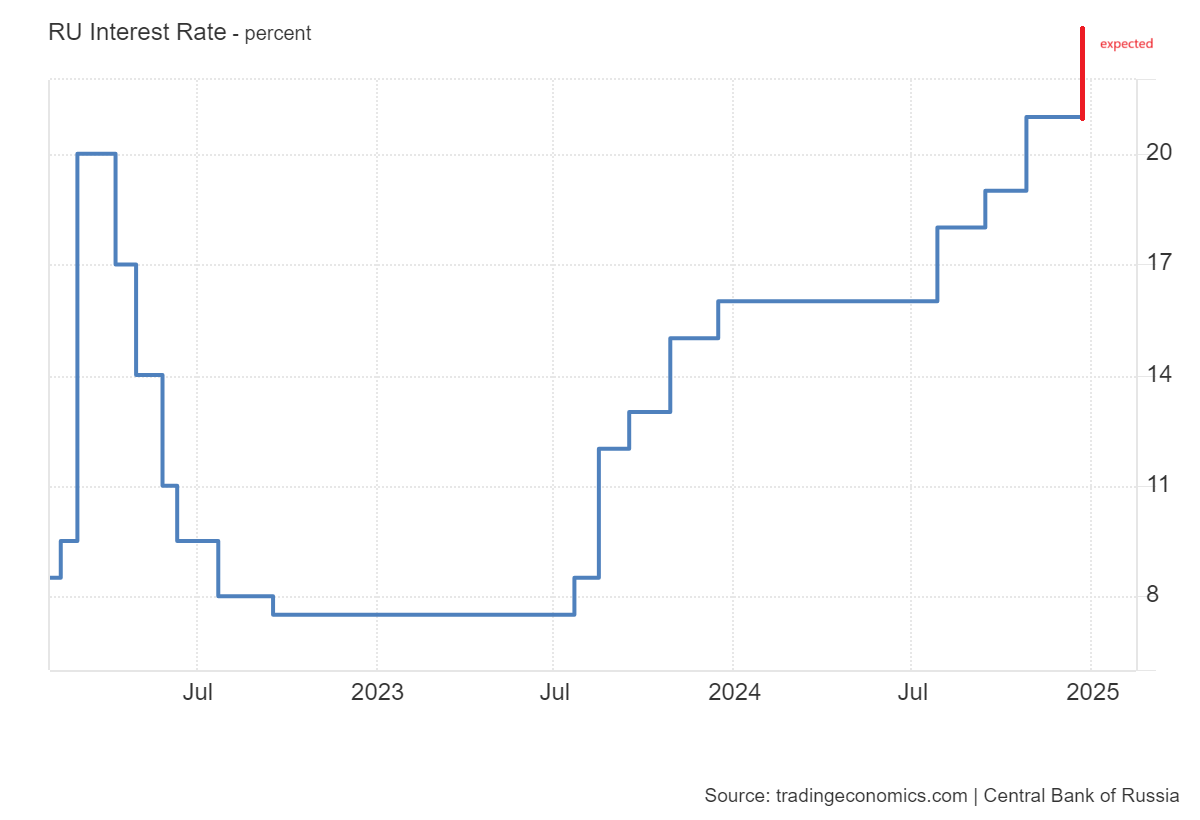

Nabiullina faces rising criticism within the Russian political and business elite ahead of the bank’s final rate-setting meeting of the year on Friday. Analysts forecast that policymakers may hike the key interest rate to 23% from 21% now, and possibly as high as 24% to curb persistent high inflation.

So, here’s the policy rate (red was what most people expected, an increase to 23%):

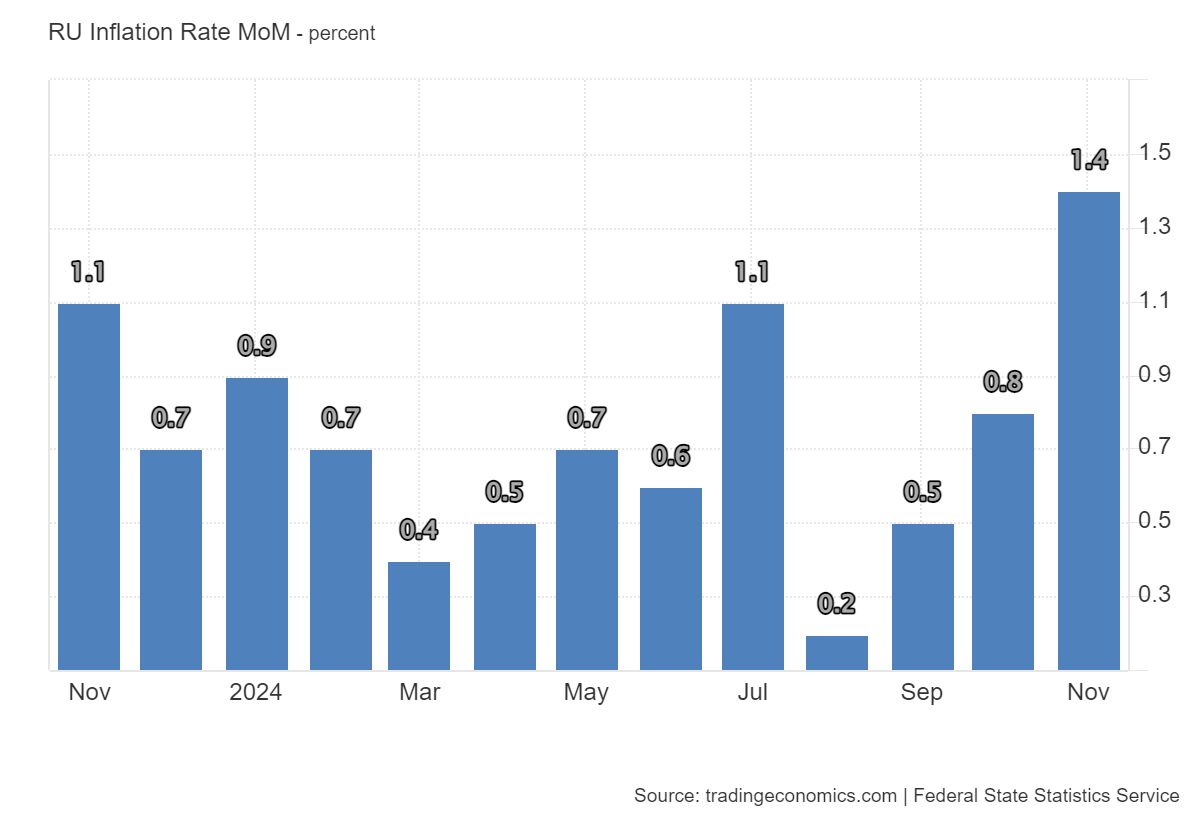

Here’s November official inflation (m/m):

November inflation at 1.4% m/m is 18.2% at an annualized rate (y/y is 8.9%).

If you were wondering what Romir’s FCMG indicated was inflation (see discussion here), you are out of luck, as the publication of this series has “ceased”.

So, as Mark Sobel noted, Russia’s economy looks a lot weaker than the reported (official) statistics indicate.