Over the last couple of years, the technology industry has become overwhelmingly enamored with artificial intelligence (AI). In particular, semiconductor stocks have witnessed newfound growth and investors can’t seem to get enough. While Nvidia is the biggest icon in the chip space right now, I see another company emerging as a superior investment over the next several years.

Let’s explore why Taiwan Semiconductor Manufacturing (NYSE: TSM) — commonly known as TSMC — might be the most lucrative opportunity of all at the intersection of AI and chipmaking.

Nvidia is in the driver’s seat, but…

Nvidia specializes in the development of advanced semiconductor chips called graphics processing units (GPUs). GPUs are a core component across many generative AI applications such as training large language models (LLMs).

Right now, Nvidia’s A100, H100, and new Blackwell GPUs are widely perceived as the best chips on the market. It’s no surprise to learn that Nvidia has an estimated 80% market share in the AI-powered chip space.

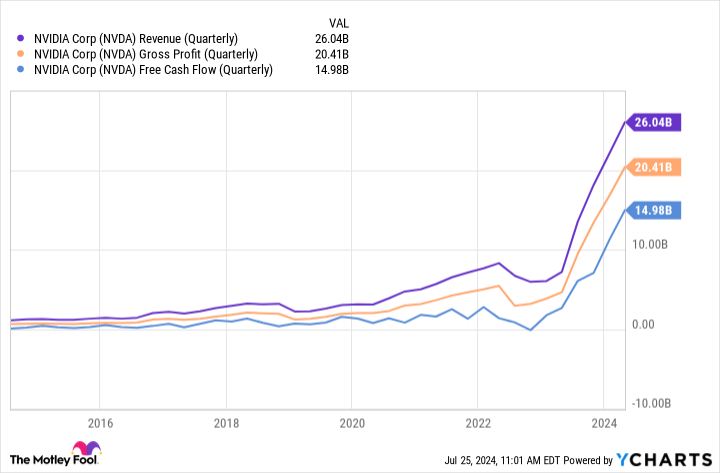

Given the outsize demand for Nvidia’s chips, the company has amassed significant pricing power over the competition. This dynamic has played a big role in Nvidia’s current growth, as seen in the chart below.

Nvidia stock is up a staggering 157% over the last year. While there is likely still money to be made owning the stock, investors should always be thinking about the longer term.

Taiwan Semiconductor is the engine powering the car

Considering the level of growth across Nvidia’s entire business, I think it’s safe to say that the company is the main driver in the chip race.

However, Taiwan Semiconductor is quietly playing an enormous role in the background, fueling the car. While Nvidia designs some of the world’s leading GPU processors, the company does not specialize in manufacturing. Rather, Nvidia outsources much of its manufacturing process to Taiwan Semiconductor.

TSMC operates advanced fabrication facilities where these chips are actually made. Moreover, Nvidia is just one of many leading semiconductor companies that rely on Taiwan Semiconductor. Aside from Nvidia, TSMC also makes chips for Advanced Micro Devices, Broadcom, Intel, Sony, Qualcomm, NXP Semiconductors, and Amazon.

Is Taiwan Semiconductor stock a good buy right now?

The obvious takeaway from some of the themes explored above is that Taiwan Semiconductor’s services are in high demand. But the more subtle opportunity that I see is that the company’s growth is really just beginning.

Nvidia faces stiff competition in the GPU and data center space, and I suspect the company’s current level of momentum will eventually begin to slow. As such, I wouldn’t be surprised to see Nvidia’s revenue and profit acceleration start to dip over the next several years.

Conversely, Taiwan Semiconductor works with a variety of companies across the broader chip industry. Given the breadth of TSMC’s customer base, I see the company as the engine powering many of these chip businesses. Therefore, I think demand for Taiwan Semiconductor’s manufacturing capabilities will continue to thrive for years to come.

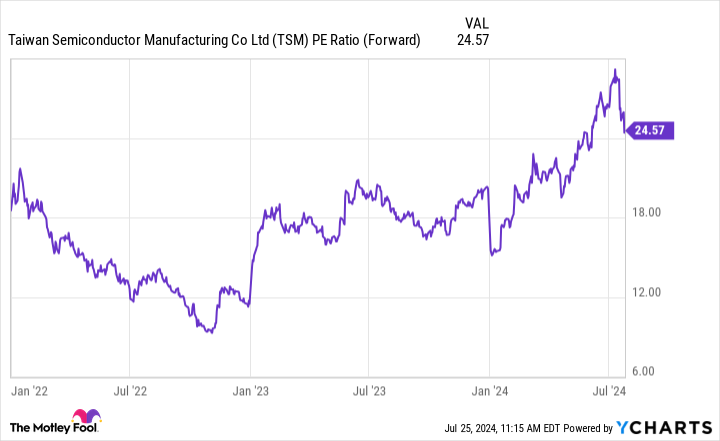

The one area to keep an eye on with Taiwan Semiconductor stock is its valuation. The company currently trades at a forward price-to-earnings (P/E) ratio of 24.6 — and per the chart above, there’s been some clear valuation expansion throughout much of 2024.

While this could suggest that some future growth is already baked into the stock, I wouldn’t get too caught up in trying to time the perfect moment to scoop up some shares.

Instead, I think using a dollar-cost averaging strategy over a long-term horizon is the optimal way to start building a position. To me, TSMC has enormous potential for the long haul and I don’t see the company losing momentum anytime soon. Investors who are looking for exposure to AI and the chip space may want to consider a position in Taiwan Semiconductor and prepare to hold for the long run.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $692,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom, Intel, and NXP Semiconductors and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

Prediction: This Artificial Intelligence (AI) Semiconductor Stock Will Be the Best Chip Company to Own Over the Next Decade (Hint: Not Nvidia) was originally published by The Motley Fool