Yves here. This article explains how, believe it or not, the US used to act as a moderating force in sovereign debt negotiations. Now that the US has ceded its role to private creditors, distressed borrowers are getting even rougher treatment.

By Martin Guzman, Professor, School of International and Public Affairs Columbia University; Professor of Money, Credit, and Banking National University of La Plata; Maia Colodenco, Director, Global Initiatives Division Suramericana Vision; and Anahí Wiedenbrüg, Researcher Latin American University for Social Sciences. Originally published at VoxEU

Many developing countries are currently facing debt distress, and sovereign debt restructurings often occur with delays. Emerging market debt composition has shifted away from Paris Club creditors and toward private lenders. This column argues that the asymmetry in coordination between private creditors and emerging market debtors has equity and efficiency implications. Private creditors are often better coordinated and able to extract power rents, suggesting that sovereign debt markets are not perfectly competitive. Historical examples such as the Cartagena Group in the 1980s provide useful examples of how borrower coordination can work in practice.

After two recent massive external shocks, the Covid-19 pandemic and the monetary tightening in advanced economies that followed the war in Ukraine, many developing economies are currently facing debt distress. Despite certain policy innovations since the pandemic, including the Common Framework for Debt Treatment beyond the Debt Service Suspension Initiative (DSSI), the International Debt Architecture (IDA) is still largely inadequate for supporting countries facing debt sustainability problems, and sovereign debt restructurings continue to occur ‘too little and too late’. The social consequences of sovereign debt crises transcend the interests of academics and policymakers. In a recent workshop at the Pontifical Academy of Social Sciences, Pope Francis called for the creation of a multinational mechanism for the resolution of sovereign debt crises (Pope Francis 2024; see also Guzman and Stiglitz 2016).

In this context, looking at past cases of heightened debt vulnerabilities can be revealing, as history sheds light on the particularities of the IDA’s current incentive structure. The Latin American Debt crisis of the 1980s is a case in point. Since then, much has changed in developing countries’ debt composition, including the increase in debt owed to non-Paris-Club creditors, and the increase in private, bonded debt as a significant source of financing, the latter now making up 47% of total debt in emerging markets and developing economies (EMDEs) (Colodenco et al. 2023).

The current approach to debt crisis resolution, and the US involvement therein, represents another significant change. During the Latin American debt crisis, the US sat in the driver’s seat of most of the debt deals reached, calling restructuring plans the ‘Baker Plan’ (after Treasury Secretary James Baker) and ‘Brady Plan’ (after Treasury Secretary Nicholas Brady). Former Federal Reserve Chairman Paul Volcker (1979-1987) left no room to doubt the US’s central role as a dealmaker, when boldly telling the New York Times, “I don’t know who you thought was making all those deals; I was.” (Makoff 2024, p.39) The US involvement was aligned with its interests: in an era of syndicated loans, the US banking system was systemically exposed to Latin American countries’ potential defaults.

A disclosed Central Intelligence Agency (CIA) report from 1986 also demonstrates the role that the US played in breaking up debtor coordination in the 1980s: Primarily motivated by “their lack of bargaining power with international banks,” according to the CIA report, foreign and finance ministers of 11 Latin American countries met in Cartagena, Colombia, in June 1984 to formally establish a group they hoped would help them strengthen their negotiating position vis-a-via international banks. According to our recent paper (Guzman et al. 2024), the Cartagena Group can be said to have shown potential to help debtors exert influence both ex-ante (positively impacting the IDA) and ex-post (contributing to more equitable and efficient restructuring outcomes). While the Cartagena Group was too short-lived to significantly influence the IDA, the Group’s activities showed the potential power of greater borrower coordination.

Today, the US is taking a more distant approach with respect to negotiations between distressed sovereign debtors and private creditors. After what many Republican congressmen and congresswoman felt was one bailout too many from the IMF to EMDE private creditors, the US Treasury under George W. Bush stated that it will let “the sovereign government and its creditors […] work out the terms on their own,” and have the IMF stand back from negotiations, without restructurings having to be carried out “without involvement of a central group or panel” (Taylor 2002).

The question this raises is whether the US’s retreat as the main dealmaker in the IDA has resulted in a more level playing field between EMDE debtors and their private creditors. In Guzman et al. (2024), we argue that it did not. We show that private creditors have had significant influence in shaping the current IDA. In the 1970s, banks in advanced economies succeeded in establishing mechanisms for coordination which endure until today. From the London Club to the International Capital Market Association and the Institute of International Finance, private creditors have succeeded establishing institutions to coordinate in order to advance their interests. No analogous degree of coordination exists among sovereign debtors largely because of the short-term incentives that debtor governments face.

In Guzman et al. (2024), we argue that this asymmetry in the degree of coordination between private creditors and EMDE debtors has equity and efficiency implications, both ex-ante and ex-post (see Table 1). The ex-ante dimension refers to private creditors’ capacity to shape the rules of the IDA, which govern the debt cycle. The ex-post dimension captures private creditors’ ability to influence the outcome and process of debt restructurings. Certain characteristics of the system have both equity and efficiency considerations at the same time – for instance, the 9% compensatory pre-judgment rate that defaulted bonds yield under New York State Law, now under discussion in the New York legislature, not only has distributional consequences in favour of creditors but also affects incentives for sovereign debt crisis resolution, implying inefficiencies.

Table 1 Private creditors’ capacity to shape the international debt architecture and restructurings, along equity and efficiency dimensions

| Equity | Efficiency | |

|---|---|---|

|

Ex-ante: Capacity to shape the rules of international debt architecture, which govern the debt cycle. |

The rules of the international debt architecture and domestic legislation from the main sovereign lending jurisdictions (mainly New York State and the City of London) reflect private creditors’ influence. Examples: Cross default and acceleration clauses; 9% compensatory pre-judgment interest rate for debt in arrears under New York State law (also leads to ex-post inefficiencies); repeal of Champerty under New York State law (which affects the balance of power between the debtor and bondholders as well as among cooperative and uncooperative bondholders, leading to ex-post inefficiencies). |

The norms of the international debt architecture are such that they do not always incentivise sustainable lending decisions under the expectation of bailouts in times of debt distress Examples: No definition of debt payment capacity in sovereign debt contracts that clarifies the broad circumstances that justify a ‘risk premium’; expectation of IMF bailouts. |

|

Ex-post: Capacity to influence the process and outcome of restructurings |

Outcome: Private creditors manage to extract rent from debtors (the ex-post return on a global portfolio of external sovereign bonds is larger than the ‘risk-free’ benchmark of UK or US government bonds; Meyer et al. 2022). Process: Private creditors tend to overpower sovereign debtors in their bargaining power during restructuring negotiations. |

Outcome: Delayed and insufficient restructurings of unsustainable sovereign debts with private creditors, which result in the incapacity to restore economic growth and the need for repeated restructurings with high probability. Process: The system sets incentives for dragging the restructuring process and granting insufficient relief for the purposes of restoring debt sustainability in order keep the possibility of upside returns if a positive shock materialises under incomplete contracts. |

The implications of this paper are wide-ranging, both for the IDA and debt restructuring outcomes in practice as well as for the evolution of the sovereign debt field in academia.

First, the history of how private creditors succeeded in shaping the international debt architecture suggests that coordination does not need to be perfect to be effective in influencing the underlying structures and environments in which restructurings take place. Past experiences of borrower coordination highlight the extent to which the mere existence of a debtors’ group altered the power dynamics between creditors and debtors, making these dynamics less unequal. The content of debtors’ coordination does not necessarily need to be radical, because the existence of the group itself can already shake up the power balance between creditors and borrowers, as well as the environment within which they operate.

Second, with regard to its academic contribution, our paper highlights the role of power in explaining sovereign debt outcomes. A central weakness in mainstream economic analysis of sovereign debt issues is the reliance on competitive equilibrium models. A defining feature of that model is the absence of any form of power. Ignoring power is not wise for the analysis of sovereign debt.

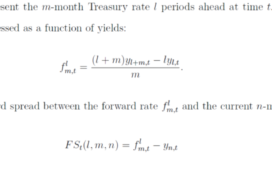

Most sovereign debt models assume that the arbitrage equation defines the cost of financing based on the premise that markets are competitive, and investors are risk-neutral—that is, they are indifferent between a loss and a gain of the same size. Any risk-premium in a transaction is a compensation for risk-taking. Under the conventional framework, we should observe that over time, the risk-premium compensates for the losses associated with defaults and restructurings in a risky environment—if investors are risk-neutral, they would demand a compensation for risk such that the expected return on a risky asset compensates for the opportunity cost given by the risk-free interest rate.

Recent evidence suggests, however, that this is not the case. Meyer et al. (2022) compiled a database of 266,000 monthly prices of foreign-currency government bonds traded in London and New York over 200 years (between 1815 and 2016), covering up to 91 countries. They found that the average real yearly ex-post return on a global portfolio of external sovereign bonds was 410 basis points higher than the ex-post returns for UK or US government bonds. These empirical findings strongly suggest that power rents exist: lending to riskier sovereigns is good business – even better business than lending to risk-free sovereigns.

Economics and political science need to study these themes more seriously, anchoring their work in the realities of the disproportionate power of international private lenders relative to developing nations.

See original post for references