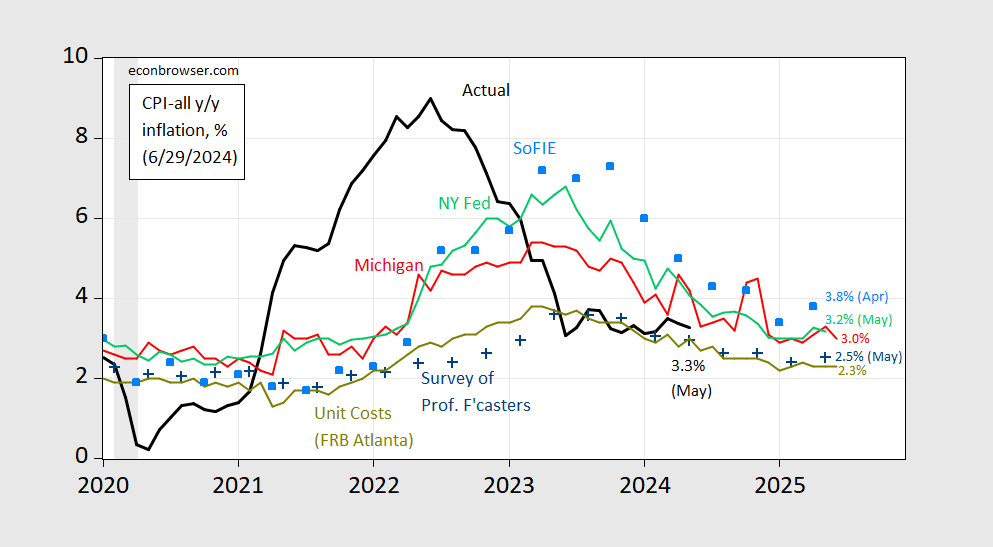

With Michigan final June survey out, we have this picture:

Figure 1: Year-on-year actual CPI inflation (bold black), and expected inflation from University of Michigan (red), NY Fed (light green), Survey of Professional Forecasters (blue +), Coibion-Gorodnichenko SoFIE mean (sky blue squares), and unit cost growth rate (chartreuse), all in %. Source: BLS, U.Michigan via FRED, Philadelphia Fed, Atlanta Fed, Cleveland Fed, and author’s calculations.

With CPI inflation running about 0.45 ppts faster than PCE inflation over the 1986-2024 period, we are close to the 2% PCE inflation target, at least insofar as the SPF is concerned, perhaps half a ppt from the Michigan survey (which historically has been upwardly biased in terms of forecast errors). Note that unit cost expectations (Atlanta Fed) do not suggest imminent cost push pressures.