There has been almost nothing but good news from Nvidia (NASDAQ: NVDA) over the past four quarters. Many investors might not recall that Nvidia’s revenue actually declined 13% year over year in the first quarter of its fiscal 2024 (which ended April 30, 2023).

Fast-forward to fiscal 2025’s first quarter, when revenue exploded higher by more than 260% year over year. In conjunction with that growth, the stock price has more than tripled in the past year, and investors continue to receive positive signs that the business will keep growing. The latest bullish news should have investors thinking Nvidia still has a long runway to increase sales in its data center segment.

AI spending soars

After such a huge jump in sales over the past year, some investors may be wondering if Nvidia’s revenue growth may have peaked. But recent news from its fellow tech company Broadcom suggests that the addressable market for artificial intelligence (AI) equipment is broad and still growing.

Broadcom supplies semiconductor solutions and infrastructure that AI requires. Its products include switching solutions, accelerators, server storage equipment, and on-site and cloud connectivity offerings.

Like Nvidia, Broadcom recently reported strong results for its latest quarter. Revenue from its AI-related products set a record, and made up a quarter of total sales as the top line increased by more than 40% year over year. But it’s something Broadcom CEO Hock Tan said during management’s conference call with investors that should make Nvidia investors more bullish.

Tan admitted that Broadcom wasn’t going to try to compete with Nvidia in its leading position as a supplier of graphics processing units (GPUs) to provide AI systems with computing power. He acknowledged, however, that Nvidia was increasingly becoming a competitor to Broadcom on the networking side. Nvidia’s next-generation Blackwell platform is just the first step. Speaking of Nvidia, Tan noted, “They are trying to create a platform that is probably end-to-end very integrated.”

That should make Nvidia investors confident that the AI spending being directed to the company can continue to grow for the foreseeable future.

What’s next for Nvidia?

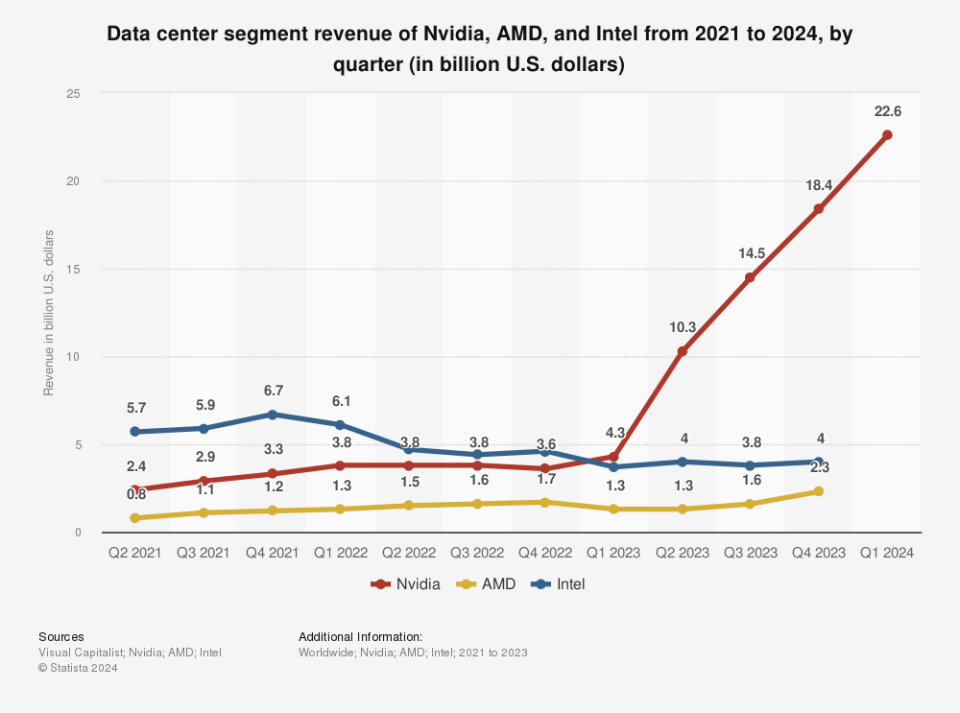

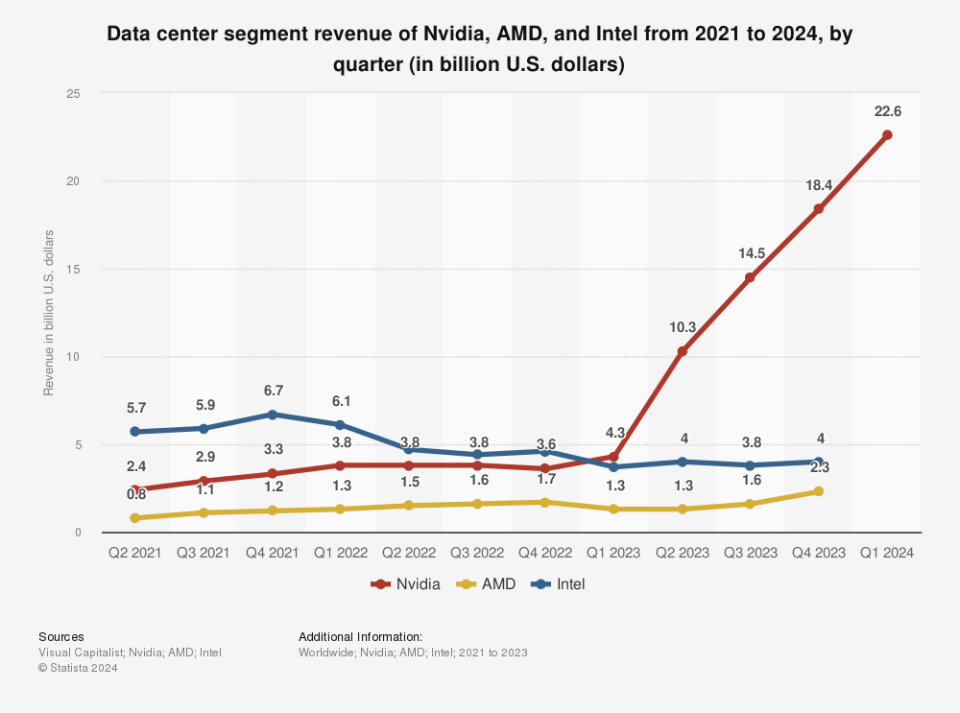

It’s notable how much Nvidia has already dominated its competitors in reaping the investments that companies are making in data center computing power.

Now consider that there is yet another segment of Nvidia’s business with the potential to take a similar growth trajectory. Nvidia’s automotive and robotics segment has more than doubled its revenues over the last two years. While its automotive segment still contributes only a minor portion of total sales, self-driving technology is advancing and numerous automakers are already Nvidia customers.

Several Chinese electric vehicle (EV) makers, autonomous driving technology companies, and global automakers are using Nvidia’s Drive platforms. In its latest earnings report, Nvidia also noted that “an array of partners are using Nvidia generative AI technologies to transform in-vehicle experiences.”

Most recently, U.S.-based EV maker Rivian Automotive said it would be using Nvidia’s Drive Orin processors to increase computing power and improve the performance of its R1 platform vehicles.

Don’t ignore valuation

While the potential remains immense for Nvidia to grow sales and earnings, investors shouldn’t ignore the fact that some of that expected growth is already baked into the company’s current valuation. Some investors believe the stock has already risen beyond a reasonable valuation and is due for a major correction.

While earnings are up by more than 600% so far this year, the stock followed a similar trajectory. With a forward price-to-earnings ratio of about 50 and a price-to-sales ratio of nearly 30 based on this year’s projected revenue, Nvidia will need to deliver significantly more growth before the stock looks like a bargain again.

While there are realistic paths for that to occur, the stock’s rise could pause as the market waits to see what actually happens. The stock could even dip. Aggressive investors still might want to have Nvidia in their portfolios based on both its past successes and the potential for more. However, after its meteoric rise, this stock is a good candidate to buy in stages rather than deploying all the funds you plan to commit to it all at once.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $830,777!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Howard Smith has positions in Nvidia and Rivian Automotive. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Nvidia Investors Just Got Some Bullish News was originally published by The Motley Fool