The car industry ex China is reeling, between conventional car markers having trouble adapting to the EV/hybrid world (where EV new entrants have considerable advantages via the vehicles’ much lower mechanical complexity), European manufacturers being whacked by the new normal of much higher energy prices, and Trump tariffs disrupting supply chains to the critically important US market. We’ll examine with the dire straits at Nissan, once a bedrock maker of solid mid-range cars (I have some fondness for Nissan; the first car I drove regularly was my parents’ second car, a lime green Datsun), as a new window into these accelerating problems

Readers are invited to pile on, since I am not a vehicle maven and are likely quite a few issues from the customer or product/product line end that we’ll skip over in getting to the broad outlines of the precipitous decline of a once-storied company. The fall of Nissan, as far as I can tell, does not have a simple though line, unlike Boeing (“Great engineering company merges with defense contractor run by beancounters and financiers, putting the money men in charge, who proceed to cost cut and disinvest into bad products and performance”).

Regulars no doubt have noticed our pointing to unheard of factory closings by Volkswagen in Germany, a direct casualty of the decision to cut the EU off from cheap Russian energy as much as possible and a poster child of the blowback to European manufacturers. But before we turn to Nissan, a new story at the Financial Times shows the extent to which other established Western carmarkers are struggling. From Stellantis chief executive Carlos Tavares resigns:

Stellantis chief executive Carlos Tavares has resigned following a sharp decline in financial performance at the world’s fourth-largest carmaker, marking an abrupt exit for one of the automotive industry’s most high-profile leaders.

In a statement on Sunday, Stellantis, which owns the Peugeot, Fiat and Jeep brands, said the company’s board accepted the resignation of Tavares…

People familiar with Tavares’ departure said there were increasing tensions between him and other Stellantis board members on how to put the company back on track following a steep decline in reported profits in 2024 due to slumping sales in the US and Europe. Stellantis’ shares have fallen 43 per cent this year.

Mind you, Stellanis is not in serious financial trouble. The pink paper notes that even with negative 2024 cash flow on the order of €5 billion to €10 billion, still has a very solid balance sheet.1

Nissan as of early November initiated an emergency turnaround plan after a second cut to its 2024 profit forecasts. But the coverage in major outlets like the Financial Times described the deep cuts planned without even mentioning the impending cash crunch (might the reason be that the Financial Times is Japanese owned?). From its account then:

Nissan has launched an emergency turnaround plan that includes 9,000 job losses and a voluntary 50 per cent pay cut for chief executive Makoto Uchida after unveiling it had fallen to a quarterly loss.

Japan’s third-largest carmaker said it would slash global production capacity by 20 per cent and cut costs by ¥400bn ($2.6bn). It downgraded its full-year profit forecast for the second time this year, this time by 70 per cent.

The crisis at Nissan came as it failed to counter a slowdown in global electric vehicle sales with a strong hybrid offering, which has helped rivals Toyota and Honda….

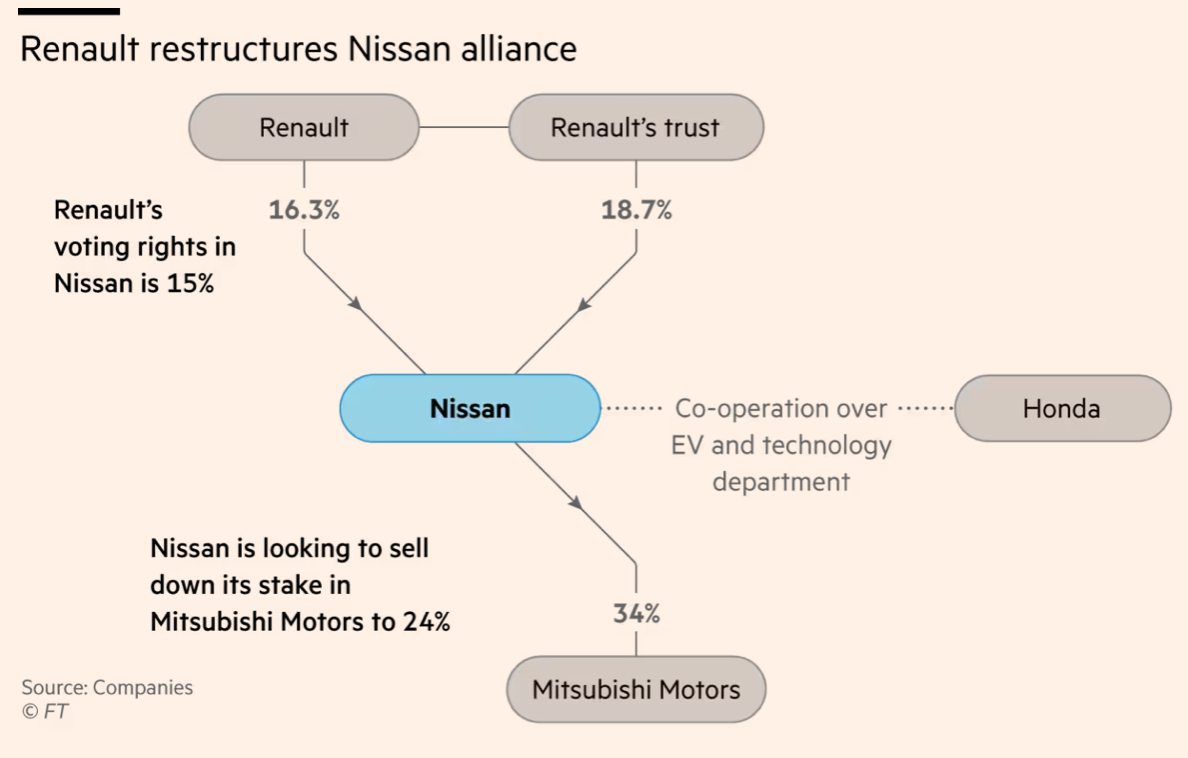

As part of the measures, Nissan also cut its stake in alliance partner Mitsubishi Motors on Thursday from 34 per cent to 24 per cent to bolster its balance sheet.

Nissan recently turned to a partnership with Honda to survive the competition after a long-standing alliance with France’s Renault significantly weakened in recent years. The two Japanese companies plan to roll out a new electric vehicle before the end of the decade and jointly develop software to go toe-to-toe with Chinese rivals.

This additional tidbit from the Guardian account on the same date:

The company said it was facing a severe situation as it battled with higher costs for sales and in its factories, as well as having too many cars with dealers in the US in particular, which can force the company to give steep discounts.

If “severe situation” is an exact translation (or what was said in English, since Japanese executives tend to use Japanese formulations in their spoken English), that is Stage 4 disease level dire.

And indeed, less than two weeks later, keying off the November 7 presentation, from Nikkei Asia Nissan bleeds cash as sales slump and expenses mount:

The company’s cash flows reflect its struggles. Operating cash flow for its automotive business in April-September came to minus 234 billion yen. In addition to slow sales, the piling up of inventory has been among the contributing factors.

Nissan’s cash flow for capital investments for the period reached minus 214.3 billion yen. Combined, overall free cash flow totaled minus 448.3 billion yen. In the first half of the previous fiscal year, the company saw a positive free cash flow of 193.9 billion yen.

Compared with other April-September periods, the cash flow deficit is close to the 504.6 billion yen recorded in 2020, during the coronavirus pandemic. It exceeds the minus 414.9 billion yen recorded in 2019, when Nissan announced a global downsizing and laid off about 12,500 employees.

Due mainly to the deterioration of its free cash flow, Nissan’s cash and equivalents on hand stood at about 1.4 trillion yen at the end of September, down 575.9 billion yen from the end of March. But for now, the company’s cash on hand itself is still sizeable, so “the financing risk is minor,” said Takao Matsuzaka, chief analyst at Daiwa Securities.

Concerns about raising funds in the medium-to-long term are emerging, due in part to a decline in creditworthiness. On Nov. 8, S&P Global said that if the company cannot stabilize its earnings, downward pressure on its creditworthiness will intensify.

S&P has given Nissan a long-term issuer rating of BB+, below investment grade, while Japan’s Rating and Investment Information classifies it as A and Moody’s ranks it at Baa3, the lowest of its investment-grade ratings.

More recent statements by company insiders belie the cheery take by the Daiwa analyst, particularly in light of the junk/borderline junk and deteriorating credit outlook. Nikkei describes in some detail how the higher interest rate environment versus bond refinancings needed starting in March 2026 are looming. It then continues:

Another concern is that operating and investing cash flows are likely to continue to be negative. Although the company aims to reduce fixed and variable costs by 400 billion yen per year by cutting jobs and production, it has few prospects for new products that would significantly improve the balance of payments in the near future.

A November 26 Financial Times story similarly signaled distress. From Nissan seeks anchor investor to help it through make-or-break 12 months. The new source of woes is that the Nissan-Renault tie-up, which a headline search shows have been wobbly for a while, is now moving towards a breakup:

Nissan is searching for an anchor investor to help it survive a make-or-break year as longtime partner Renault sells down its holding in the crisis-hit Japanese carmaker.

Two people with knowledge of the talks said Nissan was seeking a long-term, steady shareholder such as a bank or insurance group to replace some of Renault’s equity holding, as Nissan finalises the terms of its new electric vehicle partnership with arch-rival Honda.

“We have 12 or 14 months to survive,” said a senior official close to Nissan.

The article floats the cheery idea that perhaps Honda will take Renault out of its stake, since the two have increased their business collaboration. Hardcore car sites dismiss the notion as not not in Honda’s interest, both by virtue of the sheer size of the investment and Nissan’s cash-bleeding state. Of course, it is possible that the Japanese government could pressure Honda into making a rescue (but why should a Japanese car maker go that far in accommodating a European one?). That might not be so crazy if Nissan got some bond financing guarantees, as did Chrysler in its bailout. Another possibility is Japanese insurers are muscled into helping a deal, reducing the load on a Honda.

One has to think that ultimately Nissan is too big to fail from a Japanese perspective, as the US Big Three were after the global financial crisis. Remember what is at risk is not just Nissan’s direct employment but also that of its many subcontractors. But I welcome input from any readers plugged into current views in Japan.

Note that aside from the rate of the cash burn, circling vultures are adding to the sense of urgency. Again from the Financial Times:

But the search for an anchor investor has become even more critical with the turmoil at Nissan attracting investments from Singapore-based Effissimo Capital Management and Hong Kong’s Oasis Management, two of the most high-profile activists in Asia whose campaigns have previously targeted the likes of Toshiba and Nintendo.

Interestingly, the Daily Mail has just published two good new pieces on Nissan going into a financial nosedive. Nissan is of interest due to its manufacturing plant in Sunderland. While a big chunk of the story re-reports the Financial Times, Major car manufacturer ‘on the brink of collapse’ as official claims company has ‘just 12 months to survive,’ it identified additional stressors:

Nissan also last month called for urgent action to avoid car makers being penalised for the slowdown in electric vehicle sales in the UK which the firm blamed on outdated targets in the country’s Zero Emissions Vehicles Mandate.

The mandate forces firms to increase the proportion of EVs they sell each year until a total ban on new petrol and diesel motors in 2030.

This year, EVs must make up 22 per cent of a firm’s car sales and 10 per cent of van sales, with the threshold rising annually and makers facing a £15,000 fine for every sale beyond it.

Labour’s 2030 target is five years earlier than that set by former Tory prime minister Rishi Sunak.

And Nissan said that missing the target would lead to significant fines for manufacturers unless credits are purchased from EV-only brands – none of which manufacture in the UK….

The Society of Motor Manufacturers and Traders has voiced fears that the pace of the transition could hit car makers as demand for zero-emission vehicles ‘failed to meet ambition’.

The organisation forecasts a slowdown in consumer demand meant EV sales would only reach 18.5 per cent of the total market, against the 2024 ZEV Mandate target of 22 per cent.

The newer Daily Mail account gave a bit more detail on some of Nissan’s emergency responses:

Nissan’s head of manufacturing Hideyuki Sakamoto told a news conference last month: ‘Globally, we currently have 25 vehicle production lines. Our current plan is to reduce the operational maximum capacity of these 25 lines by 20 per cent.

‘One specific method for this is to change the line speed and shift patterns, thereby increasing the efficiency of operational personnel.’

This video, which gives a short-form look at Nissan’s product and sales problems in many key markets, takes issue with the idea that production cuts are a solution. Or to echo the language uses above, that Nissan can achieve efficiencies with so much investment in fixed production lines. As we have said repeatedly, direct factory labor is a small part of total car costs, estimated typically at 3%. So if you cut volumes, you will don’t do much to reduce variable costs while fully loaded costs can (will?) be higher on a unit basis.

Other useful topics are the consequences of Nissan not having a hybrid for the US market, the damage done by a big 2023 year end inventory overhang, and China eating Nissan’s lunch in Southeast Asia, with Thailand as the poster child (loss of 80% of dealer employees):

The quick takes on Nissan are much less kind. If things are this bad on the product side, it’s not easy to see how Nissan can be salvaged:

Nissan has 12-14 months to survive and they attempt to find a Hail Mary investor to save the company.

Recent Chinese brands have overtaken Nissan sales in many Asian countries, which Nissan used to dominate.

Nissan has spent the last 10 years making garbage/unreliable cars and… pic.twitter.com/wlksHBHSAy

— Edward G. 🇺🇸🦅 (@realEdwardG) November 28, 2024

Again, we’ll see how much Nissan is serving as an early warning of how bad things can get at other automaker soon enough. And don’t forget that the Trump tariffs are set to be a big spanner as far as teh critically important US market is concerned.

____

1 This section from a Magic Markets podcast gives an idea of some of Stellantis’ tsuris:

If we move on quickly to Stellantis, the polony as we like to call it, all of the brands that sort of don’t really belong together. But Stellantis is trying their best to bring them together by building platforms that all these brands then share. Unfortunately, what that does is it somewhat dilutes the brand value and the heritage.

South America was their only good news story. Much like at Volkswagen, which is why I said it’s a bit odd. In Q3, South America was up 14% and the rest was just a mess. North America down 36%, which is ridiculous. Stellantis cannot sell Jeeps. It’s just incredible. Europe down 17%, so they can’t sell Citrons and Peugeot and Alfas and Fiats in Europe. It’s not good. Alas, my beloved Maserati, my favorite car brand of all, down 60% in terms of unit sales. But the product range is just really silly at the moment. So it’s no real surprise. Stellantis has pretty much been making a mess of almost everything they’ve touched for a while. No good news there then.