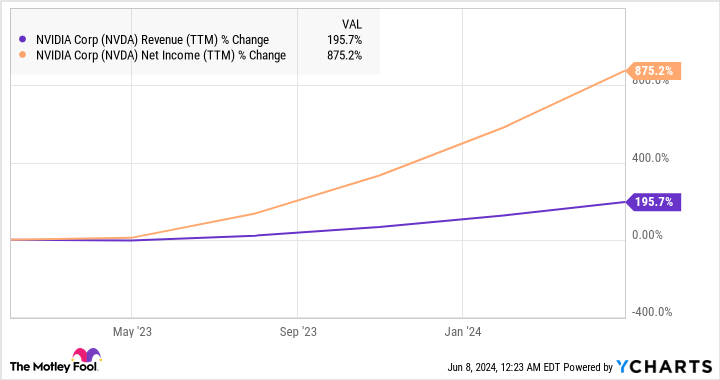

The stock market has handsomely rewarded Nvidia‘s dominant position in artificial intelligence (AI) chips with stunning gains of more than 222% in the past year. And the company has justified this red-hot rally with terrific growth quarter after quarter.

Such phenomenal growth in Nvidia’s revenue and earnings comes down to the fact that it controls a whopping 98% share of the AI chip market. Market research firm Gartner estimates that the AI semiconductor market could generate $71 billion in revenue in 2024. If Nvidia manages to keep its stranglehold over this market, it could witness a huge jump in its data center revenue from the previous fiscal year’s levels of $47.5 billion.

So there is a solid chance that Nvidia could continue to head higher and remain a top AI growth stock going forward. However, if you missed Nvidia’s terrific run-up in the past year and are worried about the stock’s valuation, there is a solid alternative to buy: ASML Holding (NASDAQ: ASML).

Let’s look at the reasons ASML is one of the best AI stocks to buy right now.

ASML Holding’s machines have made Nvidia’s AI dominance possible

ASML’s extreme ultraviolet (EUV) lithography machines may be the biggest reason Nvidia has dominated the AI chip market. These machines allow Nvidia’s foundry partner, Taiwan Semiconductor Manufacturing Company, also known as TSMC, to manufacture chips using advanced, smaller process nodes.

According to ASML, “chipmakers use our NXE systems to print the highly complex foundation layers of their 7 nm, 5 nm, and 3 nm nodes.” Nvidia’s massively popular H100 AI GPU (graphics processing unit) is manufactured on a 5-nanometer (nm) process node, while the upcoming Blackwell generation of chips is reportedly going to be manufactured on a 4nm process from TSMC.

Additionally, Nvidia’s recently announced Rubin chips, which are expected to be launched in late 2025, are expected to be manufactured using a 3nm process. Not surprisingly, chipmakers and foundries are lining up to buy ASML’s advanced chipmaking equipment to fulfill robust AI-driven demand. The Dutch semiconductor equipment manufacturer will ship its latest EUV machine to Intel and TSMC later this year.

Priced at a whopping $380 million, this machine will allow ASML’s customers to manufacture chips that will be 1.7 times smaller than the previous generation of machines. These chips are expected to be deployed for AI-related workloads. The transistors are more closely packed together on chips manufactured using smaller process nodes, allowing electrons to move faster and resulting in more computing power. Also, as the electrons have to travel a smaller distance, the heat generated in these advanced chips is lower and they are more power efficient.

Meanwhile, chipmakers’ investments to expand their production capacities will be a tailwind for ASML. For instance, a TSMC-backed chipmaker recently announced that it will invest $7.8 billion in a new chip plant in Singapore. Moreover, the growing demand for AI chips is likely to encourage chipmakers to buy more EUV lithography equipment.

Data Bridge Market Research estimates that the global EUV lithography market could generate $40.5 billion in revenue in 2031 as compared to $9.4 billion last year. Given that ASML has a monopolistic position in the EUV lithography market, the company seems in a position to keep growing at a healthy pace over the long run.

The company’s growth is set to accelerate

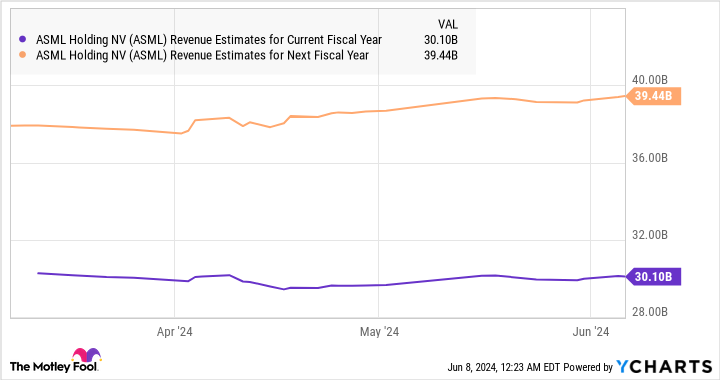

ASML finished 2023 with revenue of 27.6 billion euros, an increase of 30% from the previous year. The company is expecting a similar level of revenue this year as the semiconductor industry’s revenue fell in 2023, prompting ASML’s customers to hold off on new equipment purchases this year as they work through the bottom.

ASML is expecting to return to growth from 2025, and its huge order backlog of 38 billion euros is going to play a key role in driving that turnaround. The following chart indicates that ASML’s top line could shoot up by 30% next year.

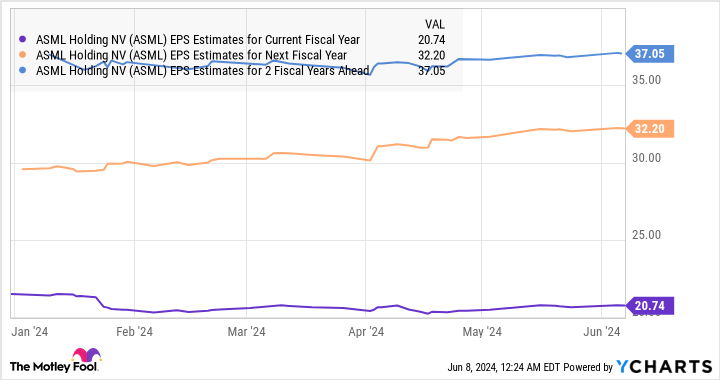

Analysts are expecting the company to deliver healthy bottom-line growth as well, thanks to the impressive momentum that its business is expected to gain.

Shares of ASML have gained 44% in the past year, which is lower than the 52% gains clocked by the PHLX Semiconductor Sector index. However, the situation could change going forward thanks to catalysts such as AI that could drive stronger demand for the company’s offerings.

With ASML trading at 14 times sales right now, which is a big discount to Nvidia’s sales multiple of 38, investors can get their hands on this AI stock at a relatively attractive valuation. Consider grabbing this opportunity before ASML stock starts soaring based on the critical role it’s playing in the AI chip market.

Should you invest $1,000 in ASML right now?

Before you buy stock in ASML, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ASML wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,690!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Gartner and Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

Missed Out on Nvidia’s Run-Up? My Best Artificial Intelligence (AI) Stock to Buy and Hold was originally published by The Motley Fool