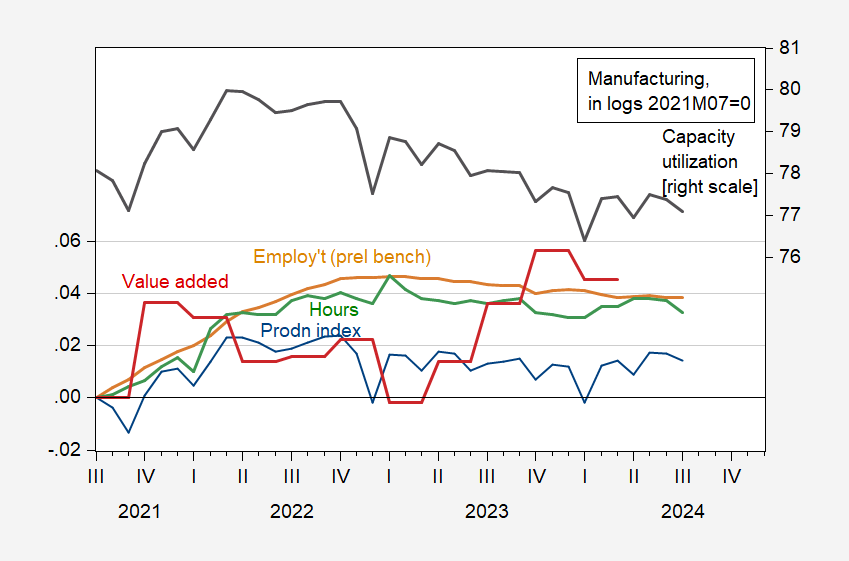

Preliminary benchmark revision takes down March employment by 0.9%. Here’s a picture of various series relevant to the manufacturing sector.

Figure 1: Manufacturing production (blue, left scale), implied employment from preliminary benchmark (tan, left scale), aggregate hours (green, left scale), and real valued added (red), all in logs, 2007M12=0, and capacity utilization in manufacturing, in % (black, right scale). NBER defined peak-to-trough recession dates shaded gray. Note: 2007M12 is NBER’s business cycle peak. Source: BLS via FRED, Federal Reserve, BLS, BEA via FRED, NBER.

With employment and production essentially flat (but below end-2023 peaks), I’d be hard pressed to say manufacturing is in recession, but here recession is in the eye of the beholder (given there’s not a technical definition of recession for a subsector).

Note that GS believes the aggregate (NFP) benchmark revision of -818K is too large; rather, theyu believe that given less than total coverage of QCEW and likely revisions, the aggregate revision is more like -300K. This would suggest a smaller downward revision in manufacturing employment.