This is Naked Capitalism fundraising week. 819 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, PayPal, Clover, or Wise. Read about why we’re doing this fundraiser, what we’ve accomplished in the last year, and our current goal, karōshi prevention.

As readers who have been following the very long running story of the litigation against fund management giants KKR and Blackstone and other relevant parties, including importantly their leaders, such as Henry Kravis and Steve Schwarzman, the defendants have so far kept what started out as a 2017 suit from getting to discovery. The very high level version of the allegations is that KKR and Blackstone violated Kentucky’s very strong fiduciary duty obligations in misrepresenting the potential risk and returns of customized hedge funds of funds they set up and managed for Kentucky Retirement Systems, the state’s public pension funds.

We’d pointed out from literally the very first post on this site that hedge funds were a poor investment option, particularly for public pension funds, since they don’t outperform traditional investment strategies. Hedge funds of funds do even worse by having a second layer of fees (as in the investor is paying not just the hedge fund fees but also a second set of fees for the manager who chooses a group of hedge funds).

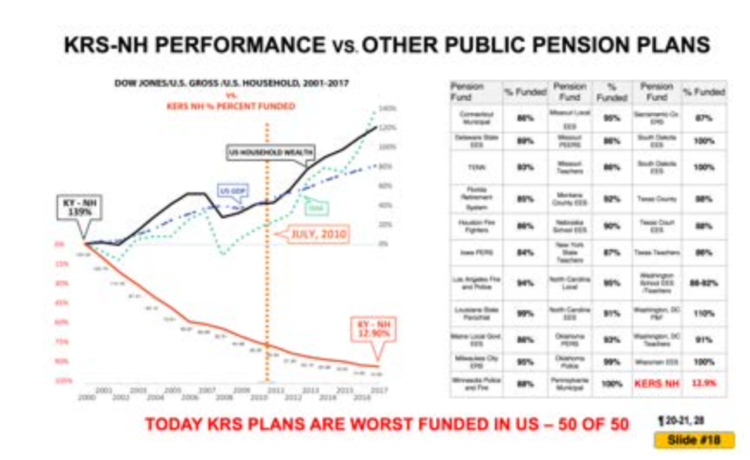

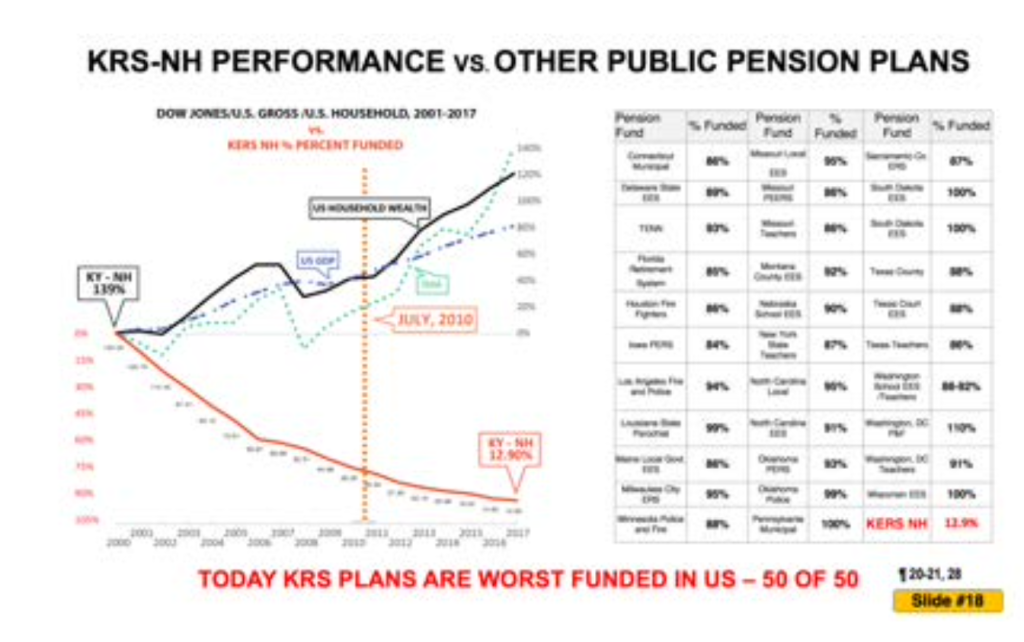

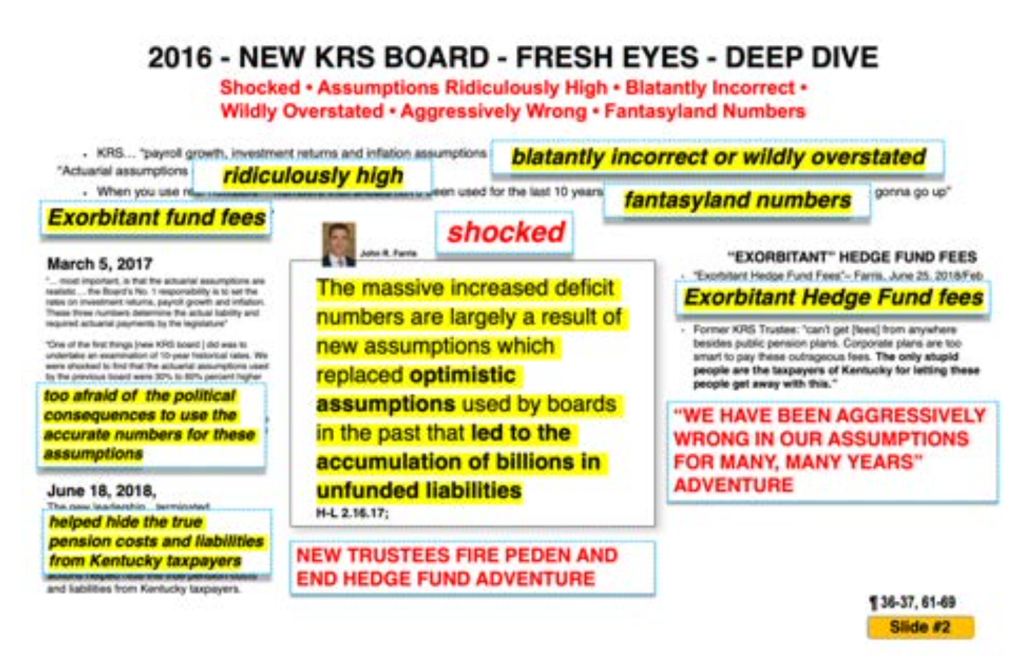

Kentucky Retirement Systems had originally performed a study when it first realized the severity of its underfunding problem, which remains on of the worst in the US. Yet a few years later, it nevertheless decided to take the plunge, apparently at least in part due to the tender ministration of consultants who were not independent (a fiduciary duty violation). These funds, with cute names like Daniel Boone, were sold as the implausible combination of low risk and high return, managed to underperform so severely that holding cash in a bank account would have provided better returns. Yet the managers collected hundreds of millions in fees.

Our status report comes in the form of two court filings embedded below, the response of the plaintiffs to an appeals court filing and the underlying writ by the defendants. But let’s first discuss, again at a high level, how things got here.

The original filing, Mayberry v. KKR, was a derivative suit. The most common type of derivative suit is one filed by shareholders, to assert rights actually held by management and/or the board who are failing to use them to protect shareholder interests (the plaintiffs have to demonstrate “demand futility” as in the parties who should have asserted their rights have not or can be expected never to despite efforts of the plaintiffs). The original suit wound up at the Kentucky Supreme Court and was dismissed due to lack of standing as a result of unfavorable precedents after the initial suit was filed. The standard had become that members of a defined benefit could not be deemed to have suffered a particularized (concrete) loss until the pension fund has actually paid them less than the plan was obligated to provide. Mere losses to the fund that seem certain to result in an eventual shortfall did not cut it.

But the plaintiffs’ counsel reconstituted the suit and achieved a major win in May. From our post then:

It now seems like an eternity ago, but the latest big play in the long-running Kentucky Retirement Systems case, with the centerpiece a deeply underfunded pension fund reaching for return, was the Kentucky Attorney General Daniel Cameron rousing himself to enter the case on behalf of allegedly all potential plaintiffs. This was despite the previous AG having filed a motion supporting the effort by the legal team lead by Michelle Lerach, with her formidable and controversial husband, one-time top securities litigator Bill Lerach, and a cast of other able lawyers to obtain damages from some of the biggest names in finance, KKR, Blackstone, PAAMCO (a one-time affiliate of bond giant Pimco), their top execs (!!!) and many co-conspirators and enablers. The basis for action was over fiduciary duty breaches and other bad conduct in the sale and management of custom hedge funds….

For those of you following this saga, the case was originally Mayberry v. KKR….

Mayberry v. KKR then went to the Kentucky Supreme Court, which tossed it due to lack of standing as a result of an intervening Federal appeals court and a Supreme Court decisions that took place after the initial filing….

In the case of intervening decisions, plaintiffs are usually allowed to replead their cases.

But then came another effort to throw a spanner. As it became clear that the plaintiffs were not going to go away easily even after their Kentucky Supreme Court defeat, Attorney General Daniel Cameron got out of bed. In July 2020, he intervened on behalf of the plaintiffs, shamelessly reworked the original plaintiffs’ filings (this was done with the cooperation of one of the original lead attorneys. Anne Oldfather, whose loyalties were seen as questionable from the outset). He later asserted he would fully occupy the field, as in represent the state (which is backstopping the funds), Kentucky Retirement Systems, and its beneficiaries. Kentucky Retirement Systems bleated, pointing out it was one of the state agencies that got to pick its own counsel and had not authorized Cameron to act on its behalf.

The core legal team sought to file a reconstituted case, which kept some of the original plaintiffs, the ones who had “hybrid” so-called “Tier 3” plans (both defined benefit and defined contribution components) and added other Tier 3 plaintiffs. Defined contribution plan members have a substantial body of precedent allowing them to sue over losses to their plan assets, even if they have not started withdrawing funds. That solved the earlier standing problem. Admittedly these beneficiaries represent a much smaller amount of total Kentucky Retirement System funds, but the fact of harm was presumably enough to get to discovery.

At the end of December 2020, the trial court court rejected nearly all efforts to replead the case except the above mentioned Tier 3 claims (now called Taylor v. KKR)…

The defendants then successfully sued to have [trial court judge Philip] Shepherd removed from the case because he had touted his tough position on the Mayberry v. KKR cases in his re-election campaign (Shepherd recused himself in May 2022). The defendants no doubt believed a more conservative judge would prove to their advantage. It appears not to have occurred to them that a competent judge, regardless of his ideological bent, would not blindly accept what the coastal

con artistsfinanciers were selling out of deference to their status.Judge [Thomas] Wingate has finally issued orders on the extremely large number of motions to dismiss, nearly all by differently-situated defendants. The magnitude of that task, plus getting his arms around the very very large body of past filings, presumably accounted for the substantial delay. The compact orders are well reasoned. They seem even more credible by rejecting the idea that the Attorney General could properly represent the Tier 3 plaintiffs, and denying the motions to dismiss of the hugely powerful defendants, KKR, Blackstone, PAAMCO, and private equity kingpins Henry Kravis, George Roberts, Steve Schwarzman, and Tomlinson Hill personally.

Needless to say, the fact that the Tier 3 plaintiffs have gotten a discovery green light further complicated the Attorney General’s life….who by the way is no longer Daniel Cameron, who left office earlier this year, leaving the hot mess of this not-completed gambit on his successor, Republican Russell Coleman’s desk…

And finally keep in mind that everyone close to the case understands what the real leverage is. It’s exposing the chicanery of the big ticket, supposedly reputable private equity leaders and getting deeply into the economic and commercial relationship of their top leaders to their firms.

Now to the latest developments. The defendants went immediately to the appeals court even though there had been no trial court decision. They had also done that with original Mayberry v. KKR filing.

Normally, what is called an interlocutory appeal, which is an appeal made before the underlying court has heard the case and issued its decision, is as far as I can tell, generally looked upon dimly in most US courts. However, Kentucky procedure provides what appears to be an unrestricted right to try that gambit. You can find it under Rules of Appellate Procedure and is referred to as “RAP 60” in the filings below.

The plaintiffs (who are now defendants in this appeal, but we will continue to call them plaintiffs, or Real Parties in Interest) pick their way though the RAP 60 filing in the first embedded document below. You can see what a confection of motions practice this case continues to be. One of the tactics in the filing by the KKR and its fellow travelers is to repeatedly misrepresent prior rulings and facts of the case. I hope some of you will read through the filing, but he’s a sampling of how the Tier 3 plaintiff counter the bogus claims made by the hedge fund big boys:

The Attorney General can adequately represent the Tier 3 plaintiffs. No, he can’t. Any recoveries by him go to the Kentucky general fund, while recoveries by the Tier 3 plaintiffs would go to the Kentucky Retirement Systems.

The Tier 3 plaintiffs are in a defined benefit plan, and hence per the earlier rulings have no business being back in court. No, their plan has a defined benefit component and a defined contribution component, and they have suffered losses in the defined contribution part as a result of the hedgies’ poor management.

The Tier 3 case is a derivative case. No, it asserts direct claims.

Blackstone, KKR and their executives argue they will suffer irreparable harm if the case proceeds. This is a ludicrous assertion given the very high bar for “irreparable harm”. In fact, KKR and Blackstone have both said in publid filings that no outstanding suit will have a material impact on them. As for the named defendants personally, their staggering wealth (described in the filing) argues otherwise.

And let us not forget that these very determined efforts to prevent discovery are to block digging into the details behind bad facts like these:

Now, sadly, the rich fund managers may get lucky and get assigned to an appeals court judge who due to lack of patience with the fact and legal arguments may come down on their side. But Judge Wingate wrote very careful and detailed ruling to try to forestall that sort of thing. So stay tuned.

00 ResponsetoWritPetition-compressed

00 Brief only (2024-07-03) Defs’ Tier 3 Writ Petition with Exhibits