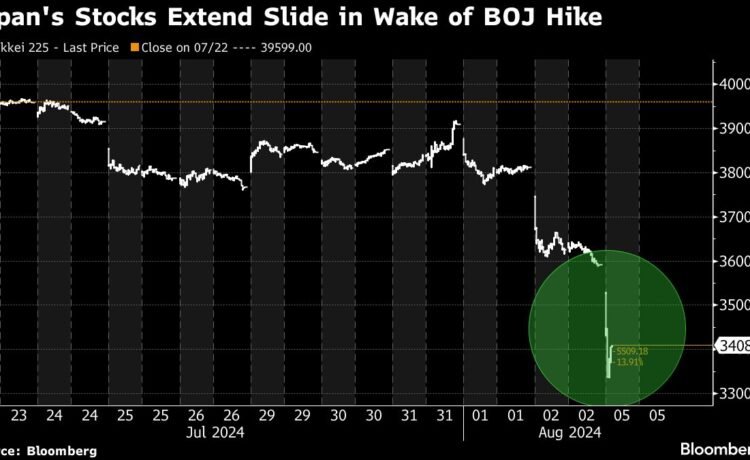

(Bloomberg) — Japan’s equity benchmarks slid about 20% from record highs reached last month as investor confidence crumbled from the surge in the yen, tighter monetary policy and the deteriorating economic outlook in the US.

Most Read from Bloomberg

The Topix and Nikkei 225 Stock Average fell more than 7% in morning trading Monday in Tokyo, with both benchmarks set for three-day declines that would be the worst since the 2011 Fukushima nuclear meltdown and put them into bear markets. A circuit breaker halted trading of Topix futures for about 10 minutes.

“We are basically seeing a mass deleveraging as investors sell assets to fund their losses,” said Kyle Rodda, a senior market analyst at Capital.Com. “The rapidity of the move has caught me off guard; there’s a lot of panic selling now, which is what causes these non-linear reactions in asset prices to pretty straightforward fundamental dynamics.”

All 33 of its industry groups have fallen since the Bank of Japan raised interest rates on July 31, triggering a surge in the yen that has cast a pall over the earnings outlook for exporters.

Even insurers and banks that were expected to benefit from higher rates are now some of the biggest losers since the BOJ’s hike as global equity markets slump. Mitsubishi UFJ Financial Group shares fell as much as 21%, their biggest intraday decline on record.

“The latest big selloff in equities, reinforced by US market’s downturn and led by technology stocks, has staged a big reset in terms of expectations for Japan equity returns for the rest of the year,” Andrew Jackson, head of Japan equity strategy at Ortus Advisors Pte in Singapore, wrote in a note.

Signs of weakness in the US economy sparked a slump on Wall Street on Friday and a plunge in Treasury yields. Nonfarm payrolls rose by 114,000 — one of the weakest prints since the pandemic — and job growth was revised lower in the prior two months. The unemployment rate unexpectedly climbed for a fourth month to 4.3%, triggering a closely watched recession indicator.

“The US employment statistics have further increased uncertainty in the US economy, which, combined with the yen’s ongoing strength, has caused the market to fall sharply,” said Hideyuki Suzuki, a general manager at SBI Securities. “There needs to be a pause as we are at a quite a good level now.”

Once the main drivers of the market’s ascent, foreign investors sold net ¥1.56 trillion ($10.7 billion) Japanese cash equities and futures combined in the week that ended July 26, according to data from Japan Exchange Group Inc. The Topix tumbled more than 5% during that period, the most in four years.

Here’s more on what market participants had to say:

Rina Oshimo, a senior strategist at Okasan Securities in Tokyo

“Although the market is currently in a ‘storm,’ Japanese stocks will gradually find a place to settle down along with the U.S. stock market,” she said. “Selling is being spurred by the unwinding of long positions and the involvement of trend-following hedge funds. Valuation and fundamental strategies are not applicable in some areas due to the panic selling aspect of the market.”

Vishnu Varathan, head of economics and strategy for Mizuho Bank in Singapore

“It is too early to tell if the summer heat will abate. But it is certainly a case of a conspiracy of ‘risk off’ triggers. The BOJ from what it did (hike and signal more) and the Fed for it has not (cut and commit to emphatic cutting) are conspiring to undermine precariously rich markets.”

Hideyuki Suzuki, a general manager at SBI Securities

“There is a general pattern of a reversal from the previous year’s data and the BOJ is not likely to raise interest rates further and will likely not be possible looking at the pace of the stock prices.”

Jumpei Tanaka, a strategist at Pictet Asset Management

“Until the bottoming out of USD/JPY is confirmed, aggressive buying of Japanese equities is likely to be restrained. At the moment, the US economic surprise index is showing a worsening trend, and investors are becoming increasingly wary of deteriorating US economic indicators.”

–With assistance from Abhishek Vishnoi.

(Updates prices and adds voices)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.