Nvidia (NASDAQ: NVDA) stock has sustained its stunning rally in 2024 as shares of the chipmaker have already surged an eye-popping 144% so far this year. And the good part is that the company has given investors multiple reasons to be bullish in recent days.

The company announced terrific fiscal 2025 first-quarter results that put to rest any doubts about Nvidia’s dominance in the artificial intelligence (AI) chip market. Additionally, it unveiled a new chip architecture that will be launched in 2026, a move that could help ensure that it maintains its technology lead over rivals.

Also, Nvidia management’s announcement of a 10-for-1 forward stock split seems to have given the stock another big boost, sending the company’s market capitalization to almost $3 trillion as of this writing. Nvidia briefly became the world’s second-most valuable company after Microsoft, overtaking Apple in the charts before falling back to third position.

But can Nvidia overtake Microsoft and eventually head to a $5 trillion market cap in the wake of its stock split? Let’s find out.

Nvidia stock has soared big time since its last stock split

First of all, investors should note that a stock split is nothing but a cosmetic move. It doesn’t alter a company’s fundamentals, market cap, or prospects. In a forward stock split, a company simply increases its outstanding share count while keeping the market cap intact. So, in Nvidia’s case, a 10-for-1 forward stock split that went into effect on June 7 means that if you owned a single share before the split, you would have 10 shares now.

However, the value of your investment will not change as the price of each Nvidia share will be reduced to reflect the split. This makes it clear that Nvidia’s stock split won’t alter the company’s fundamentals and growth drivers, nor should it affect its performance on the market.

At the same time, there is a belief that stock splits could increase the demand for a company’s shares. Investors who couldn’t afford to buy Nvidia’s shares earlier will now be able to do so, as the price of each share will come down substantially following the split on account of an increased share count. Of course, many brokerage firms allow investors to purchase fractional shares, so the concept of a split may be redundant for those investors.

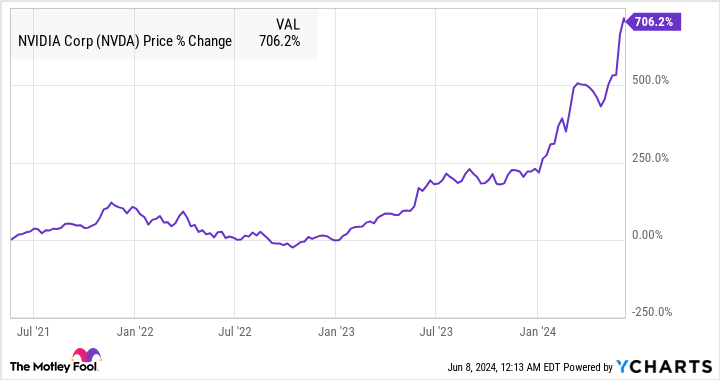

However, if we look at Nvidia’s previous stock split, which was executed in July 2021, it can be seen that its shares have appreciated big time since then. Nvidia management announced a 4-to-1 forward stock split on May 21, 2021, and it started trading on a split-adjusted basis from July 20 of that year.

Nvidia stock has surged an eye-popping 706% since it announced that 4-to-1 split in May three years ago.

Its market cap surged from $373 billion on May 21 to just under $3 trillion today. Now, past performance is not an indicator of a company’s future, and buying Nvidia following its stock split in anticipation that it could repeat its stunning run because of a cosmetic move is illogical.

However, a closer look at Nvidia’s prospects suggests the company could very well achieve a $5 trillion market cap despite the stock split. Let’s look at the reasons.

Why a $5 trillion market cap seems attainable

To understand why Nvidia stock has surged so remarkably in the past three years, let’s examine its financial performance during this period.

Nvidia’s revenue in fiscal 2021 (which ended in January 2021) stood at $16.7 billion, while its non-GAAP (generally accepted accounting principles) net income was $6.27 billion. Cut to fiscal 2024 (which ended in January this year), Nvidia’s revenue was $60.9 billion, and its non-GAAP net income zoomed to $32.3 billion. That translates into a top-line compound annual growth rate (CAGR) of 54%, while its earnings increased at a CAGR of almost 73%.

The massive demand for Nvidia’s AI chips has been central to this phenomenal growth. Of the $60.9 billion revenue it generated in fiscal 2024, $47.5 billion came from the data center segment. It is worth noting that Nvidia’s data center revenue in the first quarter of fiscal 2025 (which ended on April 28, 2024) shot up 427% year over year to a record $22.6 billion. So, Nvidia has generated nearly half of its fiscal 2024 data center revenue in just one quarter of the new fiscal year.

More importantly, the company’s robust data center growth is here to stay, as management points out that the demand for its upcoming Blackwell-based AI chips is so strong that it will have difficulty meeting the same going into 2025. Additionally, Nvidia is looking to keep the heat on its rivals by announcing the Rubin platform for 2026, which will succeed its Blackwell architecture.

Though Nvidia didn’t offer many details about Rubin, one can expect chips based on this platform to be faster than the Blackwell processors since they could be manufactured on an advanced 3-nanometer (nm) process. The Blackwell chips are manufactured on a 4 nm process and offer a tremendous increase in computing power and efficiency over the previous-generation Hopper architecture.

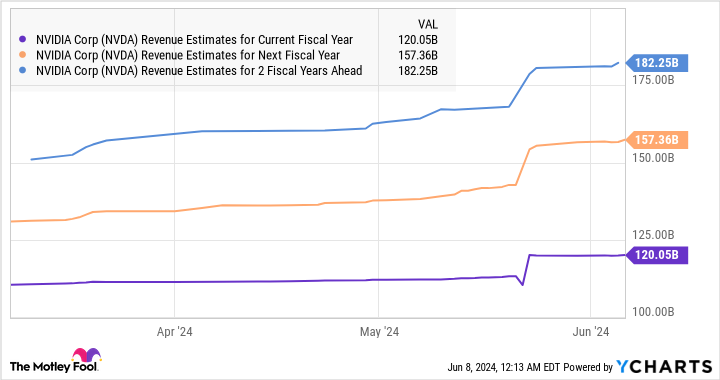

All this explains why analysts are upbeat about Nvidia’s data center growth and expect this segment to deliver phenomenal revenue in the coming years. Moreover, as the following chart indicates, Nvidia’s revenue could exceed $182 billion in fiscal 2027.

Using fiscal 2024’s revenue of $60.9 billion as the base, the above revenue forecast for fiscal 2027 suggests Nvidia’s top line could clock a CAGR of over 44% for the next three years. Throw in Nvidia’s pricing power in the AI chip market, and its earnings could grow at a faster pace.

Nvidia stock needs to rise another 68% from current levels to attain a $5 trillion market cap, and the potential growth it could offer over the next three years could help it hit that milestone.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,690!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Is Nvidia Going to $5 Trillion After Its 10-for-1 Stock Split? was originally published by The Motley Fool