Chip design and semiconductor technology company Arm Holdings (NASDAQ:ARM) almost tipped $180 a share in mid-June. That’s more than three times its IPO price of $51, and the stock is currently trading 103x non-GAAP forward earnings. Personally, I can’t get behind Arm because of this valuation despite its impressive growth trajectory and ambitions to be a lynchpin of the future of artificial intelligence (AI). It may be too late to buy the stock at its current levels.

Arm Holdings Defies Logic

Arm Holdings wasn’t evidently cheap when the IPO was made in September. After all, the stock traded pretty flat until February. However, there have been several positive catalysts since. One by one, they appear to have driven Arm’s valuation above what would be considered logical or justifiable at first glance.

For context, Arm Holdings stock is currently trading at 554x GAAP TTM earnings, 185x GAAP forward earnings, and 103x non-GAAP forward earnings. This makes it stratospherically expensive compared to the wider sector. The non-GAAP forward earnings ratio represents a 343% premium to the Information Technology sector as a whole. Also, its PEG ratio currently sits at 3.25x (1.0x or less is generally seen as undervalued), inferring that the stock is either overvalued or its intrinsic value lies beyond the medium term.

Of course, many analysts are still bullish on Arm holdings. This is due to its strong long-term growth prospects in data centers, PCs, IoT, and automotive segments. The company’s dominance in mobile and IoT markets, expanding market share in new segments, and exciting AI-driven opportunities position it as a potential global computing platform leader with significant future revenue growth. The firm also has exceptional margins (95.2% gross profit margin).

Arm Holdings’ Earnings Catalysts

So, what is driving Arm Holdings stock forward? In February, Arm Holdings saw its stock surge over 40%, driven by optimism surrounding AI. This rally followed a quarterly outlook that exceeded Wall Street’s expectations, propelling the company’s market value to a record $141 billion.

The company’s upside earnings surprises have been quite considerable in this calendar year. In Fiscal Q3, the business delivered normalized earnings per share (EPS) of $0.29, beating estimates by $0.04, and in Fiscal Q4, Arm delivered EPS of $0.36, beating estimates by $0.05.

Arm Holdings and All Things AI

The share price has also been influenced by reports that the company — which designs chips for a range of applications, including AI — was eyeing the development of its own AI chip. This AI chip division would look to develop its first prototype in 2025. It’s not clear from the reports whether Arm and its parent company, SoftBank (OTC:SFTBY), would essentially be forming a new company or whether the new entity would sit within Arm.

Arm would potentially be SoftBank’s most important asset as it reportedly intends to move into data center construction in 2026, with a focus on renewable power sources and the use of its own chips. ARM stock surged more than 6% after the report surfaced.

This report has been compounded by additional AI-focused announcements and ongoing enthusiasm for the sector. In May, Arm unveiled its latest compute solution for AI smartphones and PCs, called Arm Compute Subsystems (CSS) for Client, featuring Armv9.2 CPUs and Immortalis GPUs with 3nm implementations. CSS improves computing and graphics performance by over 30% and AI inference by 59%. Arm also introduced Kleidi software for AI and computer vision applications, which integrates with major AI frameworks.

Moreover, CEO Rene Haas further fueled the fire in June when he reportedly said that 100 billion of Arm’s devices will be AI-ready by the end of 2025. There has also been a minor boost in the successful listing of Arm-backed Raspberry Pi (LSE:RPI). Recent analyst upgrades have also helped.

Is Arm Holdings a Buy, According to Analysts?

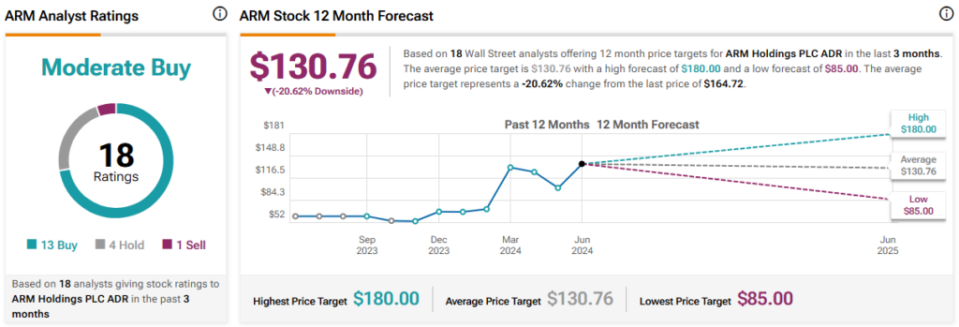

On TipRanks, Arm Holdings comes in as a Moderate Buy based on 13 Buys, four Holds, and one Sell rating assigned by analysts in the past three months. The average Arm Holding stock price target is $130.76, implying 20.6% downside potential.

There’s More To Unpack

While the average price target may indicate downside of 20.6%, it’s worth noting that analysts can occasionally struggle to keep up with fast-moving stocks like Arm. This is especially the case when there are so many positive catalysts, and to some extent, with AI, we’re in unchartered territory.

In this case, it’s worth noting that the last four analysts to cover the stock have given higher price targets than the average price target. Guggenheim raised its target to $169, Mizuho Securities issued a target price of $160, Rosenblatt Securities put Arm at $180, and Bank of America (NYSE:BAC) raised its price target to $180 from $150.

The average price target of the four most recent forecasts — all issued in the past two weeks — is $172.25. This would represent 4.6% upside potential.

The Bottom Line on Arm Holdings

Arm Holdings is among the most exciting and interesting AI stocks around. Several analysts point to long-term catalysts within AI that will propel the company to new heights, coupled with the firm’s truly exceptional margins. Personally, though, as much as I’d love to back the British success story, I’m neutral on the stock. It’s going to take a lot of growth to justify the current price tag.