Shares of Micron Technology (NASDAQ: MU) have been on a roll recently. The memory chip veteran’s shares have shown a total return of 40% in 2024 and 81% over the last 52 weeks, leaving the broader stock market far behind in both time spans.

However, Micron’s stock has also dropped 22% below the all-time high it set in June, a week before its third-quarter earnings report.

Knowing that Micron’s industry has strong cyclical tendencies, many investors are wondering whether it’s time to cash in this cycle’s profits right now. After all, the next big drop might be around the corner.

So, let’s take a look at Micron’s business cycle and whether this is a good time to convert its paper gains into cold, hard cash.

My two cents on the timing of investments

I’ll get around to the Micron analysis in a minute, but let’s ponder a very important investing strategy first.

My favorite holding period is forever. Market timing is a difficult game — and I really think of it as a game, not investing.

I’m not alone in this approach. Master investor Warren Buffett isn’t trying to maximize his returns by buying and selling stocks at precisely the right moment. And when his Berkshire Hathaway makes a move — buying, selling, moving assets from one holding company to another — the transaction isn’t inspired by the overall health of the stock market. Buffett studies each potential investment until he knows it like the back of his hand, and only then will he hit those “buy” or “sell” buttons.

As Buffett said in Berkshire’s annual meeting in the spring of 2022, the broad market is unguessable:

We have the faintest idea what the stock market is going to do when it opens on Monday. Charlie and I, I don’t think in all the time we’ve worked together, … I don’t think we’ve ever made a decision where either one of us has either said or been thinking ‘we should buy or sell’ based on what the market’s going to do or for that matter, on, on what the economy is going to do. We don’t know.

There you have it. If investing geniuses Warren Buffett and Charlie Munger never had “the faintest idea” what the market would do next, then I don’t stand a chance of making the right guess.

Perfect timing doesn’t exist

On that note, there really isn’t a perfectly right and proper time to buy Micron Technology stock. As long as the company is fundamentally strong and continues to innovate, any time can be a good time to invest, provided your investment horizon aligns with the company’s long-term growth potential. Micron Technology has shown resilience and adaptability in the highly competitive memory chip market, which bodes well for its future.

Micron’s business cycle

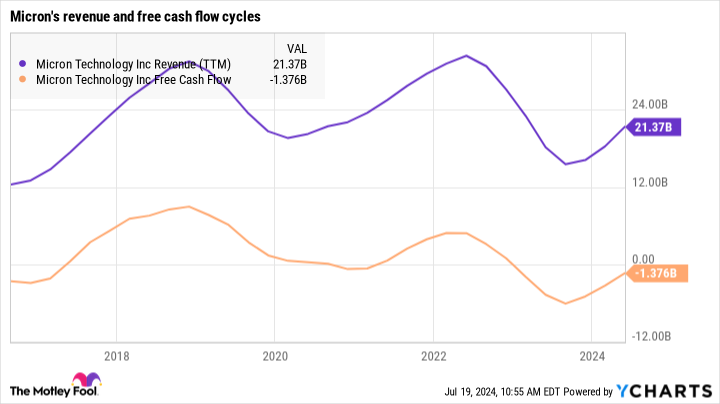

As a tightly focused specialist in memory chip design and manufacturing, Micron operates in a cyclical industry. The computer memory market is heavily influenced by supply and demand dynamics in end-stage target markets, such as smartphones, data center systems, and modern cars with tons of data processing power.

Historically, Micron has experienced several periods of rapid growth followed by significant declines, mirroring the broader semiconductor cycle. This cyclicality can make short-term investing tricky, but it also provides opportunities for long-term investors who can ride out the downturns.

Micron’s recent financial performance sure looks cyclical at a glance. Despite the impressive returns over the past year, the stock’s drop from its all-time high suggests market makers are wary of the next potential downturn. However, this drop doesn’t necessarily signal the end of Micron’s most recent swing into high-growth territory.

Analyzing Micron’s cyclical performance

From a historical perspective, Micron’s business cycle appears to be on the upswing. While past performance doesn’t guarantee future results, there are compelling reasons to bet on this positive trend.

The seemingly endless growth of artificial intelligence (AI) systems, the recent recovery in smartphone sales, and the increasing popularity of computer-packed vehicles suggest a robust future demand for Micron’s memory chips. And all of these flourishing target markets are increasing the amount of memory included per phone, server, or car — those newfangled AI features require a lot of memory, after all.

Given these factors, Micron’s growth phase appears to have plenty of life left in it.

Industry trends and future prospects

Several industry trends suggest that Micron’s long-term prospects remain robust. Beyond the markets mentioned above, data storage capacities are also rising due to cloud computing and 5G wireless networking technologies. Micron’s products are in heavy demand.

Moreover, Micron’s strategic initiatives aim to mitigate the effects of cyclical downturns. By diversifying its offerings and targeting more stable end markets, Micron can reduce its vulnerability to industry volatility. The company achieves this by focusing on high-value solutions, uniquely powerful memory products, and a rapidly expanding portfolio of specialized chips. The memory found in your smartphone would be less effective in an AI-training server, and vice versa.

Too late to buy Micron stock? Not in my book.

So, is it too late to buy Micron Technology stock? Not necessarily. I would actually argue that the lower share price opens the window for opportunistic buying of a high-quality stock.

Micron’s stock has had a strong run, and the industry is known for its cycles, but the company’s solid fundamentals and strategic positioning make it a compelling investment for those with a long-term perspective. Despite my lack of surefire insight into the stock market’s next bull run or crisis, I’m sure the demand for memory chips will rise over time and Micron will benefit from that unstoppable trend.

Timing the market is notoriously difficult, even for seasoned investors like Warren Buffett. Instead, focusing on the company’s long-term potential and maintaining a patient investment approach should yield more rewarding results in the long run.

And on that note, it’s not too late to buy Micron stock at all. In fact, I highly recommend it.

Should you invest $1,000 in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,626!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Anders Bylund has positions in Micron Technology. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

Is It Too Late to Buy Micron Technology Stock? was originally published by The Motley Fool