It seems like everyone wants to own a rental property these days. There are an endless amount of videos with people touting the benefits of passive income, meaning income you can earn by purchasing an asset, holding it, and doing minimal work. While rental properties can generate income, there is a misconception that they generate passive income, as a rental unit takes a lot of work to maintain as a landlord.

This is why dividend income investing — a true form of passive income — is superior to buying a rental property. Forget buying a rental unit. If you have $50,000, buy these two passive income stocks and earn $2,020 of growing income payments each year.

Ally Financial: Modern online banking

Ally Financial (NYSE: ALLY) is one of the largest online-only consumer banks in the United States. It has $145 billion in retail deposits and more than 3 million customers. Ally is able to convince customers to switch from legacy institutions by offering much higher interest rates on bank deposits. For example, last quarter, it paid out a 4.25% savings rate to depositors, which is significantly higher than a legacy bank such as Chase.

High interest rates are possible due to Ally’s lower cost base. It has no branch locations and much fewer employees than the big banks.

However, paying high interest rates can lead to a squeeze on its profits if the Federal Reserve goes through a major interest rate hiking cycle like it did over the past few years. See, Ally makes money by taking these deposits and making loans, generally consumer automotive loans. When it has existing loans on the balance sheet from when interest rates were lower, there is a compression of the spread it earns on its entire loan book when it raises the interest rate paid to its customers, lowering its overall profitability.

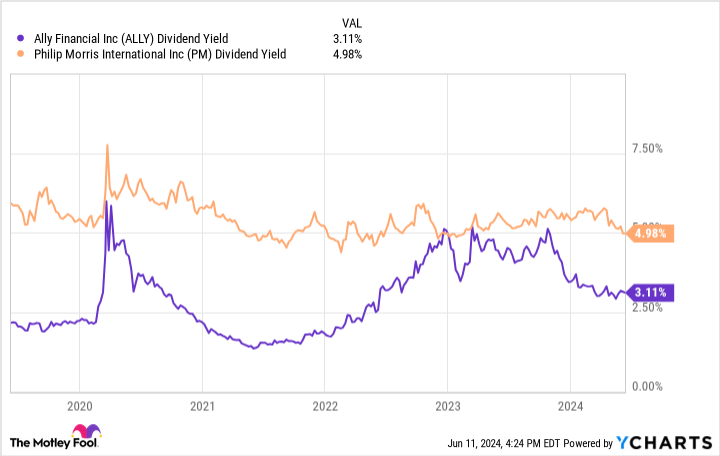

This is why Ally’s net income was only $858 million over the last 12 months compared to more than $2.4 billion in 2021. Despite this, Ally is still able to pay a dividend that yields 3.1%. When its loan book reprices, and the Federal Reserve finally lowers interest rates, it should start to see its profits grow again. This can fuel dividend growth in the years to come.

Apply a 3.1% yield to half of our theoretical $50,000 investment, and one can earn $775 in income every year by holding Ally Financial. An income that should grow consistently over the next five to 10 years and beyond.

Phillip Morris International: Profitable nicotine products

The second passive income stock is Phillip Morris International (NYSE: PM). The company is known as one of the leading tobacco companies worldwide, owning the Marlboro brand and others outside of the United States. However, today, it is aggressively and successfully leading customers to alternative nicotine products. These include the Iqos heat-not-burn cigarette devices and Zyn nicotine pouches.

Last quarter, Phillip Morris’s smoke-free products — generally everything except cigarettes — grew revenue by 24.8% year over year with a 37.5% increase in gross profit. This is great as the world slowly moves away from cigarette smoking and can help replace any lost profits. Despite this change in consumer preference, the company’s net revenue from its combustibles segment grew 3.7% year over year, leading to 11% consolidated revenue growth.

Today, Phillip Morris International has a dividend yield of 4.98%. As the smoke-free products keep growing, it should be able to grow its dividend per share that it pays out to investors each quarter. Applying that yield to $25,000 — half of our $50,000 hypothetical investment — an investor can earn $1,245 in income each year just by holding the stock. Like Ally, this dividend should grow in the coming years at a consistent rate.

Why dividend growth is superior to rental income

Buying these two dividend stocks is a better way to build passive income than a rental property. A rental property requires maintenance work, potentially dealing with bad tenants, and other costs or time wasters that come after making the investment. This doesn’t sound too passive to me.

On the other hand, holding dividend growth stocks such as Phillip Morris International and Ally Financial requires no work. Well, unless you count opening up your brokerage application on your phone to see how much money the companies paid to your account last quarter.

It is clear to me: If you want true passive income, forget buying a rental property and search for strong dividend growth stocks instead.

Should you invest $1,000 in Philip Morris International right now?

Before you buy stock in Philip Morris International, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Philip Morris International wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $794,196!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Ally is an advertising partner of The Ascent, a Motley Fool company. Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends Philip Morris International. The Motley Fool has a disclosure policy.

Forget Buying a Rental Property: Investing $50,000 Into These Passive Income Dividend Stocks Could Make You $2,020 In Annual Income was originally published by The Motley Fool