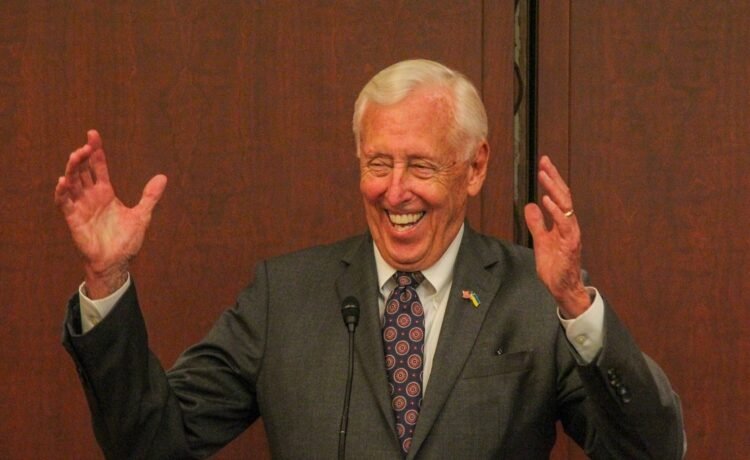

WASHINGTON – Congressman Steny H. Hoyer (MD-05), Ranking Member of the Financial Services and General Government (FSGG) Subcommittee, released the following statement yesterday on the Internal Revenue Service’s (IRS) announcement that $1 billion in past-due taxes have been collected from the wealthiest Americans, thanks to funding from Democrats’ Inflation Reduction Act:

“Today, we saw that the IRS can deliver for the American people when it receives the resources necessary to do its job. The IRS announced that it has collected $1 billion in legally owed tax revenue through enforcement since the investments that Democrats made in the agency through the Inflation Reduction Act. Contrary to Republican claims, the IRS did not collect these dollars from working families but from wealthy millionaires and billionaires who owed more than $250,000 in back taxes.

“That progress is especially impressive considering Republican efforts to claw back this enforcement funding in order to shield the wealthiest from having to pay their fair share. If my colleagues across the aisle are serious about fiscal responsibility and reducing the national debt, as I am, they ought to care about fairly enforcing tax laws that are already on the books. Instead, they make draconian cuts to vital federal agencies and programs that help the most vulnerable in our society.

“Hundreds of billions of dollars of taxes go uncollected each year, in part because of years of underfunding of IRS’ enforcement capacity. As Ranking Member of the Financial Services and General Government Subcommittee, I will keep working to provide the IRS with what it needs to deliver the level of service the American people expect and ensure that the wealthy pay the taxes they owe under existing law.”

Related