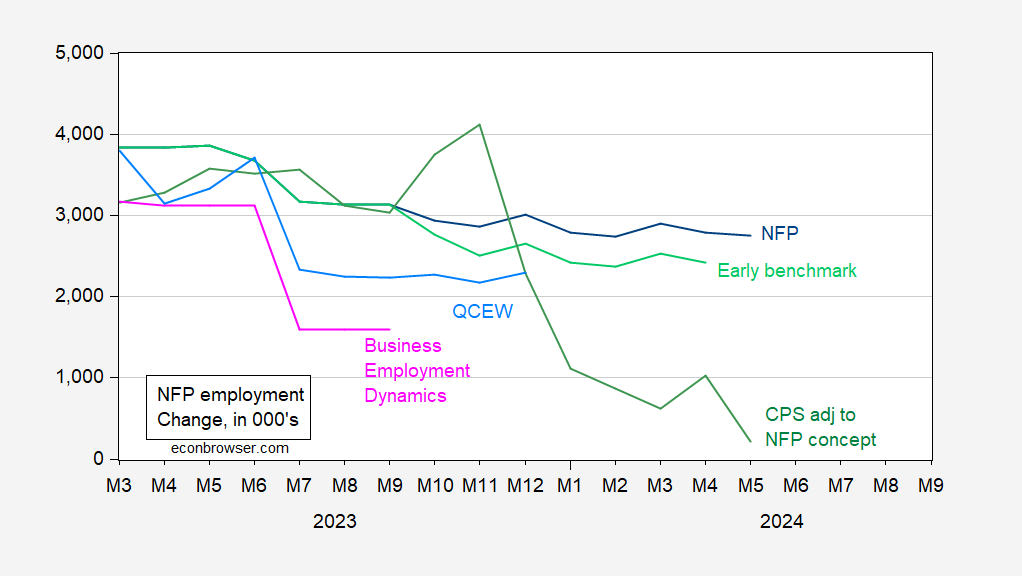

With the release of the Philadelphia Fed early benchmark, we have the following 12 month changes in employment (000’s) from different sources:

From May 2023 to April 2024, according to the Philadelphia Fed early benchmark nonfarm payroll employment grew only 2.4 mn rather than 2.8 mn as reported by CES.

Figure 1: Nonfarm payroll employment from CES (blue), QCEW adjusted by geometric moving average by author (light blue), Business Employment Dynamics (pink), and Philadelphia Fed early benchmark (light green), all in logs, 2023M05=0. Philadelphia Fed series is official CES adjusted by ratio of early benchmark sum of states to CES sum of states ratio. Source: BLS via FRED, BLS, QCEW/BLS, BED/BLS, Philadelphia Fed and author’s calculations.

Hence that the Philadelphia Fed measure implies a reduction in NFP employment growth relative to official by about 400,000. Does it change our view of the trajectory of the employment measures? Figure 2 shows in logs the series relative to May 2023.

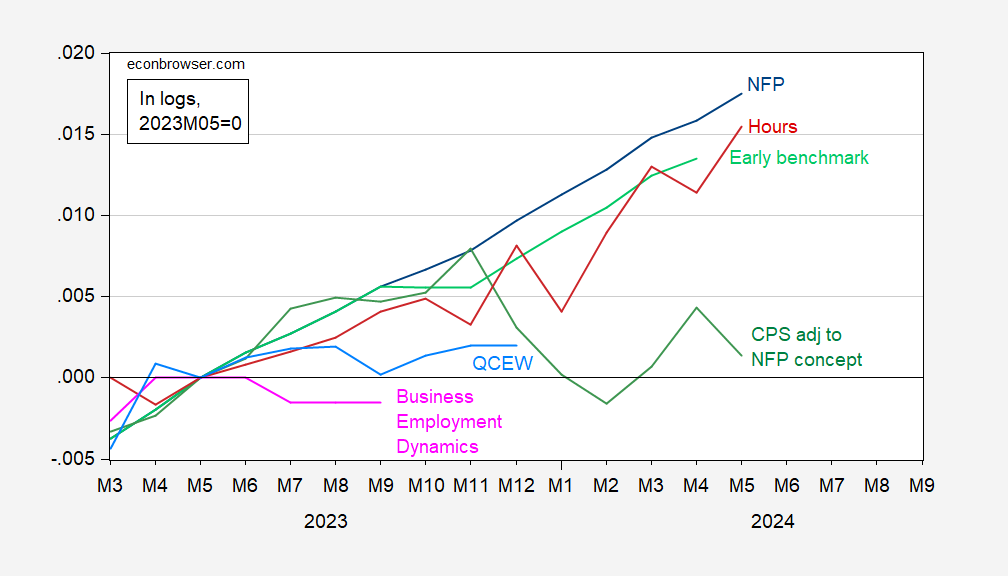

Figure 2: Nonfarm payroll employment from CES (blue), CES hours (red), QCEW adjusted by geometric moving average by author (light blue), Business Employment Dynamics (pink), and Philadelphia Fed early benchmark (light green), all in logs, 2023M05=0. Philadelphia Fed series is official CES adjusted by ratio of early benchmark sum of states to CES sum of states ratio. Source: BLS via FRED, BLS, QCEW/BLS, BED/BLS, Philadelphia Fed and author’s calculations.

Hence, utilizing the Philadelphia Fed measure which incorporates QCEW information, instead of rising 1.58% by April 2024 vs May 2023, NFP has risen by 1.35%

By the way, the CPS series adjusted to match the CES NFP concept should be viewed with particular wariness, given that it is based on the civilian employment series which incorporates new population controls.

So it’s likely that the actual trajectory of employment is depressed relative to official, not sufficiently to call a recession, but perhaps to strengthen the case for loosening monetary policy.