Conor here: According to Bloomberg, Trump has gotten at least $24.4 million from 13 members of the Billionaires Index and Harris has received $12.8 million from 20 people. So maybe Kamala has already embraced billionaires?

I figure it’s safer to assume US politicians are working for the plutocrats unless they prove otherwise. Has Kamala done anything to indicate she’s not?

Has she committed to keeping on FTC Chair Lina Khan yet? AOC who’s embarrassed herself recently attacking Green presidential candidate Jill Stein and her supporters for not backing Kamala is still out there championing Khan, so there’s that:

Rep AOC kicks off the town hall with @linakhanFTC breaking down monopoly power in groceries, housing, healthcare. She introduces her as a leader who has used creativity and is genuinely working to address corporate power. Says she has not seen an FTC leader like her. 🔥💯 pic.twitter.com/zW2mwaGLLg

— Nidhi Hegde (@nhegde) September 13, 2024

By Sonali Kolhatkar, an award-winning multimedia journalist. She is the founder, host, and executive producer of “Rising Up With Sonali,” a weekly television and radio show that airs on Free Speech TV and Pacifica stations. Her most recent book is Rising Up: The Power of Narrative in Pursuing Racial Justice (City Lights Books, 2023). She is a writing fellow for the Economy for All project at the Independent Media Institute and the racial justice and civil liberties editor at Yes! Magazine. She serves as the co-director of the nonprofit solidarity organization the Afghan Women’s Mission and is a co-author of Bleeding Afghanistan. She also sits on the board of directors of Justice Action Center, an immigrant rights organization. This article was produced by Economy for All, a project of the Independent Media Institute.

The vast majority of Americans believe that the United States economy is unfairly rigged to benefit the rich. In the past few weeks, the Democratic nominee for president, Kamala Harris, has proven that this is an accurate assessment. She initially backed her own administration’s initiative to increase top earners’ total tax rate including on capital gains to nearly 45 percent. This was included in President Joe Biden’s 2025 budget proposal. But soon after billionaire donors made it clear they preferred not to part with any fraction of their wealth, she pivoted, announcing in September that she backed a significantly lower capital gains tax rate of 33 percent.

Vermont Senator Bernie Sanders, who has made accusations of a “rigged economy” his signature phrase, explained Harris’s pivot: “I think she’s trying to be pragmatic and doing what she thinks is right in order to win the election.”

Think about how hard it has been for climate justice activists to get Harris to stick to her original idea in 2019 to oppose fracking. In the recent debate with Donald Trump, days after scientists declared summer 2024 the hottest on record, she promised, “I will not ban fracking”—ostensibly to win over Pennsylvania’s undecided voters.

It’s been even harder for anti-genocide activists to win a commitment from Harris for an arms embargo against Israel in the face of mass ethnic cleansing of Palestinians in Gaza.

Whether it is the long-term fate of our species or the short-term existence of a people, Harris—at least while campaigning for President—will apparently not budge. But on taxing billionaires? They say “hell, no,” and she asks, “How low?”

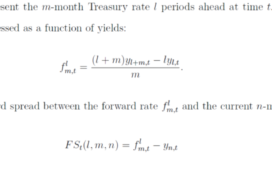

Capital gains taxes, which are taxes on the increased value of sold stocks, are currently capped at 20 percent. But what about the value of unsold stocks and other assets? Biden’s proposal is to tax billionaires on all their wealth, including “unrealized capital gains” at the rate of 25 percent. And on that matter, thankfully, Harris has backed Biden’s idea—for now.

The group Americans for Tax Fairness (ATF) estimates that “America’s billionaires and centi-millionaires (those with at least $100 million of wealth) collectively held at least $8.5 trillion of ‘unrealized capital gains’ in 2022.” These ultrarich people have lives that are completely foreign to the rest of us. ATF points out, “While most Americans predominantly live off the income they earn from a job—income that is taxed all year, every year—the very richest households live lavishly off capital gains that may never be taxed.”

Predictably, rightwing ideologues have piled on Harris, with one opinionator calling the 25 percent wealth tax rate, “so dumb it’s truly historic.”

New York Times pundit Peter Coy was less gauche, and in his September 6, 2024 column he began by calling unrealized capital gains “paper wealth,” and “gains that exist only on paper.” He revived the tired adage that higher taxes on the ultrarich could have a “potential negative effect on entrepreneurship,” and “could strongly discourage investors from putting money into startups.”

But the Center for Budget and Policy Priorities dispels the myth that it’s not real money, explaining that “wealthy households can use [unrealized gains] to finance their (often lavish) lifestyles… They can do so by borrowing large sums against their unrealized capital gains, without generating taxable income.” By borrowing money off this so-called paper wealth, they don’t owe traditional income taxes because it’s not seen as traditional income.

For years, the wealthiest Americans have held on to money that should have been extracted from them in the form of taxes. What could these taxes have paid for? Senator Ron Wyden, who chairs the Senate Finance Committee explained during a Budget committee hearing that, “The ultra-wealthy are avoiding nearly $2 trillion in taxes every 10 years.” That, he said, “is enough to keep Social Security whole till the end of this century.”

Political pundits and economists repeatedly perpetuate a fantasy that taxing billionaires stifles innovation. The real link is that taxing billionaires funds government programs that we collectively benefit from. Conversely, allowing them to remain rich, stifles our wellbeing.

And, it could even help Harris win the election. Economic inequality is, unsurprisingly, top of mind for voters. Data for Progress has found that more than 70 percent of voters are in favor of increased taxes on the wealthy. This includes a majority of Republicans. Nearly two-thirds of those polled support Biden’s and Harris’s 25 percent tax rate on all wealth held by billionaires—including unrealized capital gains.

Harris is facing the grim reality that voters are tired of their hard-earned dollars not going far enough. Four years of inflation, of seeing prices of food, rent, and other basic necessities rise faster than wages is enough to drive the fantasy that someone else—in particular Donald Trump—might do better.

Trump has embraced the billionaire agenda, promising that he would “make life good” for Musk and other wealthy people. He has promised oil executives he would do their bidding in exchange for campaign contributions. More billionaires are backing Trump than Harris. And yet, financially insecure people are more likely to support Trump than Harris.

So why isn’t Harris going all in on higher taxes overall? Even when accounting for the electoral college, which forces presidential candidates to tack toward the center to win slivers of undecided voters in a handful of “swing states,” Harris could win by leaning into higher taxes for billionaires. Data for Progress found that expanding the federally funded program of Medicare to cover dental, vision, and hearing, would help Harris the most in swing states. The second most important position backed by voters was raising taxes on the wealthy. What better way to expand Medicare than to tax the rich to pay for it?

It’s going to take a lot on Harris’s part to beat the faux populism that Trump exudes. Within such a context, it’s not a good look that Harris is giving in to any pressure from billionaire donors—in spite of Senator Sanders’s claim that it’s an election ploy. Money is the best tool that billionaires have to protect their wealth, so it ought not to surprise us that they are harnessing it in their defense. It doesn’t mean Harris should give in—not if she wants to win.