The S&P 500 stands just a touch below its closing all-time high of 5,433.74, a record it reached just last Thursday. For the year-to-date, the index is up almost 14%, a solid gain that provides support for positive investor sentiment.

Looking at the market from the technical perspective is Ari Wald, Oppenheimer’s head of technical analysis, who takes a bullish stance on large cap stocks.

“Looking ahead, we believe the weight of the evidence argues for higher market highs, and, at worst, we believe a selective approach is appropriate. For us, this selection includes a core position in large-cap growth. While the bull case is based on catch-up in lagging areas (small-caps, value) we think market leaders (large-caps, growth) still offer the more attractive risk/reward balance,” Wald opined.

Some of Oppenheimer’s top analysts are following this line, and encouraging investors to go long on two specific large-cap stocks. We ran them both through the TipRanks database to find out whether the rest of the Street is comfortable with these choices. Let’s take a closer look.

Uber Technologies (UBER)

The first stock on our list of large caps is Uber, a leader in the rideshare niche. Uber was one of the first startups active in that space, and its design – allowing users to order rides online, and allowing drivers to work when and as they want – brought a sea-change to the way that we see and use taxi services. Uber has expanded over the years, and in addition to ride-hailing services, the company also offers courier services, package and light freight deliveries, business ride plans, and even food delivery services via Uber Eats.

Uber’s market cap currently stands at $144.8 billion, and the company has built up to that scale by giving its customers what they want – quick access to transportation services, at their fingertips. Some numbers will tell the story. At the end of 1Q24, Uber’s services were available in more than 10,000 cities in 70 countries around the world, and the company boasted 149 million monthly active platform customers, had 7.1 million monthly active drivers and couriers, and was providing 28 million trips every day.

That’s a solid foundation for the rideshare business, and Uber reported some solid gains during this year’s first quarter. The company’s revenue came to $10.1 billion, up 15% year-over-year, and beat the forecast by $40 million. The company reported a 21% increase in trips year-over-year, and a 20% increase in gross bookings, to $37.76 billion. That last, however, was slightly below the consensus expectation of $37.97 billion.

We should note here that, while Uber’s stock is showing strong gains (up by 61% over the past year), its rate of gain has been slowing down. For Oppenheimer analyst Jason Helfstein, this slowdown in the stock represents a buying opportunity, and a chance for investors to get into a solid long-term holding. The 5-star analyst writes, “We see UBER shares as having the most upside within large-cap Internet on tailwinds from healthy affluent consumers (core UBER customer), travel demand, and services spending. Meanwhile, correction from highs provides attractive entry point as estimates now higher than pre-Analyst Day, while stock is lower. Wealthy consumers continue spending: Memorial Day travel strong; AXP consumer airline spend accelerated; services growth outpacing goods; and existing homes sales indicate meaningful outperformance at the high-end.”

For Helfstein, this adds up to an Outperform (Buy) rating, and his price target, of $90, suggests a 28.5% gain in the next 12 months. (To watch Helfstein’s track record, click here)

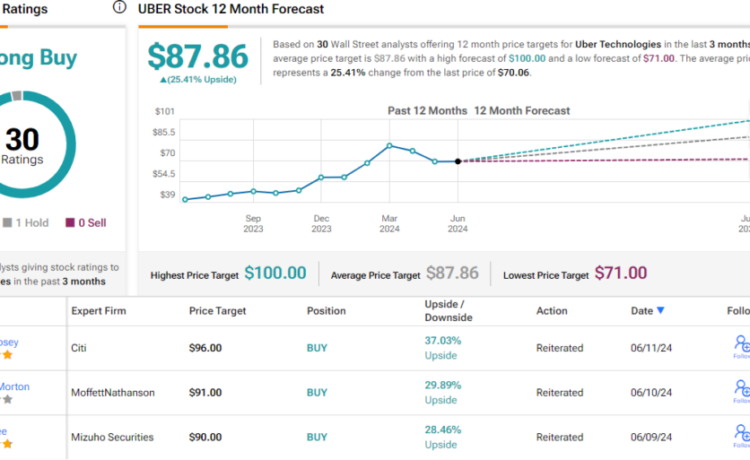

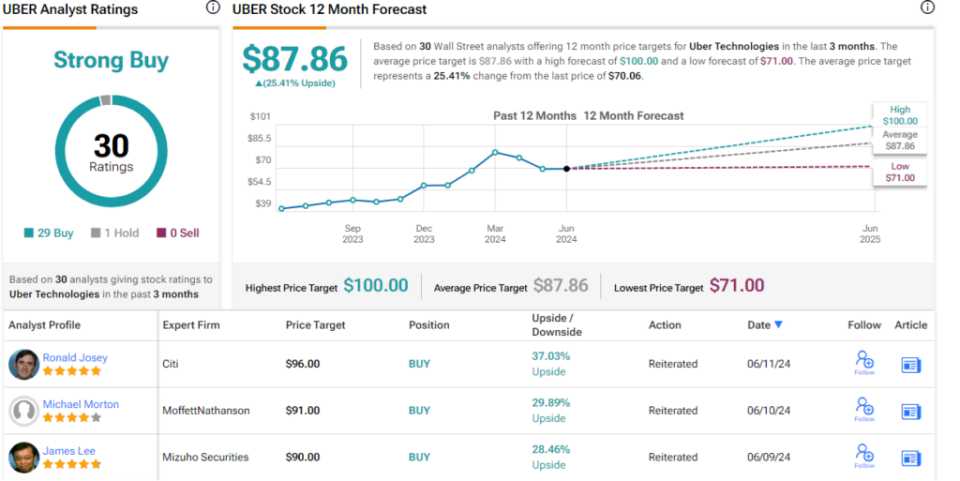

Almost no one is arguing with that take on Wall Street. The stock’s Strong Buy consensus rating is based on 29 Buy recommendations and a single Hold. The shares are priced at $70.06 and their $87.86 average price target implies a one-year upside potential of 25.5%. (See UBER stock forecast)

Snowflake (SNOW)

The second stock we’ll look at is Snowflake, a software company offering a cloud-based data analytics platform, delivering high-end data capabilities on the popular subscription model. Essentially, what Snowflake does is provide data-as-a-service, so that customers at any scale can realize the advantages of a simplified data architecture. The company puts all of its services on a single platform, eliminating silos and giving customers a more streamlined and efficient experience.

With the advent of generative AI in recent years, Snowflake has seen – and seized – an opportunity to expand its business. The company quickly understood that AI is highly data-dependent, and that the Snowflake data cloud was uniquely positioned to provide a solid foundational service for AI customers. The company’s scalable, flexible platform architecture allows for optimized data storage, easy access and easy management, and a workable combination of adaptability and interoperability. In March of this year, Snowflake announced a collaboration with Nvidia to bring together Snowflake’s secure AI data cloud with the chip maker’s full-stack accelerator capabilities.

Snowflake currently counts over 9,800 customers who rely on the company to unify their data sources. In aggregate, these customers generate more than 5 billion data queries every day on the data cloud and run more than 515 million daily workloads. The company has 485 customers generating more than $1 million in revenue each and has listed $5 billion in remaining performance obligation, or a work backlog, as of April 30 this year. The company has a market cap of $42.5 billion.

Turning to financial results, we find that Snowflake reported $828.7 million in total revenue for fiscal 1Q25, up 33% year-over-year and beating the forecast by $42.8 million. The company’s revenue total included $789.6 million in product revenue, for 34% year-over-year growth. At the bottom line, Snowflake generated 14 cents per share in non-GAAP income; this was down a penny from the prior year and missed expectations by 3 cents per share.

This stock is part of the coverage universe of Ittai Kidron, another of Oppenheimer’s 5-star analysts. Despite the recent mixed earnings report, Kidron, who is rated by TipRanks in the top 3% of Wall Street’s analysts, is upbeat on SNOW, particularly on its AI potential. He says of the company, “The AI landscape is quickly evolving, is taking a greater share of workloads/ apps, and is highly competitive. Snowflake sees AI as a foundational capability, and is positioning itself as the data backplane for AI, in order to maintain its position as a leading Cloud DBMS provider… We see the expanding product capabilities as testament to the company’s innovation and believe these could incentivize customers to build apps on Snowflake longer term.”

Kidron sets an Outperform (Buy) rating on this stock, and he complements that with a $220 price target, pointing toward a 73% gain on the one-year horizon. (To watch Kidron’s track record, click here)

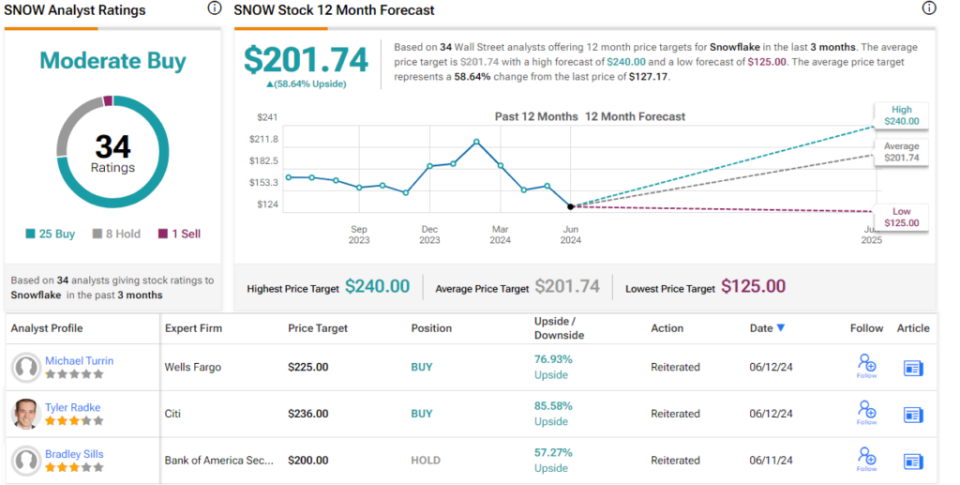

The Oppenheimer view is highly bullish, more so than the analyst consensus. The 35 recent reviews include 25 Buys, 8 Holds, and 1 Sell, for a Moderate Buy consensus rating. There are nice gains projected here, nonetheless; the stock’s $201.74 average price target suggests an upside potential of 58.5% for the year ahead. (See Snowflake stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.