For GDP, no recession on the short horizon:

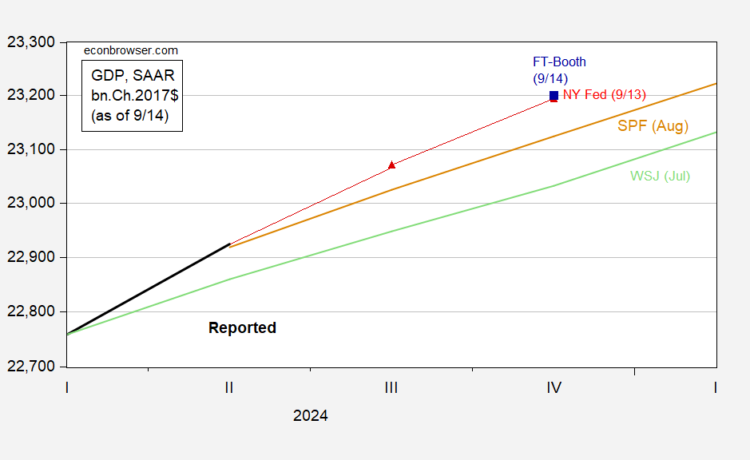

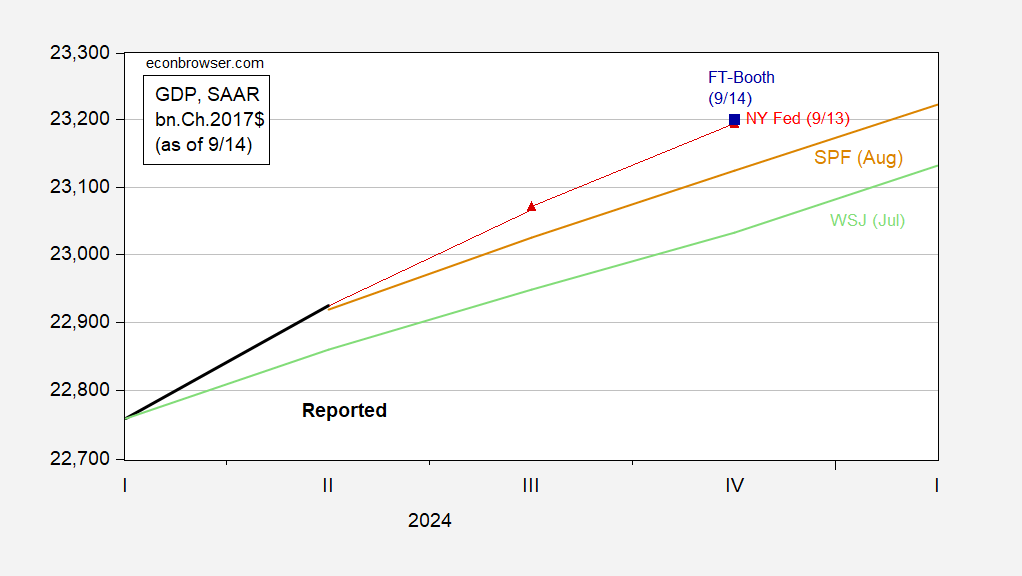

Figure 1: GDP (bold black), FT-Booth September median forecast (blue box), NY Fed nowcast (red triangles), SPF August (tan line), WSJ July (light green), in bn.Ch.2017$ SAAR. Source: BEA 2024Q2 advance, FT-Booth September survey, NY Fed, Philadelphia Fed, WSJ, and author’s calculations.

There’s been a shift upward in the FT-Booth survey GDP level (implied q4/q4 2024 growth has risen from 2.0% in June survey to 2.3% in September). Given Q2 advance growth, this implies 2.4% in 2024H2 (SAAR).

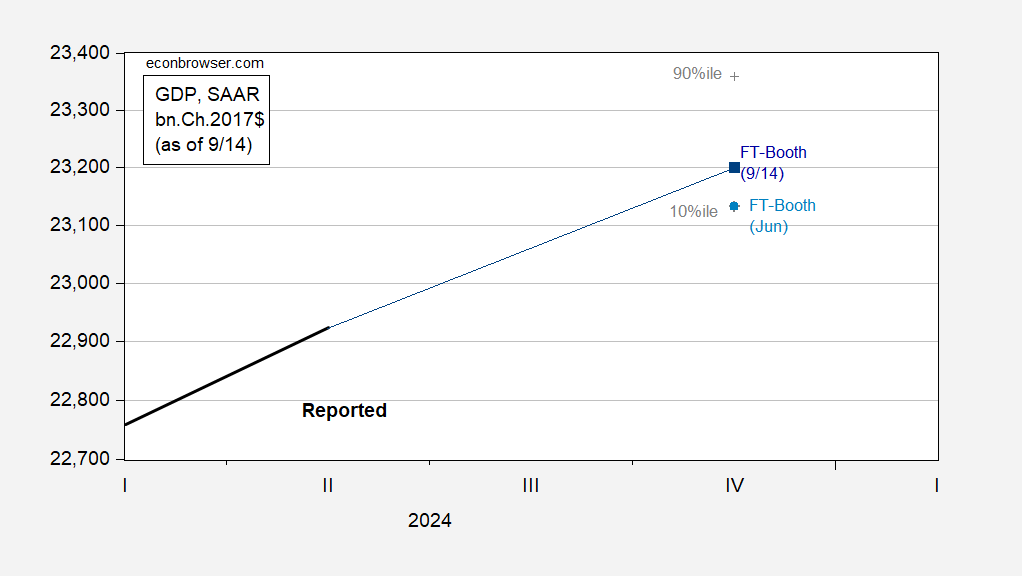

Figure 2: GDP (bold black), FT-Booth September median forecast (blue box), 10%ile/90%ile (gray +), FT-Booth June median forecast (light blue box), in bn.Ch.2017$ SAAR. Source: BEA 2024Q2 advance, FT-Booth September survey, and author’s calculations.

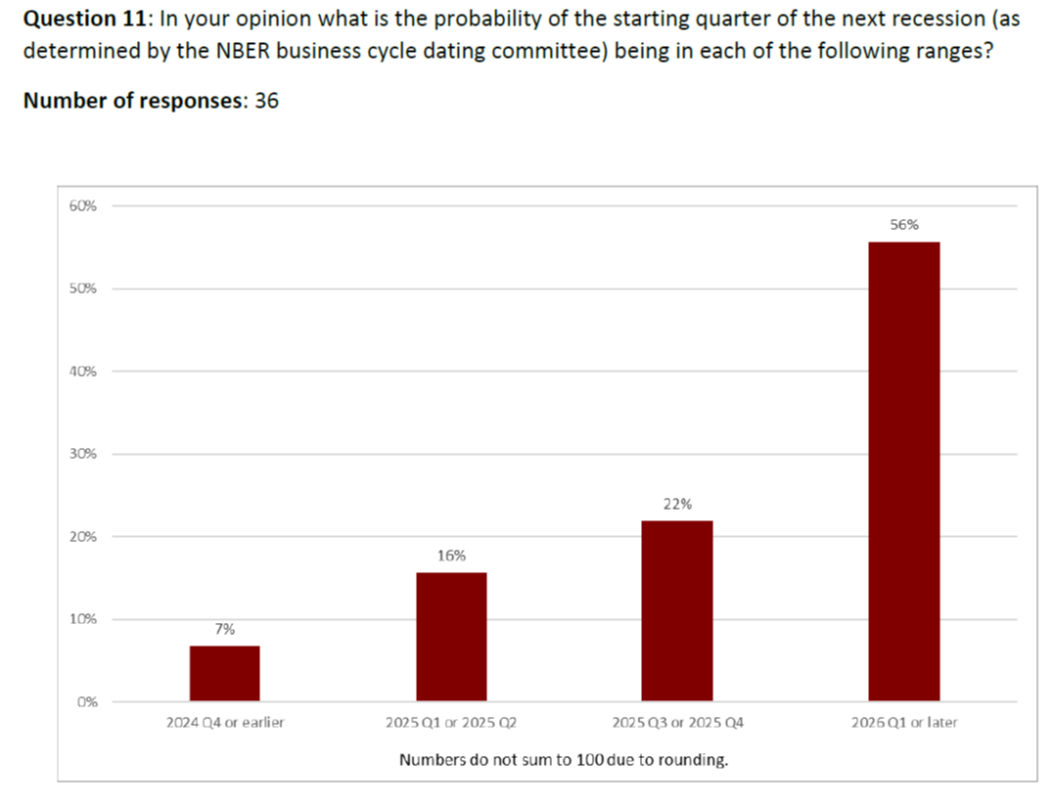

Neither the median nor 10%ile paths are suggestive of recession. The modal response is for a recession in 2026Q1 onward, as in June’s survey.

Source: FT-Booth.

The proportion of respondents that thought the recession would start in 2024 has dropped from 12% to 7%, while the proportion that thinks the recession will start in 2026Q1 or later has risen from 52% to 56%.