The Financial Times has done some useful reporting in its new lead story, Forty per cent of Biden’s major IRA manufacturing projects delayed or paused. However, it’s hard to know what the “so what” of this analysis is without having context. Is this number good, bad, or in line with expectations?

We’ll get to the meat of the findings soon, but some of the unanswered questions were:

What were the timing//completion expectations? Did they make adequate allowance for normal teething delays?

How do these results compare to similar non-government manufacturing initiatives in these particular industries?

How many of these projects (particularly ones going well) were things that the companies were planning to do anyhow? This is a general risk of subsidies and incentives, that they often wind up paying for things that would have happened regardless.

In other words, unless there is a basis for comparison, it is hard to know what these findings mean.

Admittedly, given the many industries and projects, it would take a vast amount of work for the pink paper to have come up with a solid answer. But they could at least have acknowledged the need for good benchmarks and gotten some quotes from experts.

Separately, it is curious that the Financial Times ran this story, framing it as critical of the Administration. The Financial Times, like most of the orthodox media, has been solidly in the anti-Trump camp. Is this article a reflection of a different Financial Times loyalty, to strong-form neoliberalism, so that dirigisme is suspect and must be undermined when it rears its ugly head?

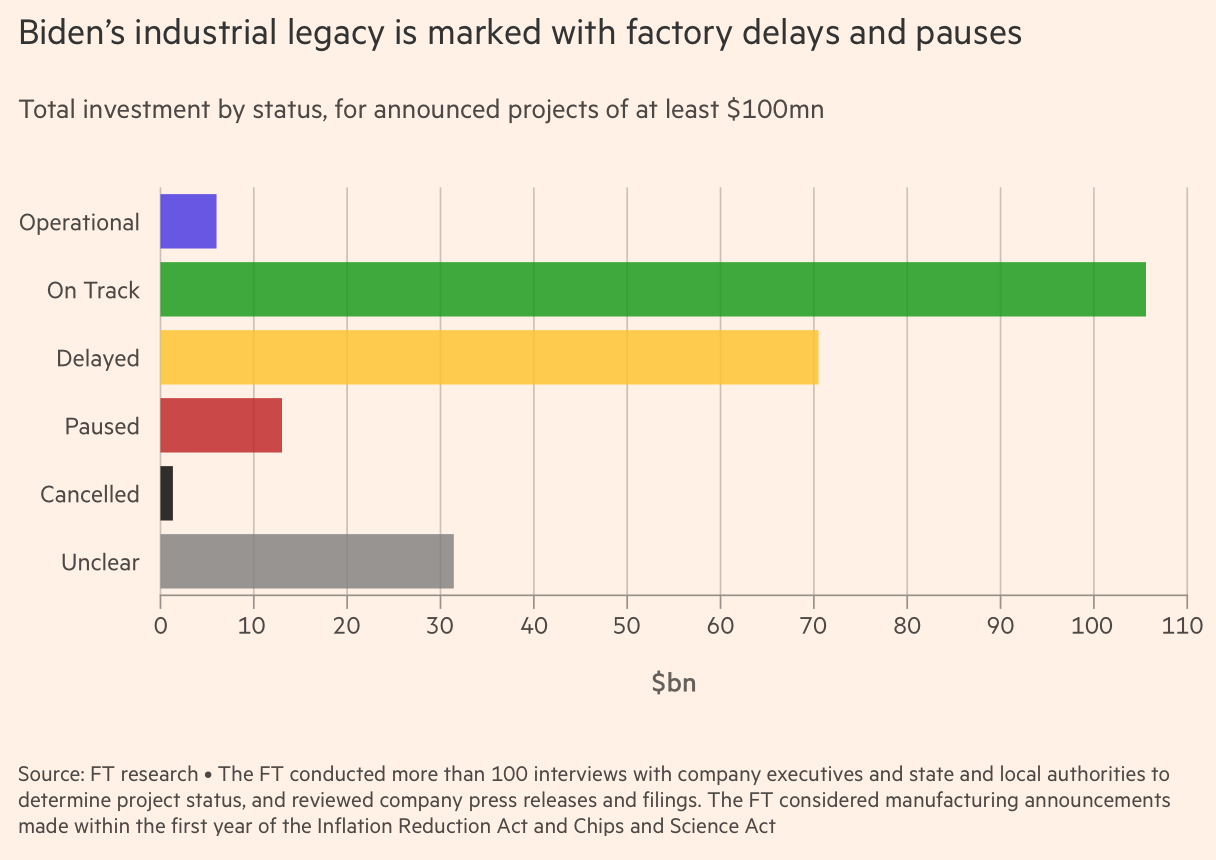

The data summary:

The authors also conducted over 100 interviews of companies and state and local official. That’s an analytically sound approach to help understand results. However, it appears they were using this method primarily to gather anecdotes rather than help qualify what the findings said about program performance. For instance, as we’ll see, some of the delays were the direct result of how the Biden Administration launched the program, specifically that deficient guidelines slowed up the launch of many projects. But other interviewees report that they paused or cancelled projects out of fear that an incoming Trump Administration would cancel or hamstring the program. So the interview findings are more atmospheric than diagnostic.

Additional impediments are arguably in the “shit happens” category, such as difficulty in finding workers or a slackening of demand. But again, in at least some of these cases, there is more here than meets the eye. For instance, faltering EV demand in the US is significantly due to US automakers not being able to make these vehicles to meet a low enough price point….when the Chinese can. And adequacy of supply of charging stations is another US buyer concern.

On the “labor shortages” theme, hopefully knowledgable reader will pipe up as to how much of this obstacle is due to an actual shortage of workers with relevant skills (which is entirely possible) versus employers not being willing to pay enough to attract them (particularly if they would have to relocate).

Snippets from the story:

The US president’s Inflation Reduction Act and Chips and Science Act offered more than $400bn in tax credits, loans and grants to spark development of a US cleantech and semiconductor supply chain.

However, of the projects worth more than $100mn, a total of $84bn have been delayed for between two months and several years, or paused indefinitely, the FT found…

The delays raise questions around Biden’s bet that an industrial transformation can deliver jobs and economic returns to the US, which has offshored its manufacturing for decades.

A point this humble blog and many other have raised is that restoring manufacturing prowess, even if that can be achieved, will take one to two decades. The US has not only ceded far too many skills at all levels (not just the factory floor but also supervisors and managers) but also has gutted public education, meaning many workers may not be able to fill important roles without remedial training. For instance, I have seen more than occasional complaints from manufacturers that they can’t find workers who can read blueprints or worse, are too weak in reading and numeracy to fill certain roles.

Back to the story:

Among the largest projects on hold are Enel’s $1bn solar panel factory in Oklahoma, LG Energy Solution’s $2.3bn battery storage facility in Arizona and Albemarle’s $1.3bn lithium refinery in South Carolina.

While many delays have been made public, others have not been announced. Forty minutes away from Albemarle’s inactive site is a facility where semiconductor manufacturer Pallidus said last year it would relocate its headquarters from New York and open manufacturing operations, investing $443mn and creating more than 400 jobs. Operations were expected to start in the third quarter of 2023, but the building sits unused.

“You’re holding your breath and seeing what transpires,” said Ted Henry, city manager of Bel Aire, Kansas, where Integra Technologies announced a $1.8bn semiconductor factory last year but has not moved forward with the project due to uncertainty over government funding.

Henry was clearly willing to talk. Yet the reporter appears not to have probed to find out what “uncertainty over government funding” was about.

We later see that this could be the reason…but why not firm that up?

While the IRA’s tax credits extend until 2032 and the Chips Act awards generous funds to selected applicants, companies often cannot receive funding until they achieve certain production milestones.

On the “government procedures holding things up,” the story later provides more examples:

Some of the delays are policy driven. Slow government rollout of Chips Act funding for semiconductor projects and lack of clarity on IRA rules have left a number of projects at a standstill.

Nel Hydrogen, an electrolyser manufacturer, has paused its $400mn factory project in Michigan due to uncertainty over tax credit rules for hydrogen. Anovion, a battery parts manufacturer in Georgia, delayed its $800mn factory by more than a year due to lack of clarity over the IRA’s electric vehicle regulations.

The article recites that participants announced over $220 billion in investments in the first year of the IRA, which includes projects “reshored” from abroad. But we then learn that many have run into high labor costs and supply chain issues. But we aren’t told what those supply chain problems were. The one example is actually downstream, not upstream. Taiwan Semiconductor Manufacturing Company delayed a second fab. That whacked its suppliers Chang Chung Group and KPCT Advanced Chemicals who paused their projects. The article implies the latter two were also IRA beneficiaries but it not as clear as it should be. But in any event, the usual understanding of supply chain problems is being unable to get needed inputs, such as when automakers in the Covid recovery were hamstrung by being unable to get needed electronics. Here, we don’t know exactly why Taiwan Semiconductor Manufacturing Company postponed its second fab, but the loss of orders led suppliers to hold back on their expansions.

The piece describes how the plunge in solar panel prices thanks to a Chinese glut and the oft-lamented weak EV demand in the US have led some IRA projects to be mothballed.

Finally, the piece explains that the Republicans really hate the IRA, with no Team R Congresscritters supporting the legislation even when their districts could/would benefit.

Ironically, here if beneficiaries in Republican districts were going ahead with their IRA enterprises, it would make it harder for an incoming Trump Administration to cancel them. They might need to find a way to finesse gutting the program while grandfathering projects that were underway. So delays and pauses out of political worries could be self fulfilling.

Mind you, this piece did some very useful gumshoe work. It’s just too bad that the editors didn’t let the writers go a bit further to reach firmer conclusions.