The “Magnificent Seven” was a phrase coined by CNBC’s Jim Cramer to group the most dominant stocks in the market. The seven stocks are:

-

Microsoft

-

Apple

-

Nvidia

-

Alphabet

-

Amazon

-

Meta Platforms

-

Tesla

While this is a solid list, I believe it leaves out one incredibly important business. In fact, if this company didn’t exist, these seven companies wouldn’t look the same.

So, instead of the Magnificent Seven, I’m proposing the Incredible Eight, which adds Taiwan Semiconductor (NYSE: TSM) to the cohort.

Taiwan Semiconductor’s product innovation has kept it on top of its industry

With a $900 billion market cap, TSMC is actually the seventh-largest company listed on U.S. exchanges — larger than Tesla’s $585 billion.

Taiwan Semiconductor is a chip foundry, meaning companies design chips and then outsource the manufacturing to Taiwan Semiconductor, which has the expertise to create them. The company is the market leader in this space and has industry-leading 3 nanometer (nm) chip technology that allows it to manufacture the most powerful chips possible right now. Additionally, TSMC has a culture of continuous innovation, and the next generation of 2nm chips is slated to launch sometime in 2025.

Although TSMC doesn’t name all its clients, every member of the Magnificent Seven is either a direct or indirect customer. That’s a great position to be in, and a TSMC investment gives investors a chance to benefit from all technological innovations made by the original Magnificent Seven.

And multiple catalysts are in line to boost its business.

TSMC is about to experience two significant tailwinds

In Apple’s latest announcement, it launched Apple Intelligence, its take on artificial intelligence (AI). In this announcement was the kicker that only the latest generation of iPhones and newer will have access to this technology, so consumers will have to upgrade to gain access to this feature. Over the past three years, Apple essentially made up a quarter of TSMC’s revenue, so if this ignites an upgrade cycle, TSMC will be a huge beneficiary.

This is a big relief, as 38% of TSMC’s revenue in the first quarter came from the smartphone segment, which saw its quarter-over-quarter revenue figure drop by 16%. Given how important smartphones are to TSMC’s business, it’s critical that this area turns around.

However, another division, AI, is also starting to shine. Management projects a 50% compound annual growth rate (CAGR) for the next five years with AI-related hardware. After that catalyst is complete, it projects it will make up around 20% of total revenue.

That’s massive growth from a segment that is just emerging, and it’s critical to get in before the lion’s share of that growth occurs.

Both factors give credence to management’s long-term goal of growing revenue at a 15% to 20% CAGR for the foreseeable future.

It’s rare to find a company that consistently delivers that kind of growth over the long term, but Taiwan Semiconductor is well-positioned to do it. As a result, I think it’s one of the best stocks to buy now and hold for the long term.

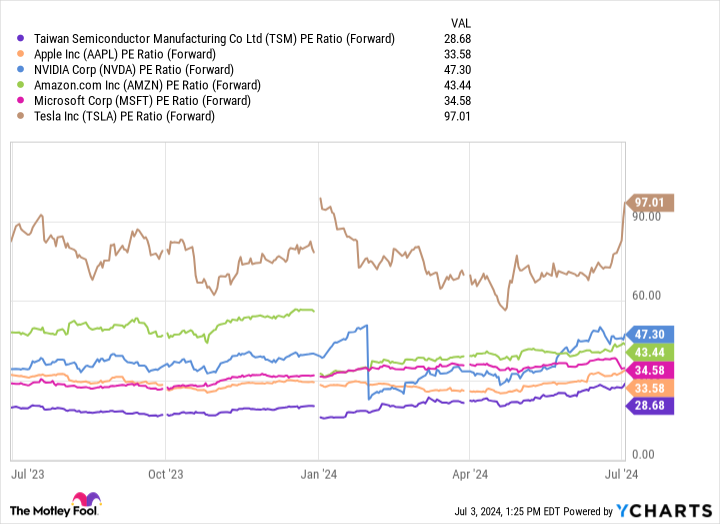

One slight caveat to this pitch is that Taiwan Semiconductor’s stock isn’t the cheapest at 28 times forward earnings.

However, considering that other Magnificent Seven members like Apple, Microsoft, Amazon, Nvidia, and Tesla trade at much higher multiples, it’s still a fair price to pay.

Taiwan Semiconductor’s long-term trajectory is just too good to ignore, and every investor should consider owning some shares. Although I don’t know if the Incredible Eight will become a trend, I think adding Taiwan Semiconductor to this cohort makes sense.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $771,034!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet, Amazon, Meta Platforms, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Forget the “Magnificent Seven.” What About the Incredible Eight? was originally published by The Motley Fool