Kamala Harris announced her plan for the economy, which includes many incentives and disincentives for the real estate industry. Many of her points are actually designed to stimulate the real estate industry, which could benefit investors (although cause some unintended consequences to boot). For others, we’re in the crosshairs.

Let’s take a look at each one individually and how they’ll affect the economy, particularly the real estate industry. We’ll ignore proposals that don’t relate to real estate—for example, a “price-gouging ban” or limiting taxes on tips—and just focus on our industry.

Helping First-Time Homebuyers

Harris’s plan is to offer “…first-time homebuyers with $25,000 to help with the down payment on a new home.” This would be the most significant down payment assistance the government has ever offered and dwarves the $8,000 First-Time Homebuyer Tax Credit that was in place between 2008 and 2010. That also happened while we were in the middle of a deep recession and credit crunch, unlike today.

In 2020, there were 1,782,500 first-time homebuyers in the country. Had all of them used such an incentive, that would have cost the taxpayer a cool $44.6 billion.

Of course, not every first-time homebuyer would use it. But then again, with such an incentive in place, demand for first-time homebuyers would likely skyrocket.

FHA loans already only require 3.5% down to purchase a home. And Fannie Mae dropped its required down payment for multifamily properties where the owner lives in one unit to just 5% last November.

Indeed, with a 3.5% down payment, a house that costs $714,286 would conceivably have the down payment completely covered by this program. (And this ignores seller credits, which are commonly offered to homebuyers during negotiations.)

Affording the down payment is an issue for prospective homebuyers, but not the main one. One recent survey found 40% of non-homeowners said that their inability to afford a down payment was their main obstacle. But more (46%) cited insufficient income. Especially outside expensive coastal cities with almost comically bloated housing prices, the biggest issue for homebuyers isn’t the down payment—it’s affording the monthly mortgage payments, especially with interest rates where they are.

By throwing money at the demand side without addressing the supply side, the most likely result is just to increase the price of properties all the more, as prospective homebuyers with $25,000 in government money behind them bid up prices against each other. This will make the mortgage payments even less affordable. This program could certainly be beneficial for house hackers, but on a policy level, it’s likely throwing good money after bad.

Expanding Affordable Housing

To give Harris credit, she acknowledges the first-time homebuyer tax credit is only a stopgap “while we work on the housing shortage.” As I’ve said repeatedly, the only way to truly alleviate the nation’s housing issues is to build more.

Harris wants to focus on expanding affordable housing. As The Hill describes:

“Harris’s plan pushes for the construction of 3 million new housing units over the next four years, along with what it described as the ’first-ever’ tax incentive for building starter homes for first-time homebuyers.

“The plan calls for an expansion to an existing tax credit for businesses that build affordable rental housing, as well as a $40 billion federal fund to help boost construction. The plan also details a proposal to make some ‘federal lands eligible to be repurposed’ for new and affordable housing developments.”

Unfortunately, affordable housing doesn’t always turn out to be affordable. One study by Michael Eriksen found that the Low-Income Housing Tax Credit (LITHC) program “encourages developers to construct housing units that are an estimated 20% more expensive per square foot than average industry estimates.”

On the plus side, Harris’s plan to offer tax credits for businesses building affordable rental housing could be a major opportunity for developers. This is especially true, as such incentives could alleviate some of the regulatory costs that make it so difficult to build housing for lower-income residents. (One study found regulatory costs amounted to $93,870 for each house built in 2021, almost a quarter of the total.)

That said, single-family starts were already at an annualized rate of 1.46 million in December 2023. That would amount to almost double the 3 million new housing units Harris’s administration wants to build over the next four years and doesn’t even include multifamily. Government spending tends to crowd out private investment unless in an economic slump (which housing development is not), so this may just end up costing the taxpayer more and getting the consumer less. (Such government programs also tend to be ripe for corruption.)

Lastly, the U.S. has had near-record levels of immigration over the course of the Biden-Harris administration. While this is a politically fraught issue, it would be a good time to slow that down until the housing shortage is alleviated in order to cool off demand in the housing market. This is something a Harris administration is highly unlikely to do.

Stopping “Predatory Investors”

Harris also wants to stop Wall Street from buying up single-family homes with a “Stop Predatory Investing Act.” The bill is rather simple. Here it is in its entirety:

“This bill denies taxpayers owning 50 or more single-family properties any tax deduction for interest paid or accrued in connection with any single-family residential rental property. It also disallows depreciation of residential rental property owned by such taxpayers.”

The mortgage interest deduction is not nearly as important as many think, but prohibiting depreciation could have severe consequences for real estate investors. This deduction allows real estate investors to deduct building depreciation (the IRS considers a residential property to depreciate to zero over 27.5 years) from net income to reduce their income tax liability. It’s a key advantage of real estate investing and given how cash-intensive real estate is, removing it could be particularly damaging.

Investors invest a substantial amount in lower-income neighborhoods, where there are relatively fewer homeowners, and such a tax change would likely cause a flight of capital from neighborhoods that need it the most.

It’s also distressing that Harris describes “taxpayers owning 50 or more single-family properties” as “institutional investors.” Most investors who own that many properties (like us) are much closer to being small businesses than “institutional investors.” Trust me, we’re nothing close to BlackRock.

The idea that Wall Street is buying Main Street is mostly a myth. As I noted in a previous article:

“…What appears to be a skyrocketing amount of houses being bought by institutional investors only changed the percentage they purchased from about 0.5% to 2.5%, not exactly what I would call a ‘significant chunk…’ The percentage of homes being bought by all investors had actually been decreasing from 2013 until the end of 2020; from 29% of all purchases to 20.5%.”

If Harris is elected, this proposal would hopefully be amended or scrapped.

Who’s Paying For All This?

For all the intense political rhetoric flying back and forth between Kamala Harris and Donald Trump, Americans should look for commonalities to bridge what appear to be our implacable differences. And one point of apparent bipartisan agreement is to spend like a drunken sailor with a stolen credit card.

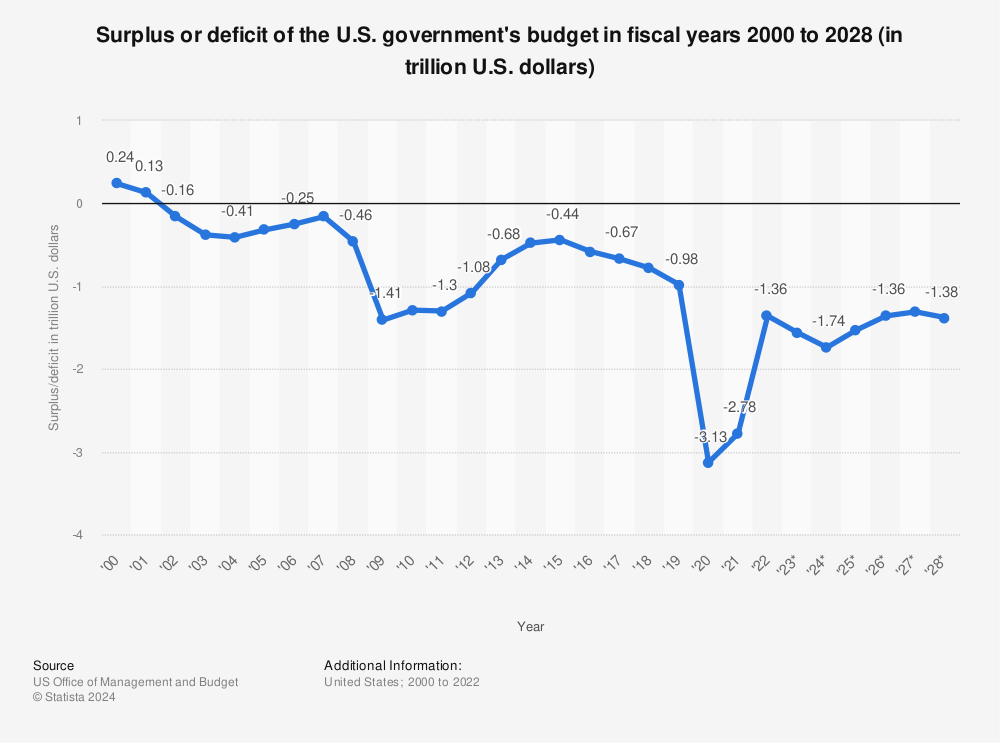

Indeed, despite the COVID-19 pandemic being over and the U.S. not (at least officially) being at war, the United States is running deficits of over $1.5 trillion a year. Trump can’t make much of an issue of this, though, as in 2019, the year before COVID hit, he had a “peacetime” deficit of $0.98 trillion. Personally, I don’t think saying, “I didn’t even technically have a trillion-dollar deficit before COVID,” is a particularly convincing campaign slogan.

Find more statistics at Statista

The Harris campaign is promising a lot of new spending (to be fair, so is Trump). While there will be some new taxes, such taxes obviously have a cost to the economy and won’t come close to covering the shortfall.

Next year, for the first time ever, the United States will spend more on debt service than its military. And it will get much worse in the years to come.

I, for one, am in favor of cutting the military budget substantially, but that’s a bit beside the point here. As historian Niall Ferguson points out in Bloomberg:

“Any great power that spends more on debt service (interest payments on the national debt) than on defense will not stay great for very long. True of Hapsburg Spain, true of ancien régime France, true of the Ottoman Empire, true of the British Empire, this law is about to be put to the test by the U.S. beginning this very year.”

Unfortunately, the piper may come calling sooner than we all would have hoped. New spending programs (and tax cuts, for that matter) are likely to exacerbate this problem all the more, which will have significant ramifications for not just the real estate industry but the economy as a whole.

Neither Harris nor Trump seem to be taking this issue seriously.

Find the Hottest Deals of 2024!

Uncover prime deals in today’s market with the brand new Deal Finder created just for investors like you! Snag great deals FAST with custom buy boxes, comprehensive property insights, and property projections.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.