(Bloomberg) — European stocks were set for a tepid start after Asian shares were mostly higher as traders weighed the firming expectations of Federal Reserve interest rate cuts against continued weakness in technology shares.

Most Read from Bloomberg

The Euro Stoxx 50 futures was little changed, while the contracts for US stocks advanced following a drop on Wall Street overnight. The yen gained against the dollar, while Treasuries were steady ahead of the key US inflation data later on Friday.

Stocks in Australia, Japan, Hong Kong and South Korea climbed along with futures contracts for US equities on Friday. Chinese shares in Hong Kong and mainland fluctuated.

Taiwanese shares were the worst performers, tumbling as much as 4.3% as trading resumed after disruptions caused by Typhoon Gaemi. The declines marked a catch-up to previous tech-related declines in global stocks and included a steep drop for Taiwan Semiconductor Manufacturing Co. which fell as much as 6.5%.

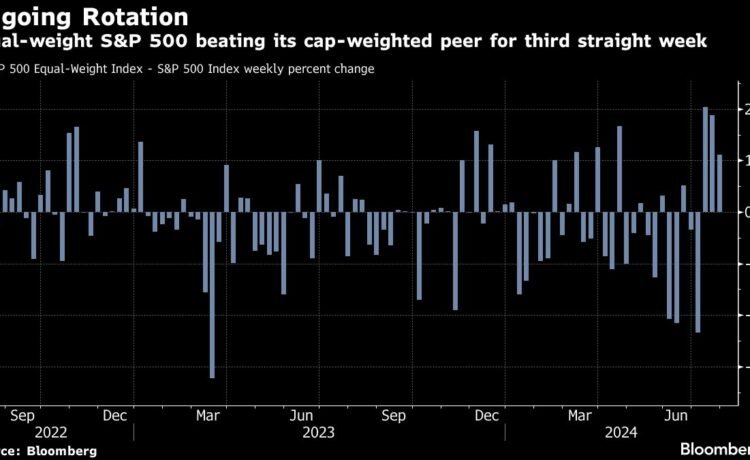

Asian equities are set for the first back-to-back weekly losses since May as a global rotation out of technology stocks — particularly those benefiting from the AI boom — and toward this year’s laggards quickened this week. A gauge of technology stocks in Asia was set for third straight day of losses.

“We’re still not calling a peak in Asian AI, but it feels as though we are getting closer,” HSBC Holdings Plc strategists including Herald van der Linde wrote in a note. Momentum is shifting fast and “we are now even more convinced that the sector warrants close attention.”

China’s benchmark government bond yield fell to a new record low as a bond rally extended, testing policymakers’ resolve to stem the move. Meanwhile, the CSI 300 Index headed for its worst week since early February, as traders sought haven assets amid a flailing economic recovery.

“The policy boosts look to be ineffective for market sentiment until it translates into earnings boost,” said Bloomberg Intelligence’s Marvin Chen. “From that perspective, the upcoming earnings season in August may be a catalyst, but expectations are not high.”

The yen traded below 154 per dollar in erratic trade and headed for its fourth day of gains in five sessions. Inflation in Tokyo accelerated for a third month in July, reinforcing bets of a possible interest rate hike when the central bank’s policy board meets next week.

“To convincingly crack below 150, we need the Fed to actually deliver, or to see much more in the way of selling of foreign bonds by institutional Japan,” Tim Baker, Head of Macro Research for Deutsche Bank AG, said on Bloomberg Television.

The yen’s rally remains fragile, with only 30% of BOJ watchers surveyed by Bloomberg forecasting a hike, even if more than 90% see it as risk.

A squeeze back toward 155.30 per dollar is “not out of the question” ahead of the BOJ meeting, said Tony Sycamore, an analyst at IG Australia Pty. “However, after that, all bets are off.”

Growth Accelerates

The US 10-year yield was little changed in Asian trading after slipping four basis points on Thursday as Treasuries pushed higher. Gains for US government debt came as traders weighed signs of a resilient US economy against calls for quicker rate cuts from the Federal Reserve. The swaps market is currently pricing in the first rate cut in September.

On Thursday, the S&P 500 slipped 0.5% while the Nasdaq 100 declined 1.1% as tech giants including Nvidia Corp. and Microsoft Corp. slumped. Small caps outperformed in a further sign investors are preparing for interest-rate cuts that will support the broader economy.

Economic growth quickened by more than forecast in the second quarter, illustrating demand is holding up under the weight of higher borrowing cots. A closely watched measure of underlying inflation rose 2.9%, easing from the first quarter but still above estimates.

Strong GDP growth in the US “is good for non-tech stocks,” Hamza Ayub, executive director and portfolio manager at Farro Capital told Bloomberg TV. “If it remains strong we will continue to see a catch up and improvement in market breadth.”

The US will end the week on the back of the monthly PCE data, the last big data point before next week’s Fed meeting. The core figure is expected to slow to near the central bank 2% target on a three-month annualized basis.

“After last night’s upside surprise in the GDP price deflator, there are concerns about upside risk to the current consensus estimate for the PCE Index,” said Kyle Rodda, a senior market analyst at Capital.Com. “While a modest upside surprise wouldn’t necessarily derail the path back to the target of inflation, it could impact the expected timing of the first cut and the number of cuts that could come over the next six months.”

In corporate news, Mercedes-Benz Group AG’s earnings plummeted 19% in the second quarter as sales of its passenger electric vehicles dropped sharply and demand in China weakened. Meanwhile, Eni SpA increased its full-year profit guidance second-quarter profit was better than expected.

In commodities, West Texas Intermediate pared intial gains even as it was heading for third successive day of gains. Gold edged higher.

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.4% as of 2:47 p.m. Tokyo time

-

Nasdaq 100 futures rose 0.5%

-

Japan’s Topix was little changed

-

Australia’s S&P/ASX 200 rose 0.8%

-

Hong Kong’s Hang Seng rose 0.2%

-

The Shanghai Composite fell 0.2%

-

Euro Stoxx 50 futures were little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro rose 0.1% to $1.0858

-

The Japanese yen rose 0.2% to 153.70 per dollar

-

The offshore yuan fell 0.2% to 7.2529 per dollar

Cryptocurrencies

-

Bitcoin rose 2.5% to $66,876.15

-

Ether rose 3.3% to $3,258.21

Bonds

Commodities

-

West Texas Intermediate crude was little changed

-

Spot gold rose 0.4% to $2,373.54 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from John Cheng, Zhu Lin and Winnie Zhu.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.