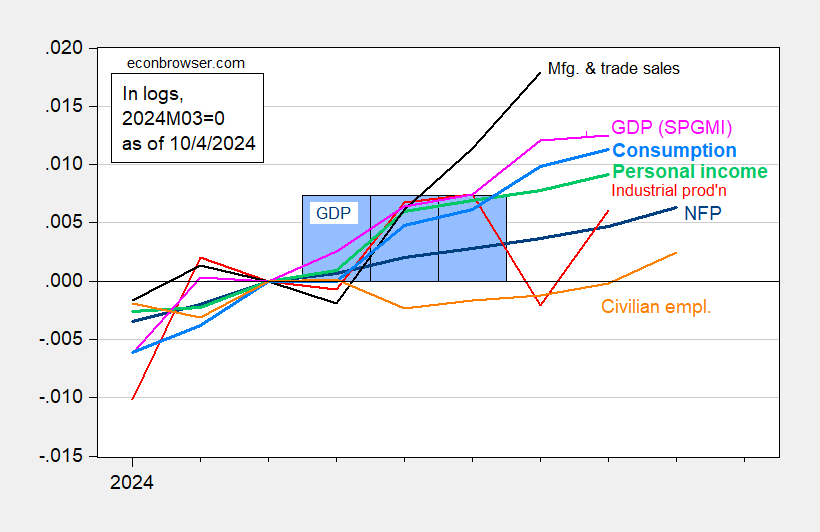

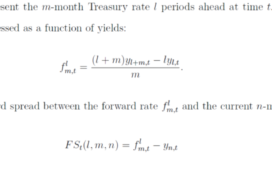

From FoxNews. Here’s a picture of indicators followed by the NBER’s BCDC over the past year. Note that August numbers are mostly up.

Figure 1: Nonfarm Payroll (NFP) employment from CES (blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q2 3rd release/annual update, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (10/1/2024 release), and author’s calculations.

It’s possible that NBER will backdate the recession to starting in July. So far we have preliminary data for August for consumption, personal income ex-transfers, and industrial production, and don’t have Q3 GDP (although all nowcasts for Q3 indicate growth). Still, NBER peak in July does seem a little unlikely to me.

By the way, Dr. Antoni also declared a recession a little more than two years ago.