Carnival (NYSE: CCL) has been generating strong results in recent quarters, but its stock is still nowhere near its levels before the pandemic, when shares were trading above $50. Investors still appear to be hesitant to load up on the stock. After all, if a recession is looming and interest rates don’t come down, it could be a tough combination for a travel stock with a high debt load.

But are those fears exaggerated? Can the stock prove its naysayers wrong and be a great buy right now? Here’s a closer look at the company’s fundamentals to see whether this is a possible gem in the markets or if investors should stay away from the stock.

Carnival’s business is booming

I love Carnival’s business because of its strength — and it’s not just due to pent-up travel demand. Cruises target an older, more affluent customer base that’s more resilient to the effects of inflation and a potential recession. That doesn’t mean it may not struggle if economic conditions worsen, but it’s in a better position to succeed than many other travel stocks.

The company has great insight into its bookings because consumers need to secure spots ahead of time. According to its investor presentation, Carnival says that at any given time, approximately 50% of its demand for the next 12 months is already booked. And 55% of its guests are repeat customers.

This provides good visibility for the company into what demand will be and how strong sales are going to be. If there are warning signs ahead for the travel industry, Carnival will know about them fairly early on, giving it time to adjust accordingly. And as of now, there aren’t any looming warning signs for investors to worry about.

When the company last reported earnings in June, it raised its full-year guidance for fiscal 2024 (which ends in November), citing “strong demand” for cruises. This is even as the company reported record second-quarter revenue totaling $5.8 billion for the period ending May 31, which rose by 18% year over year.

The stock could soar once interest rates start coming down

Carnival’s growth rate looks great, but there’s just one problem — interest expenses. The company has more than $27 billion in long-term debt on its books.

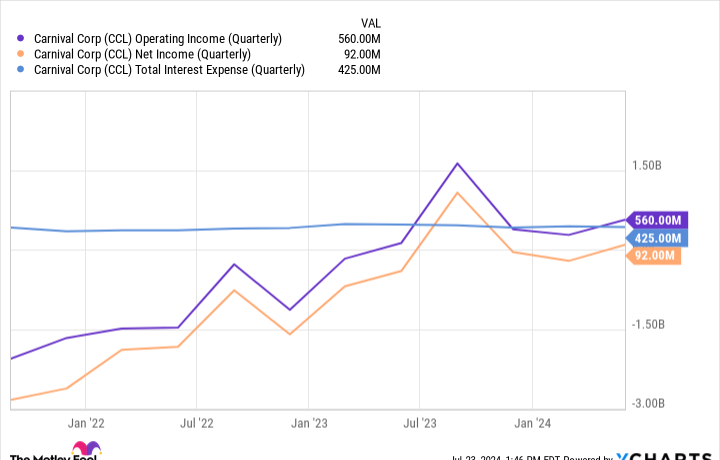

It’s been chipping away at that, but it’s still a huge albatross around what would otherwise be strong earnings numbers. This is best illustrated with the following chart that shows the company’s operating income and how much interest costs take away from that.

Carnival’s operating income has been climbing steadily, which is great news for investors. But with interest rates remaining high, those interest costs are keeping the company’s bottom line fairly thin.

Carnival is working on cutting expenses and being more efficient, but if it can get some help from regulators in reducing interest rates so that it can finance debt at lower rates, it could quickly result in better numbers on the bottom line.

Should you buy Carnival Corp stock?

Carnival’s stock is down close to 60% in the past five years. The pandemic hammered the business, which resulted in Carnival taking on a lot of debt as a result of extremely challenging economic conditions. Investors are clearly not convinced the worst is over for the stock.

But there’s hope that interest rates could soon be coming down, and the company is still reporting strong numbers. As a result, I see Carnival as potentially being one of the best growth stocks to buy right now. Although there’s some risk with the company’s high debt load, I think there’s more reason to be bullish about its future than there is to be bearish.

Should you invest $1,000 in Carnival Corp. right now?

Before you buy stock in Carnival Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Carnival Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $692,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.

Down More than 60% From Its Pre-Pandemic Highs, Is Carnival Stock a Steal of a Deal? was originally published by The Motley Fool