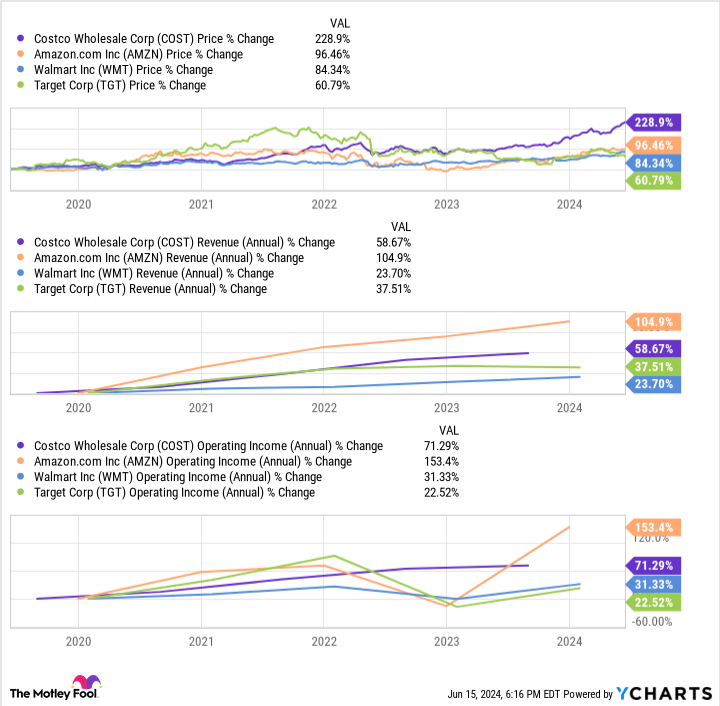

Shares in Costco (NASDAQ: COST) have risen 229% over the past five years, delivering the kind of growth usually reserved for tech stocks. The company ranks fifth among the world’s largest retailers, with some of its biggest rivals including Walmart and Amazon.

Yet Costco appears to have plenty of room left to run. The retail giant’s share price has skyrocketed more than 92,000% since it went public in 1985, likely creating more than a few millionaires. However, the company is only just getting started on its expansion abroad and has tapped into a lucrative subscription-based model.

As a result, it’s not too late to make a long-term investment in this retailer and profit from its future. So here’s why Costco remains a millionaire-maker stock worth considering right now.

The power of a subscription-based model

Retail can be a tricky industry, with many companies having to contend with lower profit margins than other sectors. However, Costco has found a way around that, with its business more reliant on memberships than product sales.

In a similar strategy to Amazon’s Prime subscription, which has likewise seen exponential success, entry into a Costco location requires shoppers to pay for an annual membership. While requiring consumers to pay to go inside a grocery store could’ve gone very wrong for the company, the opposite has occurred.

Costco has attracted millions of consumers over the years, charming them with access to quality products at wholesale pricing, all for a low annual fee. The company’s commitment to this model has seen it amass nearly 75 million paid memberships, a figure that rose 8% year over year in its latest quarter, the first quarter of its fiscal 2024. Meanwhile, Costco boasts a 90% renewal rate worldwide.

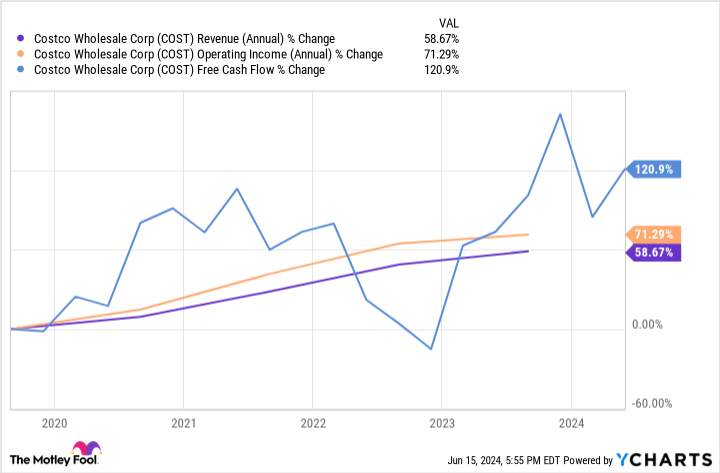

Costco’s success over the years has seen its financials skyrocket, with this chart showing how the company’s annual revenue, operating income, and free cash flow have grown since 2019.

Costco’s fiscal 2023 earnings best represent the company’s winning membership model and its positive effect on profits. The retail company achieved over $6 billion in profits during the year, with membership fees making up 73% of that.

Costco’s stock is worth its premium price tag

Costco almost always trades at a premium, represented by its high forward price-to-earnings (P/E) ratio of 53. The figure is higher than many of its rivals, with the same metric for Walmart and Target at 28 and 15. Even Amazon’s is lower at 40.

However, I’d argue that Costco is worth its price tag for investors willing to hold for the long term. The data above shows that Costco has outperformed all these companies in stock growth over the past five years. Besides, Amazon has beaten its fellow retailers in annual revenue and operating income growth.

Moreover, Costco is only just getting started with its expansion abroad, which will probably continue to boost earnings for years. The company operates 876 locations across 14 nations. However, Costco has six or fewer stores in six of those countries, representing massive growth potential. And that’s before considering the many regions the company has yet to enter.

For instance, Costco opened its first location in China in 2019 and the second in 2023 after being held up by the COVID-19 pandemic. Yet, the company already has six stores in the East Asian country and has barely scratched its surface.

It’s a similar situation in France. There are only two Costco warehouses in France, with one opening last year, and both located near Paris. However, significant expansion potential remains in the European nation and many other countries.

In Q3 2023, international revenue rose 9% year over year, outperforming domestic revenue growth by about 2%. The segment will likely continue outperforming domestic sales over the long-term as Costco remains on its current growth trajectory.

In addition to a solid growth history and a winning business model, Costco is a stock that could make you a millionaire if you’re willing to wait.

Should you invest $1,000 in Costco Wholesale right now?

Before you buy stock in Costco Wholesale, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Costco Wholesale, Target, Walmart, and Walt Disney. The Motley Fool has a disclosure policy.

Could Costco Be a Millionaire-Maker Stock? was originally published by The Motley Fool