High-profile stock splits are en vogue, it seems. Just days after Nvidia split its shares 10-for-1, Broadcom announced it would follow suit. In fact, several big names are choosing to split theirs this summer. After Nvidia’s stock split, maybe the most anticipated is fast-casual restaurant pioneer Chipotle (NYSE: CMG).

Shares of Nvidia are up about 10% since it executed the split on June 7. Can Chipotle investors expect a similar bump in stock price? Let’s consider a few basics first.

Here’s how Chipotle’s split will work and what it might mean

A stock split, or more specifically a forward stock split, in this case, is when a company issues new stock to shareholders, increasing the number of shares on the market. The shares then begin trading at a lower price. It’s done proportionately so that the total value of an investor’s portfolio doesn’t change.

So in the case of Chipotle’s 50-for-1 split, each shareholder will be issued 49 additional shares for every share they own after the market closes on June 25. They now have 50 times the shares they had before. However, they aren’t suddenly 50 times richer; rather, when markets open the next day, shares are 50 times cheaper than the day before.

So the move itself doesn’t affect the value of a portfolio directly, but it can affect it down the line. Lowering the price removes a barrier to many retail investors to afford shares of the stock, allowing for more volume and money in the market. This certainly has the potential to positively affect the stock price, but not necessarily. Don’t count on this as a guarantee that just because Nvidia’s stock rose after the split, Chipotle’s will rise too.

Besides, this is short-term thinking; don’t get lost trying to time the market. Instead, focus on the value of the company long-term.

So is Chipotle a good long-term play?

Chipotle is smoking its peers in growth

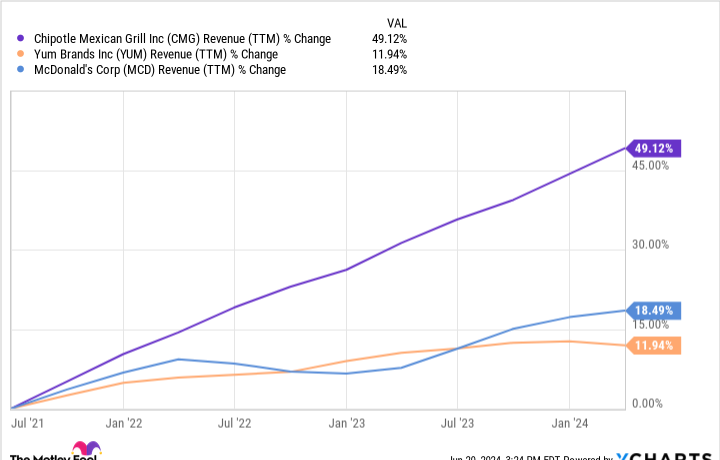

There are a lot of options in the quick-service restaurant (QSR) market. Chipotle has to compete with players like McDonald’s and Yum!, the owner of chains like KFC and Taco Bell. Over the last few years, Chipotle has grown revenue at a seriously impressive pace. Look at the difference in this chart.

And the strong growth has been consistent even through tough times in the larger market. In 2020, the year restaurants were hardest hit by the COVID-19 pandemic, Chipotle still managed to grow revenues by more than 7%. McDonald’s shrank revenue by more than 10% in the same year. Showing that it is resilient and agile in times of crisis is not something to take lightly; it speaks to the company’s solid leadership.

This growth looks to be continuing. The company is expecting to raise its earnings per share (EPS) by about 53% for 2024 compared to 2023. That’s about four times the growth McDonald’s expects.

There are some reasons to be cautious

Chipotle certainly has a lot going for it, and its growth can’t be denied. However, there are some aspects of the business that don’t look quite as rosy. The incredible revenue growth has been largely driven by the expansion of locations. If you look at comparable-store sales, the company saw a 7% increase for Q1 2024, or about half the top-line growth for the same period.

Its stock is also valued significantly higher than McDonald’s and Yum! in relation to its current earnings. Investors are counting on its growth to continue to justify the valuation. If this growth is disrupted or begins to cool off, suddenly that premium might not look so justified.

Even with this in mind, I still think Chipotle is a good bet over the long term. Keep an eye on that comparable-store growth, however. That’s the number the company will need to be able to drive when it isn’t opening so many stores.

Should you invest $1,000 in Chipotle Mexican Grill right now?

Before you buy stock in Chipotle Mexican Grill, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chipotle Mexican Grill wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Chipotle’s 50-for-1 Stock Split Is Coming. Here’s What Investors Need to Know was originally published by The Motley Fool