This is Naked Capitalism fundraising week. 216 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, PayPal. Clover, or Wise. Read about why we’re doing this fundraiser, what we’ve accomplished in the last year,, and our current goal, supporting the commentariat.

Yves here. Reports on the China effectively squeezing the rare earths market and the lack of robust alternatives oddly skip over the way the US ceded its position in the rare earths market, with the US decline significant decades ago. From a 2010 post:

Reader James S. highlighted a useful article at the MIT Technology Review, “Can the U.S. Rare-Earth Industry Rebound?” Our only quibble to this solid piece is its summary, which underplays some critical aspects of the article:

The U.S. has plenty of the metals that are critical to many green-energy technologies, but engineering and R&D expertise have moved overseas.

In fact, the while the article does discuss US versus foreign engineering expertise in rare earths mining, it describes in some detail how difficult rare earths mining is in general (more accurately, not the finding the materials part, but separating them out) and the considerable additional hurdles posed by doing it in a non-environmentally destructive manner. Thus the rub is not simply acquiring certain bits of technological know-how, but also breaking further ground in reducing environmental costs.

And this issue has frequently been mentioned in passing in accounts of why rare earth production moved to China in the first place. It’s nasty, and advanced economies weren’t keen to do the job. China was willing to take the environmental damage. For instance, the New York Times points out:

China feels entitled to call the shots because of a brutally simple environmental reckoning: It currently controls most of the globe’s rare earths supply not just because of geologic good fortune, although there is some of that, but because the country has been willing to do dirty, toxic and often radioactive work that the rest of the world has long shunned.

From the MIT Technology Review:

Getting from rocks to the pure metals and alloys required for manufacturing requires several steps that U.S. companies no longer have the infrastructure or the intellectual property to perform….

In the 1970s and 1980s, the Mountain Pass mine in California produced over 70 percent of the world’s supply. Yet in 2009, none were produced in the United States, and it will be difficult, costly, and time-consuming to ramp up again…

The two mines that will be stepping up production soonest are Mountain Pass, being developed by Molycorp, and the Mount Weld mine, which is being developed by Lynas, outside Perth, Australia. Mountain Pass has the edge of already having been established. But the company cannot use the processes used in the mine’s heyday: they’re both economically and environmentally unsustainable.

Several factors make purification of rare earths complicated. First, the 17 elements all tend to occur together in the same mineral deposits, and because they have similar properties, it’s difficult to separate them from one another. They also tend to occur in deposits with radioactive elements, particularly thorium and uranium. Those elements can become a threat if the “tailings,” the slushy waste product of the first step in separating rare earths from the rocks they’re found in, are not dealt with properly…

Mountain Pass went into decline in the 1990s when Chinese producers began to undercut the mine on price at the same time as it had safety issues with tailings. When the Mountain Pass mine was operating at full capacity, it produced 850 gallons of waste saltwater containing these radioactive elements every hour, every day of the year. The tailings were transported down an eleven-mile pipeline to evaporation ponds. In 1998, Mountain Pass, which was then owned by a subsidiary of oil company Unocal, had a problem with tailing leaks when the pipeline burst; four years later, the company’s permit for storing the tailings lapsed.

Meanwhile, throughout the 1990s, Chinese mines exploited their foothold in the rare-earth market. The Chinese began unearthing the elements as a byproduct of an iron-ore mine called Bayan Obo in the northern part of the country; getting both products from the same site helped keep prices low initially. And the country invested in R&D around rare-earth element processing, eventually opening several smaller mines, and then encouraging manufacturers that use these metals to set up facilities in the country.

Back to the current post. A second issue is the US negligence in either providing for or otherwise funding and supporting sources of supply in vassals loyal allies, given the importance of rare earths to defense production. But given how the inability of the US and its NATO allies to meet Russian military production and how the output gap is widening in favor of Russia, again shows how our putative leaders cannot plan their way out of a paper bag.

By Jennifer Kary for MetalMiner, the largest metals-related media site in the US according to third party ranking sites. Originally published at OilPrice

- China’s restrictions on rare earth mining and exports have disrupted global supply chains and driven up prices.

- US businesses, particularly in the defense sector, are vulnerable to these disruptions due to their reliance on Chinese rare earths.

- Diversifying supply chains, investing in domestic production and recycling, and exploring alternative technologies are crucial strategies for mitigating risks.

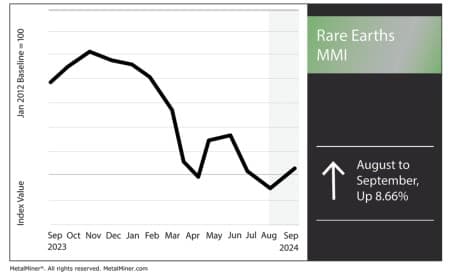

The Rare Earths MMI (Monthly Metals Index) managed to reverse and pull up by 8.66% after experiencing steady declines since May. Numerous parts of the rare earths index reversed price action, including neodymium and terbium oxide. China’s recent crackdown on rare earth supplies has caused a shift in the global market, creating significant bullish sentiment in the short term, the trends of which covered weekly in MetalMiner’s newsletter.

China’s Crackdown on Rare Earths Causing Price Increases

Over the past few months, China’s crackdown on rare earth minerals and its broader regulatory tightening have sent ripples through global markets. China has long dominated the rare earths market, producing around 90% of the world’s refined rare earth output. This dominance allows Beijing to exert significant influence over global supply chains for critical minerals like neodymium, praseodymium, and dysprosium, elements vital to the magnets used in everything from electric cars to wind turbines.

One of China’s main centers for the production of rare earths, Jiangxi, is among the provinces that spearheaded a four-month campaign against illegal mining activities. While crackdowns on illicit mining benefit the market in the long run, they also drive up rare earth prices in the short term.

The Supply-Demand Crunch

Many expect the demand for rare earths to keep rising with the push for green energy. In fact, some analysts predict a supply-demand mismatch due to this continued global growth. China’s recent actions to crack down on illegal mining and tighten regulations have placed some fresh strain on the global REE market.

Some analysts predict that the rare earth market will shift from a surplus to a global deficit by the end of 2024. A smaller number also anticipate a potential global shortage of 800 metric tons of NdPr, a critical component of permanent magnets, by year’s end. Meanwhile, China’s decision to reduce production quotas for rare earth elements will likely widen this gap and push prices higher.

U.S. Defense Sector at Risk

China’s restrictions on exporting rare earth processing technologies have also caused supply chain issues for defense contractors, making it harder to secure a reliable source of materials. Businesses like Raytheon and Lockheed Martin need rare earth elements for fighter jets, radars, and missile systems. Aware of this vulnerability, the U.S. Department of Defense has warned about the national security risks tied to a heavy reliance on Chinese rare earths.

What U.S. Businesses Can Do to Mitigate Risks

While the reliance on Chinese rare earths presents challenges, U.S. companies have options to reduce their exposure and prevent financial losses.

For starters, U.S. companies must expand the diversity of their supplier networks. Nations like Australia, Brazil, and Canada also hold significant rare earth reserves and continue to ramp up production. In recent years, companies like Australia’s Lynas Rare Earths have become key alternative suppliers, particularly for neodymium and praseodymium.

Meanwhile, the U.S. government continues to actively encourage domestic production of rare earths to reduce dependency on Chinese suppliers. MP Materials, which operates the Mountain Pass rare earth mine in California, plays a key role in this effort. The U.S. Department of Defense has also invested in building local rare earth processing plantsto ensure the country can source these resources domestically.

Another strategy involves recycling rare earth elements from products that have reached the end of their life cycle. Although rare earth recycling technology is still in its early stages, it holds significant potential as a long-term solution to supply chain challenges. Companies in industries like tech and automotive, which handle large volumes of rare earth-containing products, can benefit from investing in recycling infrastructure to recover these valuable materials from outdated electronics and vehicles.