Amid rising diplomatic tensions with the US, Mexico’s diplomatic and economic relations with China appear to be going from strength to strength.

Before we get to the meat of this story, a quick primer on where relations between the US and Mexico currently stand.

Over the past few years, Mexico has clashed repeatedly with the US over a litany of issues, from USAID and NED’s funding of domestic political opposition groups to Washington’s attempts to prevent Mexico from banning GMO corn for human consumption; to Mexico’s refusal to support project Ukraine or US-EU sanctions against Russia despite concerted pressure; to presidential candidate Donald Trump’s threats to send kill teams to Mexico to take out the country’s drug kingpins — a threat that should not be taken lightly given US-Mexican history.

The irony is that as tensions have risen between the two neighbours, business has never been better. Due to changing global trade patterns and nearshoring strategies, Mexico has become the US’ biggest trading partner, as the volume of goods the US buys from its southern neighbour has surged past those of China and Canada. Exports to the US from Mexico have increased 20 percent-plus annually between 2020 and mid-2024 while exports from China have steadily fallen, according to data cited by CNBC.

End of an Era

At the end of this month, Mexico’s President Andrés Manuel López Obrador (aka AMLO) will leave politics, at least officially speaking. In Mexico, presidents are limited to a single six-year term in office, called the sexenio, and AMLO’s is due to expire on September 30. In October, he will depart for his Tabasco ranch, “La Chingada“, with approval ratings of up to 76%. He has also secured legislative approval for his judicial reform package, which opens the way to sweeping constitutional reforms on energy, mining, housing, labour and indigenous rights, among other things.

This has all happened despite constant US meddling in Mexico’s political affairs over the past half year. As readers may recall, the US Drug Enforcement Agency interfered directly in Mexico’s general elections by spreading unsubstantiated claims across Western media that AMLO’s 2006 electoral campaign had been part-financed by the Sinaloa drug cartel. As we reported at the time, the DEA is still smarting at the strict limits AMLO’s 2020 National Security Law imposed on the actions of foreign intelligence agencies like itself on Mexican soil.

Then, a few weeks ago, the US and Canadian Ambassadors warned that Mexico’s proposed judicial reforms, which include the direct election of judges — something that already happens in many US states — could have dire consequences for the US-MCA trade agreement. AMLO’s response was to: a) ignore the threats; and b) put Mexico’s relations with the two ambassadors on hold.

At roughly the same time, the DEA kidnapped Ismael “El Mayo” Zambada, a long-elusive Sinaloa cartel capo, and shipped him to the US to face trial. According to the Mexican journalist Anabel Hernández, who has been accusing AMLO of ties to drug cartels for months, the US wants Zambada to rat out “a president of Mexico.” It’s not hard to guess which one. Even in this year of 2024, Washington continues to use the War on Drugs as a means of toppling or even extraditing and incarcerating Latin American leaders or military figures.

In last Thursday’s morning press conference, a visibly rankled AMLO accused the US government of acting unilaterally in seizing Zambada and of infringing Mexican sovereignty in the process. He also blamed the DEA for creating a power vacuum in Sinaloa and the all-too-predictable explosion of gang violence that has followed in its wake. The agency, AMLO said, had kicked over a hornet’s nest. He then asked a question many have been asking for years, if not decades:

Where are the US’ drug cartels?

“How are all these drugs distributed” once they reach the US, AMLO asked. “How is it that we never hear of the US’ famous cartels and capos? We never know who they arrest (on their side of the border)? That information never reaches us.”

Mexico-China Relations

Amid diplomatic tensions with the US, Mexico’s diplomatic and economic relations with China appear to be going from strength to strength.

When the DEA accused AMLO of receiving cartel money a few months back, Mexico’s president responded by holding a two-and-a-half hour meeting with the Chinese ambassador. In that meeting, AMLO expressed his gratitude to Beijing for its support during difficult times for the country, such as the category 5 hurricane that devastated Acapulco in late October as well as all the material aid Beijing sent during the COVID-19 pandemic.

Just a few weeks ago, the Chinese government urged the US to give up its antiquated Monroe Doctrine, as Washington intensifies its meddling in Mexico, Venezuela and Honduras. In reply to a question from Global Times, Chinese Foreign Ministry spokesman Lin Jian said:

China firmly supports the just position of Latin American countries on opposing foreign interference and safeguarding their nations’ sovereignty. The US should not turn a deaf ear to the legitimate concerns… of Latin American countries… We urge the US to discard the outdated Monroe Doctrine…, stop its unilateral actions of bullying, coercion, sanctions and blockades, and develop… mutually beneficial cooperation with regional countries based on mutual respect, equality and non-interference in each other’s internal affairs.

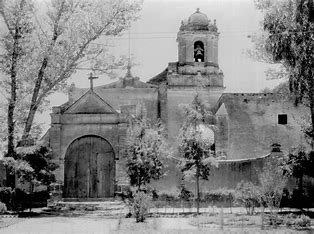

“Non-interference in each other’s internal affairs” is a notion that no doubt appeals to a country like Mexico that has suffered multiple US and European military incursions and invasions since gaining independence from Spain in 1810. Mexico City is even home to a National Museum of Interventions, which I visited a couple of weeks ago. Housed in the former Monastery of San Diego Churubusco, which was used as a makeshift fort during the US army’s invasion of Mexico City in 1847, the museum offers a fascinating trip down a dark collective memory lane.

On its walls are maps of the Mexico that existed before the US invaded and seized possession of over half the country’s territory between 1846-8. Among the many episodes of history recounted is that of the San Patricios, a military unit in the US army consisting of hundreds of immigrants of Irish and German Catholic stock who defected en masse to the Mexican army during the US invasion. After fighting with distinction in numerous battles, most of the San Patricios perished or were captured during the Battle of Churubusco. Many of those who were captured were tortured and executed as traitors.

This is a story that is little known even in Mexico though it is widely commemorated. In the US it is, presumably, forgotten history. The victors of Colonial wars and their descendants have the luxury to forget the crimes of the past; the losers far less so. On the contrary, they have a responsibility to remember.

Rediscovering the “Global South”

A couple of weeks ago, Mexico’s embassy in Beijing held an event to commemorate 214 years of Mexican independence. Qiu Xiaoqi, special representative of the government of China for Latin American Affairs, said at the event that “under the leadership of the new government headed by Dr Claudia Sheinbaum Pardo,” Mexico is expected to “continue to achieve great success along its path of independent and autonomous development” as well as expand its international influence.

“China and Mexico, both important members of the Global South and large developing countries with significant influence, firmly adhere to their respective independent development paths according to their own national conditions, firmly uphold international justice, and raise a strong voice to safeguard the legitimate rights of developing countries in the international arena,” Qiu emphasized.

It is a message that dovetails neatly with Mexico’s newfound interest in the Global South, as expressed by the country’s Foreign Minister Alicia Bárcena at last year’s UN General Assembly.

This is historic. At the UN, Mexico 🇲🇽 stated clearly: “Mexico belongs to the Global South, indeed, through history and conviction”.

It called to “strengthen the negotiating position of the Global South”, and announced it is rejoining the G77+China.

Mexico left the G77 in 1994,… pic.twitter.com/TcvM7bjrmh

— Ben Norton (@BenjaminNorton) September 28, 2023

“Everything indicates that Mexico and China will continue on the path of cooperation, dialogue and friendship — a desire clearly expressed by Claudia Sheinbaum, who in 19 days will begin her functions as the first woman president in the history of my country,” the Mexican ambassador to China, Jesús Seade Kuri, told the delegation of students, military figures, businessmen and Chinese lawmakers gathered at Mexico’s embassy in Beijing.

“Win-Win Cooperation”

“China and Mexico are comprehensive strategic partners and close friends in win-win cooperation and common development… the pragmatic economic and trade cooperation between the two countries has brought tangible benefits to our respective peoples,” said Qui who, was China’s ambassador to Mexico between 2013 and 2019.

And that economic and trade cooperation is growing fast. New data published by Mexico’s Economy Ministry reveals that bilateral trade between the two countries increased 12.3% year over year in the first half of 2024. This recent surge in trade consolidates China’s position as Mexico’s second most important trading partner, accounting for 20% of the North American country’s total imports, up from 15% in 2015.

The trade volume between China and Mexico exceeded $100 billion for the first time last year. Of course, most of that consists of Chinese imports flowing into Mexico, many of which are then used to assemble products destined for the US market. In July, for example, international sales from Mexico to China were US$649M, while international purchases reached US$11.4B. Mexican imports of Chinese goods are up roughly 100% in the npast ten years and more than 500% since 2006.

Chinese investment in Mexico is also growing rapidly, as Chinese companies seek to take advantage of the US’ nearshoring strategy by setting up shop in Mexico. The sectors most affected include photovoltaic energy, 5G communications, aerospace technology and biomedicine.

Globally, Mexico is the tenth largest destination for Chinese exports, representing 2.4% of the total. Granted, many of those exports do not stay in Mexico. The US’ imposition of tariffs on goods from China such as solar panels, electric vehicles and EV batteries have led to shipping costs rising by around six times, according to an recent editorial in China Daily. As a result, many Chinese companies have opened operations in Mexico, taking advantage of the nearshoring trend:

“When you’re producing commodity products, and shipping costs rise that much, your product is now 15 to 20 percent higher. So, I think it becomes more and more attractive to manufacture in Mexico as we continue to face these challenges,”… [Tom Melchiorre, president of Direct Link USA, a joint venture of Fuling Plastics, a Chinese company that sells plastic straws and cups to the likes of McDonalds, Wendy’s and Dunkin’, told China Daily].

Mexico’s exports to the US last year surpassed China’s for the first time in two decades, a development linked to the political tensions between China and the US. However, the trade relationship between China and the US is resilient, even under strained conditions.

Researchers analyzed the evolution of the trilateral trade relationship between Mexico, the US and China from 1993 to 2020, and found that, in general, for every 1 percent increase in Mexico’s exports to the US, Mexico’s imports from China increased by 1.06 percent.

Growing Demand for Chinese-Made Cars

In Latin America, Mexico is now the main market for China, even surpassing China’s fellow BRICS member Brazil. Besides meeting the demands of nearshoring, this preference is also due to Mexico’s burgeoning homegrown demand for Chinese-made electronic products, mobile phones and, most recently, automobiles. In 2019, close to one-fifth of Mexico’s imports in electronics such as mobile phones, auto parts and motor vehicles came from China, sectors where the US was traditionally the main supplier, according to Americas Quarterly.

As Wired magazine reported in late August, Mexico is now the second largest market for Chinese automobiles worldwide, behind only Russia:

Led by the automaker BYD, China has established itself as the main car supplier in Mexico. The US worries China could use Mexico as a “back door” to sidestep tariffs and gain footing in the US market.

Prevented from selling their wares to the United States due to tariffs, Chinese EV manufacturers have explored other markets to sell their high-tech cars. However, as Mexico establishes itself as a key market for Chinese electric vehicles, officials in Washington fear that Mexico could be used as a “back door” to access the US market.

That tariff-free access is part of the US-Mexico-Canada Agreement (T-MEC), an updated version of the North American Free Trade Agreement that, as of 2018, eliminated tariffs on many products traded between the North American countries. Under the treaty, if a foreign automotive company that manufactures vehicles in Canada or Mexico can demonstrate that the materials used are locally sourced, its products can be exported to the United States virtually duty-free.

According to official figures, 20 percent of light vehicles sold last year in Mexico were imported from China, representing 273,592 units and a 50 percent increase compared to 2022. Currently, most of the vehicles imported from China come from Western brands that have established manufacturing plants in that country, such as General Motors, Ford, Chrysler, BMW, and Renault.

Chinese brands such as MG and electric vehicle manufacturer BYD are also enjoying bumper sales, with many Mexicans lured by their competitive prices. BYD markets its Dolphin Mini model in Mexico for around 398,800 pesos (about $21,300 dollars), a little over half the price of the cheapest Tesla model. Earlier this year BYD only had six dealerships in Mexico, one of which is just round the corner from my father-in-law’s apartment in the south of Mexico City, but it plans to have 50 (with a presence in all of Mexico’s 32 states) by the end of the year.

As demand for electric vehicles grows, BYD has even unveiled plans to build an EV plant in one of three Mexican states (Durango, Jalisco, or Nuevo Leon), despite the US government’s recent imposition of 100% tariffs on Chinese-made electric vehicles. The company insists that the factory’s output would be exclusively aimed at Mexico’s domestic market.

However, a couple of weeks ago, rumours began circulating that BYD had put its plans on hold, just as Tesla had done with its proposed Mexican “giga-factory”. Citing “people familiar with the matter”, Bloomberg claimed that the Chinese automaker, like Tesla, had decided to wait to see the outcome of the US election before making a firm commitment. The story was quickly picked up by media inside and outside Mexico, before being categorically denied by BYD executives.

“BYD has not postponed any decision on a factory in Mexico,” Stella Li, executive director of BYD Americas, said in a statement. “We continue to work to build a factory with the highest technological standards for the Mexican market, not for the U.S. market, nor for the export market.”

Interoceanic Corridor

Another area that will be interesting to watch over the coming months and years is the flow of investments into Mexico’s southern regions as the Isthmus of Tehuantepec Interoceanic Corridor nears completion. Launched in 2020, the project is a $4 billion endeavour aimed at revitalising a 186-mile railway line connecting the ports of Coatzacoalcos on the Gulf of Mexico and Salina Cruz on the Pacific Ocean.

The railway line, together with highway expansions, significant port improvements and a network of industrial parks dotted along its route, aims to handle freight traffic of up to one million containers annually. Coming at a time when the Panama Canal is grappling with water shortages, this megaproject has the potential to transform global trade routes as well as cement Mexico’s position as a key player in international commerce.

But who will be investing most? As Forbes reported last year, while the corridor is of vital strategic importance to Washington’s trade security plan for supply chains, it is Chinese investors that are pouring funds into Mexico’s infrastructure projects, including its Mayan Train route, the Dos Bocas refinery in AMLO’s home state of Tabasco and numerous ports.

Connectivity between the two nations is also on the rise. In addition to reopening direct flights between Beijing and Mexico with Hainan Airlines and between Shenzhen and Mexico with China Southern, a third route from Shanghai is planned. Also, to help meet the growing demands of surging bilateral trade, China COSCO Shipping recently launched its “Dalian Port to Mexico” container express service. Until now, goods exported from the China’s North-Eastern hinterland to Latin America had to be transshipped through the Busan port in South Korea, said Li Xiaoguang, general manager of Dalian Container Terminal Co.

“The new route saves more than 10 days compared to the traditional transshipment model, significantly reducing time and logistics costs for enterprises, and establishing a stable and convenient new logistics channel between the Northeastern hinterland and Latin America,” Li said.

China to Mexico container trade was up by 26.2% from January to July 2024, after growing by 33% in 2023, according to data from freight analytics firm Xeneta . The month of May, in particular, recorded the most containers from China into Mexico, with June only a couple of hundred containers shy of May volume.

A Complex “Trilateral Relationship”

The trilateral relationship between China, Mexico and the US is unique in the world today. The US and Mexico share the world’s most frequently crossed border and after 30 years of NAFTA and USMCA, their economies are tightly coupled. China and Mexico are not just trade partners but direct competitors vying for the custom of the world’s largest consumer market, which is trying to wean itself off Chinese products. Mexico has so far emerged as the largest beneficiary of the US’ nearshoring strategy, but the more it exports to the US, the more it needs to import from China. And that is the last thing the US wants.

Over the past year, the US has escalated its war of words against both China and Mexico over the illicit fentanyl trade that is killing tens of thousands of US citizens a year. But as AMLO has repeatedly argued, the US government has spectacularly failed to address the root causes of drug addiction within its borders. Instead, some US lawmakers and pundits have proposed using military force on Mexico’s sovereign territory, with or without Mexico’s permission, to combat drug cartels.

The Biden Administration’s recent imposition of tariffs on Mexican steel that includes Chinese components was a sign, if ever needed, that the trilateral relationship was about to get even more complicated.

In April, Mexico’s government, under pressure from the US, announced hundreds of “temporary” tariffs on imports from countries with whom it does not have a trade agreement. The tariffs were imposed on 544 imported products, including footwear, wood, plastic, electrical material, musical instruments, furniture, and steel, and range from 5% to 50% in size. They had one clear target in mind: imports from China, Mexico’s second largest trade partner, though the word “China” is not mentioned once in the decree.

As we noted at the time, although the AMLO government ended up yielding to US pressure, Washington’s increasingly aggressive tone regarding Mexico-China relations elicited rare criticism in the Mexican business press. The online financial newspaper Expansión.mx featured a fiery op-ed from Jonathan Torres, a former editorial director for Forbes Media LatAm, titled “US to Mexico: You’re Against China or Against Me”:

Since 2022, US officials Janet Yellen (Treasury Secretary), Jake Sullivan (National Security Advisor) and Katherine Tai (Trade Representative) have repeatedly reiterated that the China threat is one of the most delicate risks in their national security strategy, so much so that they have deployed a range of measures to prevent Chinese investments from entering their territory, including through their trading partners. Reading between the lines, the message is blunt: “you are with me in my strategy against China or, otherwise, you will suffer consequences in terms of trade, investment, etc.”

The United States, given these circumstances, is not necessarily looking at the nearshoring phenomenon in the same way as the rest of the world… For the Biden administration, global supply chains are strategic but only under certain conditions; that is, as long as they do not threaten US national security. In other words, what the US is really interested is “security shoring,” not nearshoring.

The irony is stark: the superpower famed for its promotion of the (NC: so called) free market is attempting to impose its own legislation on trading with China on third countries. In Mexico, for example, the Chinese automotive industry is rapidly accumulating market share and therefore finds itself in the crosshairs of the US government.

There is no dispute, says Torres: “We are facing an illegal act.”

Tensions between the two USMCA partners could be about to intensify even further. In the coming weeks or months, the dispute over Mexico’s proposed ban on GM corn for human consumption will be settled. If the arbitration panel votes in the US’ favour, as tends to happen, Mexico will have to withdraw the ban, which could soon be enshrined in the country’s constitution, or face stiff financial penalties.

Both US presidential candidates are talking about introducing more rather than fewer tariffs on Chinese-produced goods. Donald Trump has even threatened to impose a 10% tariff on all Mexican goods entering the US and a 200% tariff on Mexican-made vehicles, making them “unsellable”, if he wins the election. Of course, coming from Trump this could be pure electoral bluster. But if he does follow through on the threat, it could plunge Mexico into a recession as early as 2025 while also fuelling inflationary forces in the US, according to Moody Analytics.

Faced with such a baptism of fire, Mexico’s incoming President Claudia Sheinbaum could respond by imposing like-for-like tariffs on Mexico’s imports of US products, which would intensify inflationary forces in Mexico while doing little to soften the impact of Trump’s tariffs. Or she could allow the peso to depreciate to blunt the tariff impact and thus avoid a larger-scale tariff war. Whatever happens, one thing is clear: managing Mexico’s relations with its two largest trade partners is going to be a hell of a balancing act in the months and years ahead, especially if the US continues to escalate its trade war with China.