The market warmed to ON Semiconductor’s (NASDAQ: ON) second-quarter earnings report, and the stock has now significantly outperformed Nvidia over the last month, with a 14.2% increase compared to a 5.4% decline for the stock market darling (as of this writing). The question is why and whether it can continue.

A cyclical stock to buy

ON Semiconductor services two highly cyclical end markets, namely automotive (electric vehicles, power management, advanced driver assistance systems, etc.) and industrial (automation, EV infrastructure, machine vision, etc.), which are declining this year for various reasons.

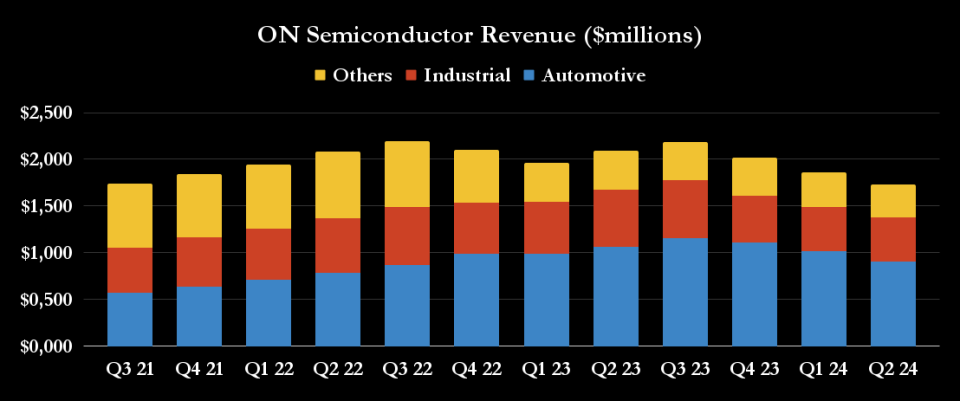

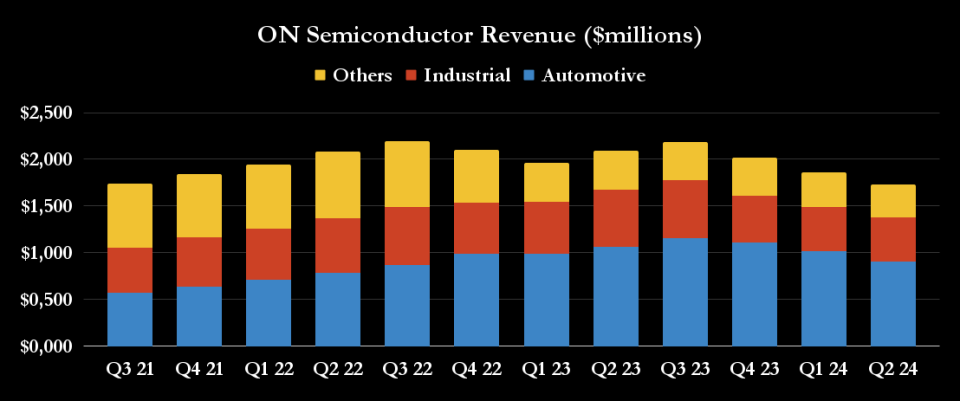

The chart below shows the sequential revenue decline trend established since the third quarter of 2023. Moreover, management expects the year-over-year declines to continue in the third quarter, with guidance for revenue of $1.7 billion to $1.8 billion, compared unfavorably with the $2.18 billion reported in the third quarter of 2023.

However, in a sign of stabilization, the midpoint of the third quarter guidance implies a sequential increase in revenue from the $1.74 billion just reported in the second quarter. This is just one of the reasons why investors bought the stock after the recent results. In other words, they are looking at the forecast for sequential improvement and taking it as a potential bottoming process in action.

It’s an intriguing viewpoint, especially since semiconductor stocks are considered highly cyclical. The optimal time to buy is often during their darkest hour before the light of recovery appears. That sort of argument is why ON Semiconductor can outperform Nvidia. Given the surging interest and investment in AI applications driving demand for high-performance computing (HPC) chips, the latter is already firing on all cylinders.

Is ON Semiconductor on the path to recovery?

The critical question here is not only whether a recovery is coming, but also what kind of recovery it will be. While investors typically look for a V-shaped recovery, ON Semiconductor’s CEO, Hassane El-Khoury, does not share this view. He continues to forecast an ” L-shaped curve” to the recovery. In plain English, this means there won’t be a dramatic uptick in sales, but instead, revenue will bottom and then move along the bottom.

That might not be what investors want to hear, particularly if they buy ON Semiconductor as a typical semiconductor recovery play. Still, El-Khoury’s cautious approach is perfectly understandable in the circumstances.

Relatively high interest rates make monthly repayments on car loans more expensive, negatively impacting car sales, including EV sales. In turn, automakers are pulling back on EV investment — bad news for ON Semiconductor, which is positioning itself in the intelligent power solutions market for EVs.

In addition, its industrial end markets, as typified by industrial automation, are battling to increase orders as customers continue to run down inventory built up when product lead times were much longer, and they need to build inventory to service demand. I’ve discussed these dynamics with regard to Rockwell Automation previously.

It’s fair to say that both of ON Semiconductor’s end markets have deteriorated through 2024.

Why ON Semiconductor is still a buy

While the near-term outlook remains uncertain, there’s little doubt that the company is set for long-term growth. In addition, it’s only a matter of time before its end markets recover. History suggests the interest rate cycle will turn, and there’s no moving back from a future in which EV sales outpace internal combustion engine (ICE) sales — ON Semiconductor has much more intelligent power and sensing chip content on EVs than on ICEs.

Indeed, in a sign of the business’s potential, the company announced that “Volkswagen Group has selected Onsemi to be the primary supplier of a complete power box solution as part of its next-generation traction inverter for its scalable system platform.”

In addition, industrial automation is the future in relatively high-cost labor countries and the solution for reshoring production cost-effectively. Investment in automation is likely to increase when end demand picks up, and distributors running down inventory now will only make the recovery stronger when it comes.

Finally, whether it’s an L-shape recovery or V-shape, or even an L-shape that turns into a hockey stick recovery, ON Semiconductor’s valuation, trading at 18.6 times Wall Street’s estimate for earnings in 2024, is highly attractive and quite capable of continuing to outperform Nvidia.

Should you invest $1,000 in ON Semiconductor right now?

Before you buy stock in ON Semiconductor, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ON Semiconductor wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $657,306!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Volkswagen Ag. The Motley Fool recommends ON Semiconductor. The Motley Fool has a disclosure policy.

Can This Hot Semiconductor Stock Keep Outperforming Nvidia? was originally published by The Motley Fool