-

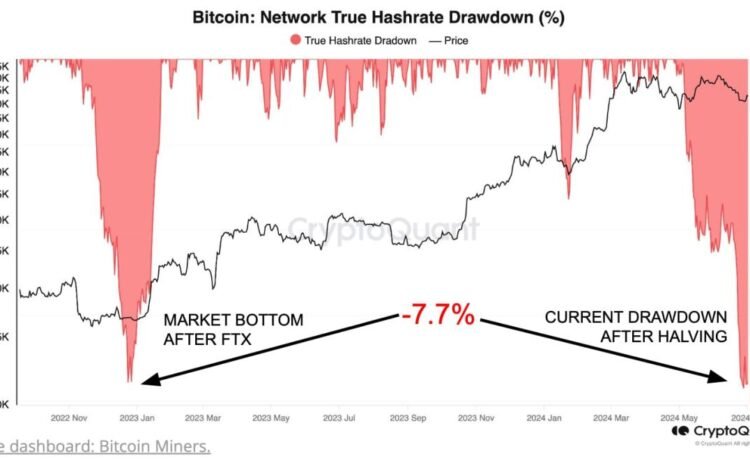

Bitcoin miner capitulation metrics are approaching the same level as the market bottom following the FTX crash in late 2022.

-

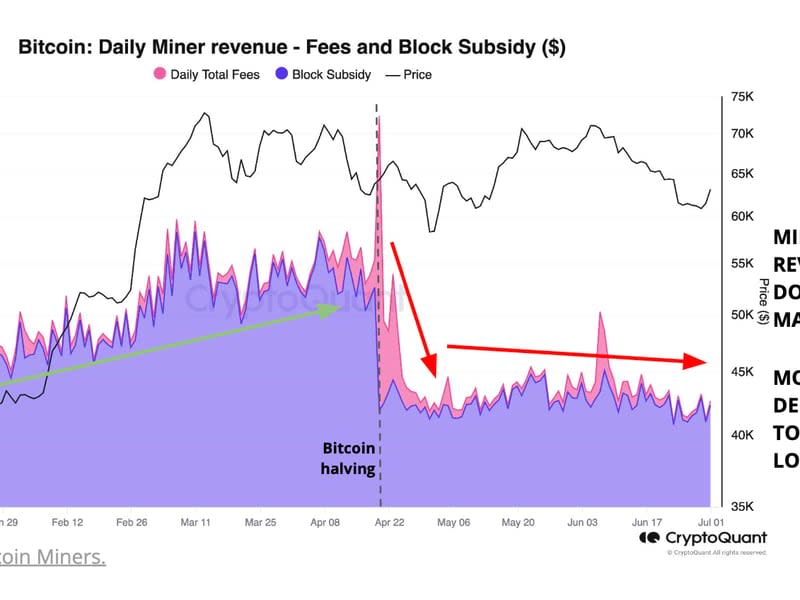

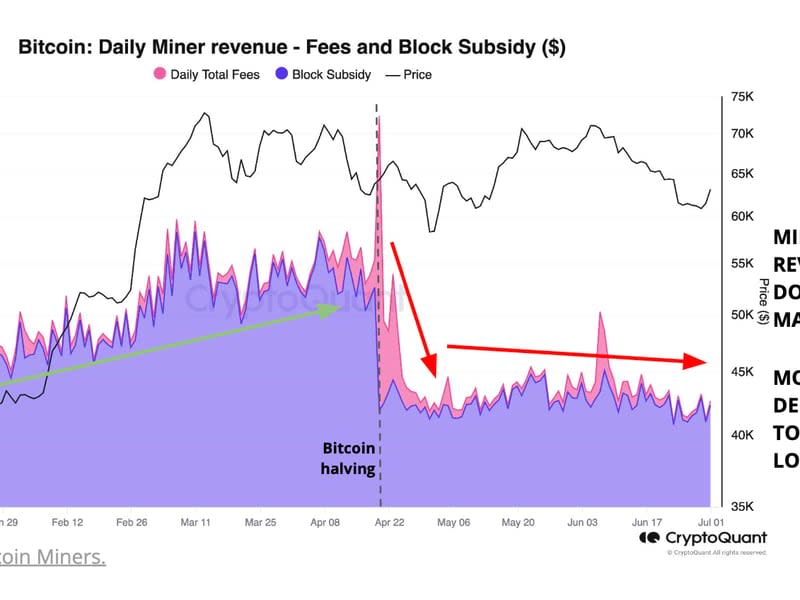

Daily miner revenue has dropped to $29 million from $79 million following the bitcoin halving earlier this year.

-

The hashrate has slumped by 7.7% since the halving as inefficient miners turn off their equipment.

Bitcoin {{BTC}} miners are showing signs of capitulation, an event that is typically tied to a market bottom after the world’s largest cryptocurrency endured a 13% plight over the past 30 days.

Bitcoin is currently trading at $60,300 after sliding by 3% on Wednesday. This level has acted as a critical support since April, with bitcoin bouncing three times from this region before heading back towards the $70,000 mark.

Data provider CryptoQuant believes this is likely to happen again in the near future as numerous signs point towards capitulation following a period of intense sell pressure.

Two signs of miner capitulation are dwindling hashrate and mining revenue by hash (hashprice), both of which are down significantly this month, with hash rate plunging by 7.7% since the halving at hashprice nearing all-time lows. Hashrate is the mining power in the Bitcoin network, and hash price refers to the revenue miners earn from a unit of hashrate.

Miners are also experiencing a hit to their daily revenue, which fell to $29 million today from $79 million on March 6. This has led to miners turning off equipment and the subsequent drop in hashrate.

“Miners have been hit by a 63% decline in daily revenues due to the halving and the collapse of transaction fees to 3.2% of total revenue,” CryptoQuant said in a report.

Miner capitulation levels are now comparable with those in December 2022, which was the market bottom following the demise of FTX.

Read more: Bitcoin Hashrate May Finally Slow as Miners Face Scorching Summer Heatwaves